Category Archives for Retirement Advice

How Much Money Makes You Wealthy, Wealthier, or Wealthiest?

Sure, having such a high income means you can afford to buy a lot of things. More importantly for our purpose here, it means you can save and invest a lot, which lets you build wealth far more easily than

Continue reading...

Investing in Uncertain Times

After taking a closer look at interest rates and inflation we come to the heart of the matter: When interest rates, inflation, or both are on the rise, what’s an investor to do?

Continue reading...

Has rising inflation got you down?

Inflation is the rate at which money loses its purchasing power over time. As you might guess, there are many ways to measure such a squishy figure. There are various economic sectors, such as energy,

Continue reading...

Fed Takes Center Stage

At its March 15–16 Federal Open Market Committee (FOMC) meeting, the U.S. Federal Reserve raised its federal target funds rate by a quarter-point. It was the first increase since December 2018, but it

Continue reading...

You Want the Size, Value, and Profitability Premiums … But How?

Capturing the size, value, and profitability premiums in real-world portfolios requires expertise. Investors should be cautious about favoring one premium over another or one region over another based

Continue reading...

Fighter Planes and Market Turmoil

Have you been reading the daily headlines—watching markets stall, recover, and dip once again? If so, you may be wondering whether there’s anything you can do to avoid the motion sickness.

Continue reading...

Market Review 2021: A Recovery Amid Challenges

It was a year of uncertainty and anticipation, of hopes for a return to a degree of normalcy following the onset of the COVID-19 pandemic in 2020. And it was a year that showed, again, the difficulty of

Continue reading...

A New Year Conversation

This is no surprise. The world is enormous. To cope with information overload, we engage in what behavioral psychologists refer to as heuristics. These are rules of thumb or mental shortcuts that take

Continue reading...

Reading Fed Tea Leaves? Watch Market Prices Instead

Yields reflect the aggregate expectations of all market participants, including opinions on how and when the Fed will act. And even if a crystal ball could reveal the timing and direction of the Fed’s

Continue reading...

Swing in Small Value Stocks Shows Benefits of Staying the Course

Value stocks, or those with low relative prices, have outperformed higher-priced growth stocks in the US over the long term. Similarly, the stocks of smaller companies have fared better than the stocks

Continue reading...

Is Inflation Haunting Your Financial Dreams? (Part 2)

The Federal Reserve has been suggesting rising rates should wane. We hope they’re right. But we also know the future remains uncharted. Nearly any outcome is possible, and none is inevitable. This means

Continue reading...

Is Inflation Haunting Your Financial Dreams? (Part 1)

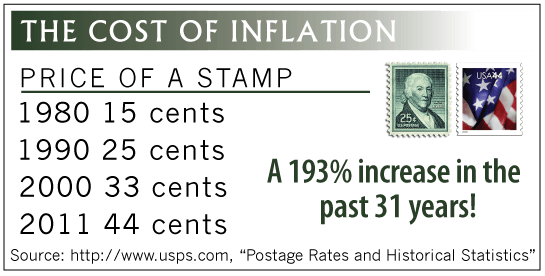

Recent headlines have been reporting a noticeable uptick in inflation. Superlatives like “best” and “worst” grab the most attention, so outlets have been abuzz with reports of how a 5% May consumer

Continue reading...

Don’t Let A Market Timer Gamble with Your Life Savings

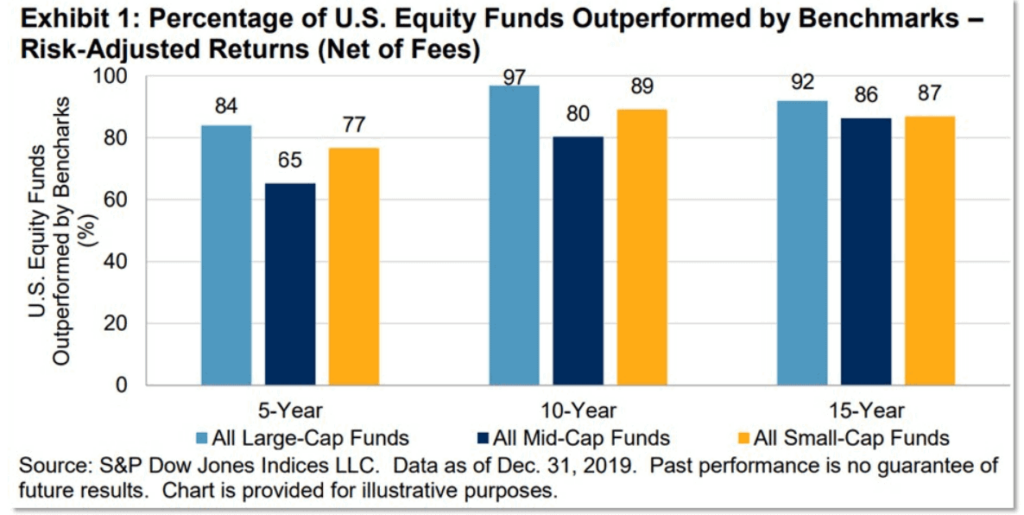

The prediction game may be a losing one for many investors, and each year there are published reports that highlight the difficulties conventional managers face.

Continue reading...

Tax Planning In Retirement

There is one major tax-planning principle that changes in retirement that is often overlooked by retirees and their advisors alike, which results in paying more taxes than necessary. Entering retirement,

Continue reading...

6 Tax Planning Strategies to Optimize Your Retirement Wealth

You’ll benefit from the tax planning strategies in this post, whether you are currently retired or are still counting down the years, months, or days until retirement. Being deliberate about your

Continue reading...

10 Steps to Easing Financial Anxiety During Major Life Changes

Life happens and, sometimes, it can be incredibly worrisome from a financial standpoint. You’ve struggled through a divorce. Perhaps you’ve faced a life-threatening illness. And, you look at your bank

Continue reading...

The Tao of Wealth Management

The path to success in many areas of life is paved with continual hard work, intense activity, and a day-to-day focus on results. However, for many investors who adopt this approach to managing their wealth,

Continue reading...

A Focus on Fixed Income

It’s been approximately a decade since the Great Recession began. By year-end 2008, the U.S. Federal Reserve (the Fed) had lowered the target federal funds rate to near-zero and embarked on an aggressive

Continue reading...

What’s Social Security Got for You?

Building the best strategy starts with pinpointing your benefit at different ages. Back in the late 1980s, when much like today there was mounting concern about the future of Social Security, Congress

Continue reading...

Timing is Critical for Boomers Preparing to Claim Social Security

Make the Most of Your Benefits It has begun. America’s largest generation, the 79 million strong, post World War II baby-boomers has begun cashing in on its Social Security benefits. And, just as history

Continue reading...

Avoiding Financial Scams and Identity Theft Fraud

Young or old, wealthy or poor, online or in person … Nobody is immune from financial scams and identity theft fraud. No matter who you are or how well-informed you may be, the bad guys are out there,

Continue reading...

The Uncertainty Paradox and Planning

“Doubt is not a pleasant condition, but certainty is an absurd one.” — Voltaire “The market hates uncertainty” has been a common enough saying in recent years, but how logical is it?

Continue reading...

Designing a Retirement Income that Works for You

If ever there were an appropriate analogy for how to invest for retirement, it would be the classic fable of The Three Little Pigs. As you may recall, those three little pigs tried three different structures

Continue reading...

Divorce and Social Security Benefits

Even if your ex-spouse has not applied for benefits, you may qualify to collect spousal Social Security payments based on his or her earnings record. When looking at divorce and Social Security remember,

Continue reading...

Make the Most of Spousal and Survivor Benefits from Social Security

Even after the crackdown, special rules can pay off handsomely for husbands and wives as survivor benefits come into play. Social Security smiles on married couples, with special rules that can richly

Continue reading...

How to Save Taxes in Retirement

When you take money from savings for retirement, you’re generally advised to tap taxable accounts first, then tax-deferred retirement accounts, and finally your Roth IRA. Here’s why: If you hold an

Continue reading...

Taxes Never Retire, but Benefits Escape

Congress’s complicated rules for the taxation of Social Security benefits open the door to opportunities to save. It used to be so simple. From the time the first checks were issued in 1937 through the

Continue reading...

The Truth About the Earnings Test

You need to know how continuing to work will affect your benefits. The good news is that the reality isn’t nearly as nefarious as critics complain. It sounds like a cruel joke: After a lifetime of working,

Continue reading...

Smart Social Security Strategies for Married Couples

Figuring out the best time to file for your Social Security benefits can be surprisingly simple or hellishly complex. If you’re retired—voluntarily or not—and need the money to live on, you may have

Continue reading...

Structured CDs: Buyer Beware!

Most investors are familiar with Certificates of Deposit (CDs). You purchase one, and the bank pays you a bit of interest on it, plus your principal back. They don’t yield much, but they’re nearly

Continue reading...