Category Archives for Investing Resources

The Power of the Market, the Ultimate AI

There’s plenty of attention on AI, but there’s another, even smarter information-processing machine: the market. Dimensional uses information in prices to put the power of the market to work for investors

Continue reading...

The Cost of Trying to Time the Market

The effect of being out of the market for even a short time can be profound—missing a period of strong returns can drastically impact overall performance.

Continue reading...

Trying to Predict Interest Rates? Good Luck.

As 2023 began, inflation was elevated, US policy makers were in a rate-hiking cycle, and talk of recession was in the news. Investors could be forgiven for expecting big changes in US Treasury yields before

Continue reading...

Market Behavior and the Weather

Investors can focus on the daily rain clouds and sunshine the markets bring. Or they can think about the long term.

Continue reading...What Do Points Mean In The Stock Market

TLDR: If you've ever wondered what do points mean in the stock market and how they can affect your portfolio, this guide aims to lift the lid on the daily changes of the Dow, S&P 500 and more.Getting

Continue reading...

Avoiding Financial Scams and Identity Theft Slams U.S. Quick-Reference

Who Are They? Financial fraudsters are after your assets.Identity thieves steal your personal information (often to then commit financial fraud). What Do They Want? Your Money and Your LifeSocial Security

Continue reading...

Time the Market at Your Peril

Technology enables immediate access to everything wherever and whenever we want it. In many cases, such as staying in touch with friends and family, or learning about world events, that’s a good thing.

Continue reading...

Which Country Will Outperform in 2023? Here’s Why It Shouldn’t Matter.

Investment opportunities exist all around the globe, but the randomness of global stock returns makes it exceedingly difficult to figure out which markets are likely to be outperformers. How should investors

Continue reading...

Two Steps Forward, One Step Back for Investors

Consider everything investors have been through in recent years: a global pandemic, rapid inflation, war in Europe, and volatile stock and bond markets. It’s reasonable to feel uneasy in the face of

Continue reading...

Don’t Buy High: Valentine’s Roses and Investing Lessons

In love as in finance, there is some value in being flexible. Buying high can cost you, whether you’re purchasing roses at their peak price on Valentine’s Day or buying stocks at the same time as

Continue reading...

Back to the Investment Basics (Part 5)

So far in our investment basics series, we’ve explored the history of investing; how important it is to save (so you have money to invest); how to invest efficiently in broad markets; and why to avoid

Continue reading...

Back to the Investment Basics (Part 4)

In our last piece, we described our marvelous markets, and how to account for their being both robust and random at the same time. Today, we’ll look at how stock pricing works, and why Nobel laureate

Continue reading...

Back to the Investment Basics (Part 3)

In our last piece, we introduced the importance of saving, which is the first of five basics that have served investors well over time. Today, we’ll look at where stock market returns really come from,

Continue reading...

Back to the Investment Basics (Part 2)

In our last piece, we wrote about how recency bias can damage your investments by causing current crises to loom large, while rewriting your memories of past challenges. Recency tricks us into overpaying

Continue reading...

Back to the Investment Basics (Part 1)

There were so many big events competing for our attention this summer … said nearly every investor, almost every summer, ever.

Continue reading...

Pursuing a Better Investment Experience (Part 5)

Welcome to the pursuing a better investment experience series. We are going to review two topic points regarding market headlines and what you can control, let’s get started.

Continue reading...

Pursuing a Better Investment Experience (Part 4)

Welcome to the pursuing a better investment experience series. We are going to review two topic points regarding market timing and emotions, let’s get started. The First Point – Avoid

Continue reading...

Pursuing a Better Investment Experience (Part 3)

Welcome to the pursuing a better investment experience series. We are going to review two topic points regarding market returns and diversification, let’s get started. The First Point

Continue reading...

Pursuing a Better Investment Experience (Part 2)

Welcome to the pursuing a better investment experience series. We are going to review two topic points regarding market performance facts, let’s get started. The First Point – Resist

Continue reading...

Pursuing a Better Investment Experience (Part 1)

Welcome to the pursuing a better investment experience series. We are going to review two topic points regarding market facts, let’s get started. The First Point – Embrace Market

Continue reading...

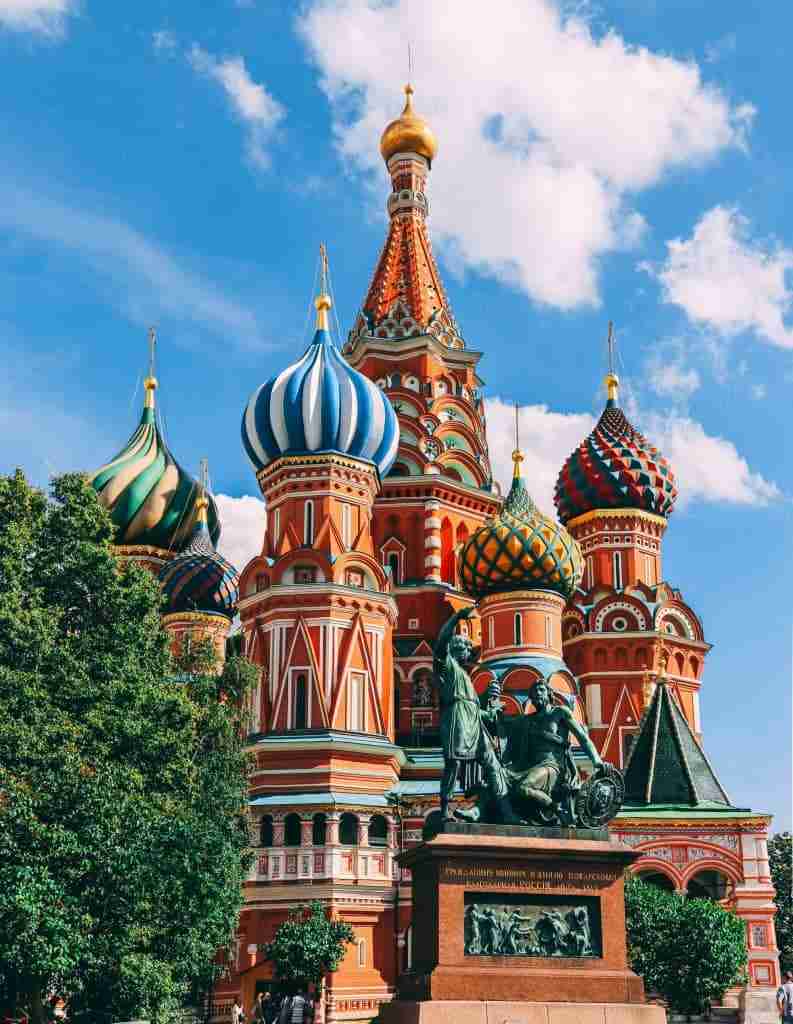

Navigating Geopolitical Events

The recent conflict between Russia and Ukraine is an important reminder that geopolitical risk is a part of investing in global markets. Navigating geopolitical events requires expertise and flexibility.

Continue reading...

You Want the Size, Value, and Profitability Premiums … But How?

Capturing the size, value, and profitability premiums in real-world portfolios requires expertise. Investors should be cautious about favoring one premium over another or one region over another based

Continue reading...

When It Comes to SMAs, How Do You Measure the Impact of Personalization?

Many investors want their portfolios to do more than just pursue reliable premiums. They may also want to seek tax efficiency; reflect their environmental, social, and governance (ESG) values; respect

Continue reading...

Tuning Out the Noise

For investors, it can be easy to feel overwhelmed by the relentless stream of news about markets. Being bombarded with data and headlines presented as affecting your financial well-being can evoke strong

Continue reading...

Which Country Will Outperform? Here’s Why It Shouldn’t Matter.

Investment opportunities exist all around the globe, but the randomness of global stock returns makes it exceedingly difficult to figure out which markets are likely to be outperformers. How should investors

Continue reading...

Swing in Small Value Stocks Shows Benefits of Staying the Course

Value stocks, or those with low relative prices, have outperformed higher-priced growth stocks in the US over the long term. Similarly, the stocks of smaller companies have fared better than the stocks

Continue reading...

Is Inflation Haunting Your Financial Dreams? (Part 2)

The Federal Reserve has been suggesting rising rates should wane. We hope they’re right. But we also know the future remains uncharted. Nearly any outcome is possible, and none is inevitable. This means

Continue reading...

Is Inflation Haunting Your Financial Dreams? (Part 1)

Recent headlines have been reporting a noticeable uptick in inflation. Superlatives like “best” and “worst” grab the most attention, so outlets have been abuzz with reports of how a 5% May consumer

Continue reading...

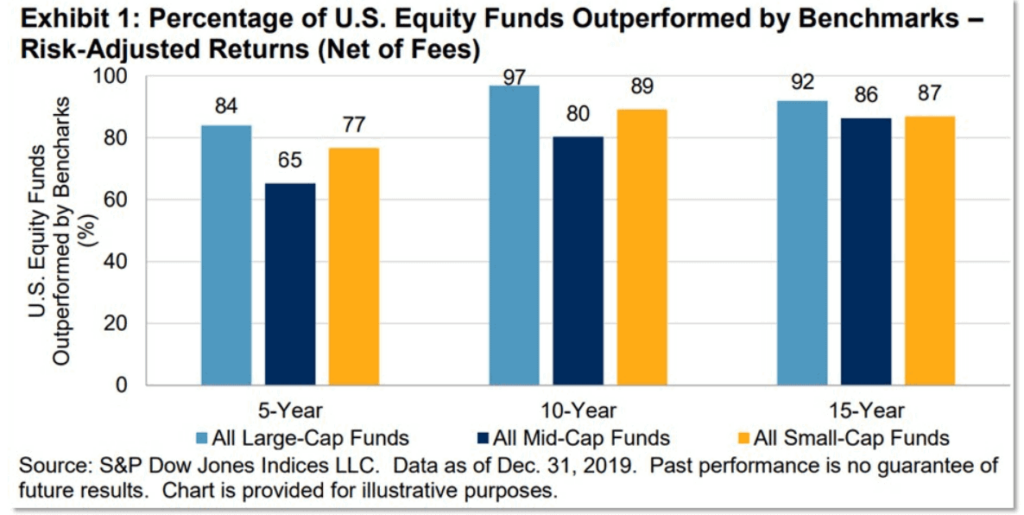

Don’t Let A Market Timer Gamble with Your Life Savings

The prediction game may be a losing one for many investors, and each year there are published reports that highlight the difficulties conventional managers face.

Continue reading...

Why Investors Might Think Twice About Chasing the Biggest Stocks

As companies grow to become some of the largest firms trading on the US stock market, the returns that push them there can be impressive. But not long after joining the Top 10 largest by market cap, these

Continue reading...