Category Archives for Financial Education & News

Back to the Investment Basics (Part 4)

In our last piece, we described our marvelous markets, and how to account for their being both robust and random at the same time. Today, we’ll look at how stock pricing works, and why Nobel laureate

Continue reading...

Back to the Investment Basics (Part 3)

In our last piece, we introduced the importance of saving, which is the first of five basics that have served investors well over time. Today, we’ll look at where stock market returns really come from,

Continue reading...

Back to the Investment Basics (Part 2)

In our last piece, we wrote about how recency bias can damage your investments by causing current crises to loom large, while rewriting your memories of past challenges. Recency tricks us into overpaying

Continue reading...

Back to the Investment Basics (Part 1)

There were so many big events competing for our attention this summer … said nearly every investor, almost every summer, ever.

Continue reading...

Rising Rates: Short-Term Pain for Long-Term Gain?

Investors have likely noticed the improved opportunity set in fixed income due to higher yields. And yet some investors may be hesitant to take advantage of higher yields because of concerns about future

Continue reading...

The Stock Market Can Be Less Risky Than Cash

Common sense will sometimes cost you a lot of money. Comparing inflation-adjusted returns shows when investing in the stock market was less risky than cash. Do You Own any Stocks? A Gallup poll shows that

Continue reading...

Want to be a Better Investor?

I was in my early 30s and finally managed to scrape enough money together to start investing. I picked a high-flying mutual fund offered by a popular asset manager at the time. For a while, it made me

Continue reading...

Investing in Uncertain Times

After taking a closer look at interest rates and inflation we come to the heart of the matter: When interest rates, inflation, or both are on the rise, what’s an investor to do?

Continue reading...

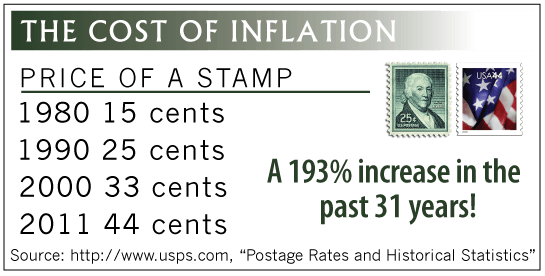

Has rising inflation got you down?

Inflation is the rate at which money loses its purchasing power over time. As you might guess, there are many ways to measure such a squishy figure. There are various economic sectors, such as energy,

Continue reading...

Fed Takes Center Stage

At its March 15–16 Federal Open Market Committee (FOMC) meeting, the U.S. Federal Reserve raised its federal target funds rate by a quarter-point. It was the first increase since December 2018, but it

Continue reading...

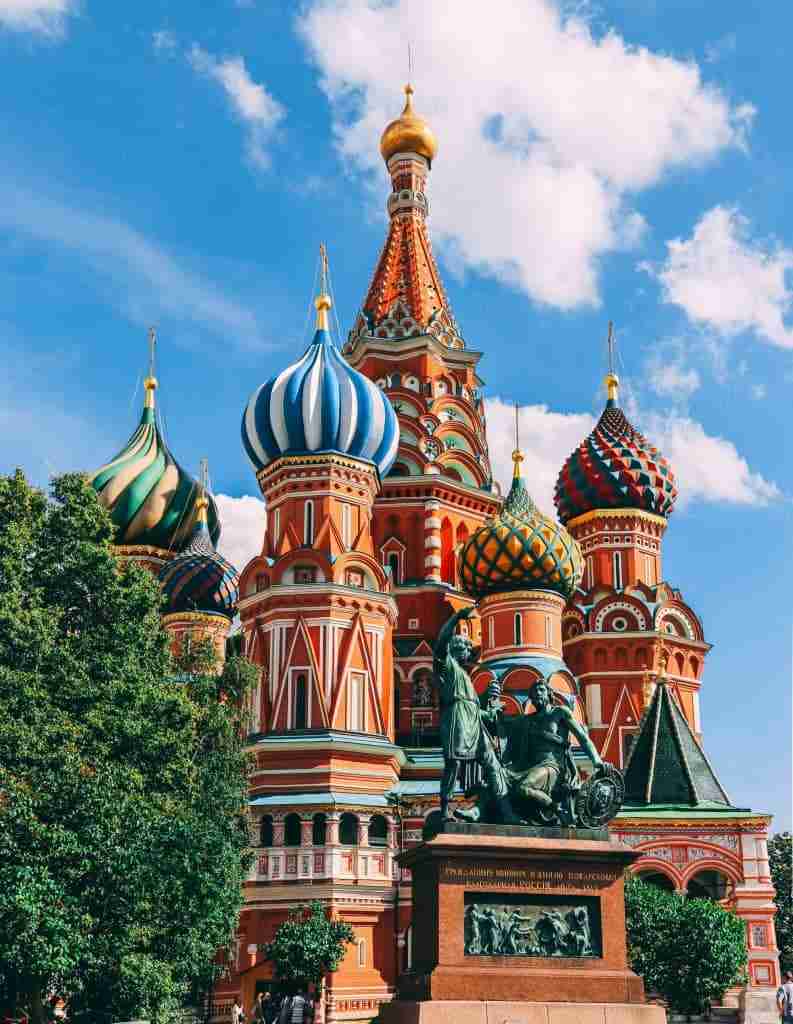

Ukraine

Despite our fervent hopes that Ukraine’s sovereign rights would prevail over tyrannical aggression, it’s now clear that Vladimir Putin has doubled down on the latter.

Continue reading...

Navigating Geopolitical Events

The recent conflict between Russia and Ukraine is an important reminder that geopolitical risk is a part of investing in global markets. Navigating geopolitical events requires expertise and flexibility.

Continue reading...

The Small Caps That May Be Holding Back Your Portfolio’s Returns

The underperformance of small caps in 2021 was driven by poor returns of small growth companies with low profits. These companies have underperformed historically. An approach that excludes small growth

Continue reading...

You Want the Size, Value, and Profitability Premiums … But How?

Capturing the size, value, and profitability premiums in real-world portfolios requires expertise. Investors should be cautious about favoring one premium over another or one region over another based

Continue reading...

Fighter Planes and Market Turmoil

Have you been reading the daily headlines—watching markets stall, recover, and dip once again? If so, you may be wondering whether there’s anything you can do to avoid the motion sickness.

Continue reading...

Market Review 2021: A Recovery Amid Challenges

It was a year of uncertainty and anticipation, of hopes for a return to a degree of normalcy following the onset of the COVID-19 pandemic in 2020. And it was a year that showed, again, the difficulty of

Continue reading...

A New Year Conversation

This is no surprise. The world is enormous. To cope with information overload, we engage in what behavioral psychologists refer to as heuristics. These are rules of thumb or mental shortcuts that take

Continue reading...

Myth-Busting with Momentum: How to Pursue the Premium

While both simulated and real-world data suggest momentum may not be suitable as a driver of long-term asset allocations, we believe momentum considerations can be integrated in a cost-effective way to

Continue reading...

When It Comes to SMAs, How Do You Measure the Impact of Personalization?

Many investors want their portfolios to do more than just pursue reliable premiums. They may also want to seek tax efficiency; reflect their environmental, social, and governance (ESG) values; respect

Continue reading...

Reading Fed Tea Leaves? Watch Market Prices Instead

Yields reflect the aggregate expectations of all market participants, including opinions on how and when the Fed will act. And even if a crystal ball could reveal the timing and direction of the Fed’s

Continue reading...

The Ever Changing World Goes On

“News is, by definition, something that doesn’t last. It exists for only a moment before it changes. … It’s not important to living a good life. It’s not going to help you make better decisions.

Continue reading...

Will Inflation Hurt Stock Returns? Not Necessarily.

Since 1991, one-year returns on US stocks have fluctuated widely. Yet weak returns occurred when inflation was low in some periods, and 23 of the past 30 years saw positive returns even after adjusting

Continue reading...

Tuning Out the Noise

For investors, it can be easy to feel overwhelmed by the relentless stream of news about markets. Being bombarded with data and headlines presented as affecting your financial well-being can evoke strong

Continue reading...

Tax-Wise Investment Techniques

We view effective tax planning as a way to reduce your lifetime tax bill—or beyond, if you’re preparing for a tax-efficient wealth transfer to your heirs.

Continue reading...

When Everything Screams Inflation

After last year’s economic shocks, we shouldn’t be surprised to see prices rebounding. But the potential for inflation is one among many factors investors take into account when agreeing on a price

Continue reading...

Tax Planning in Turbulent Times

How do we plan when we cannot know? The particulars may evolve, but it seems there are always an array of tax breaks to encourage us to save toward our major life goals—such as retirement, healthcare,

Continue reading...

Swing in Small Value Stocks Shows Benefits of Staying the Course

Value stocks, or those with low relative prices, have outperformed higher-priced growth stocks in the US over the long term. Similarly, the stocks of smaller companies have fared better than the stocks

Continue reading...

Is Inflation Haunting Your Financial Dreams? (Part 2)

The Federal Reserve has been suggesting rising rates should wane. We hope they’re right. But we also know the future remains uncharted. Nearly any outcome is possible, and none is inevitable. This means

Continue reading...

Is Inflation Haunting Your Financial Dreams? (Part 1)

Recent headlines have been reporting a noticeable uptick in inflation. Superlatives like “best” and “worst” grab the most attention, so outlets have been abuzz with reports of how a 5% May consumer

Continue reading...

Don’t Let A Market Timer Gamble with Your Life Savings

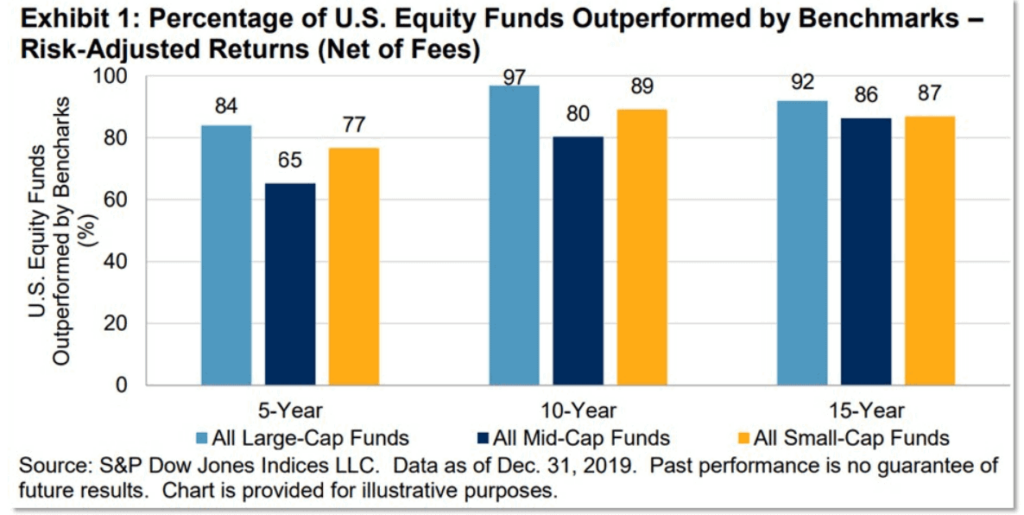

The prediction game may be a losing one for many investors, and each year there are published reports that highlight the difficulties conventional managers face.

Continue reading...