- You are here:

- Home »

- Blog »

- Financial Education & News »

- The Small Caps That May Be Holding Back Your Portfolio’s Returns

The Small Caps That May Be Holding Back Your Portfolio’s Returns

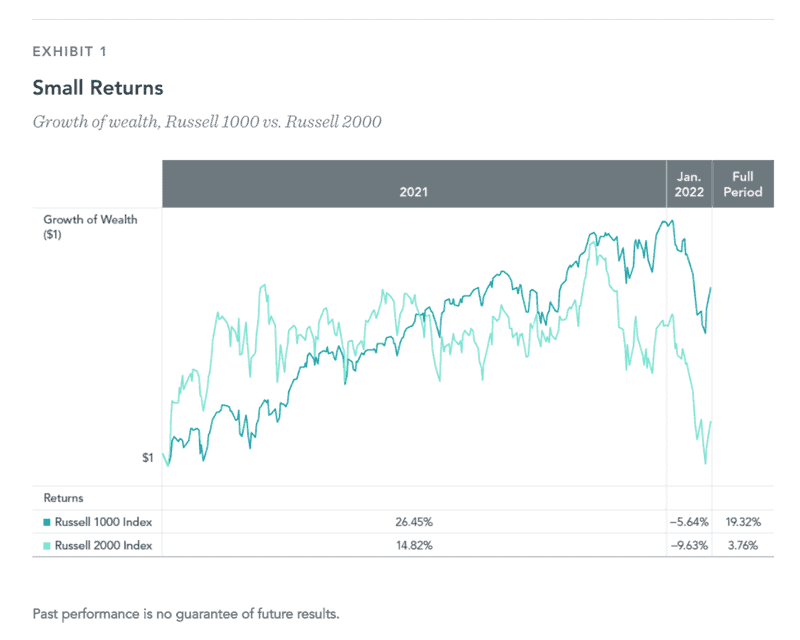

The stock market is off to a rocky start in 2022. Some shares have fallen more than others: Exhibit 1 shows how small caps have lagged large caps in 2021 and into 2022, at least when measured using Russell indices. However, a deeper look shows a subset of small-cap stocks drove much of this underperformance. Small companies with high stock prices that lose money or generate little profit may be holding back your small-cap portfolio.

Growth of wealth, Russell 1000 vs. Russell 2000

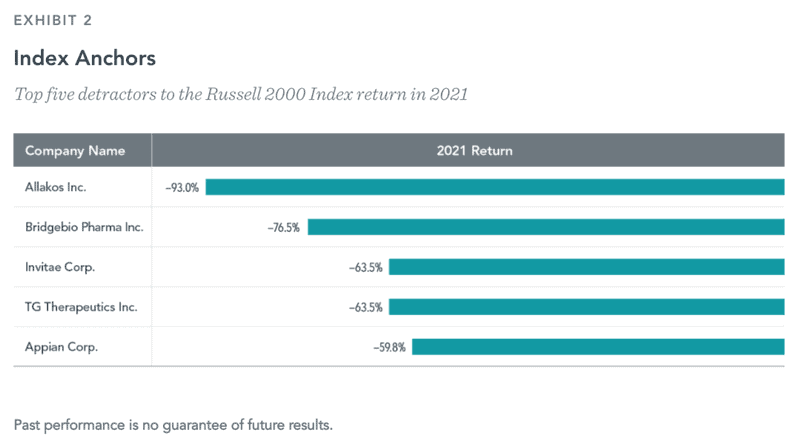

The top detractors to the Russell 2000 Index performance in 2021 share a common trait: they have low to negative profits and trade at high relative prices. At the beginning of 2021, each of the five companies charted in Exhibit 2 had generated negative profits over the previous year and traded at price-to-book ratios that placed them in the highest relative price quartile of the market.

Top five detractors to the Russell 2000 Index return in 2021.

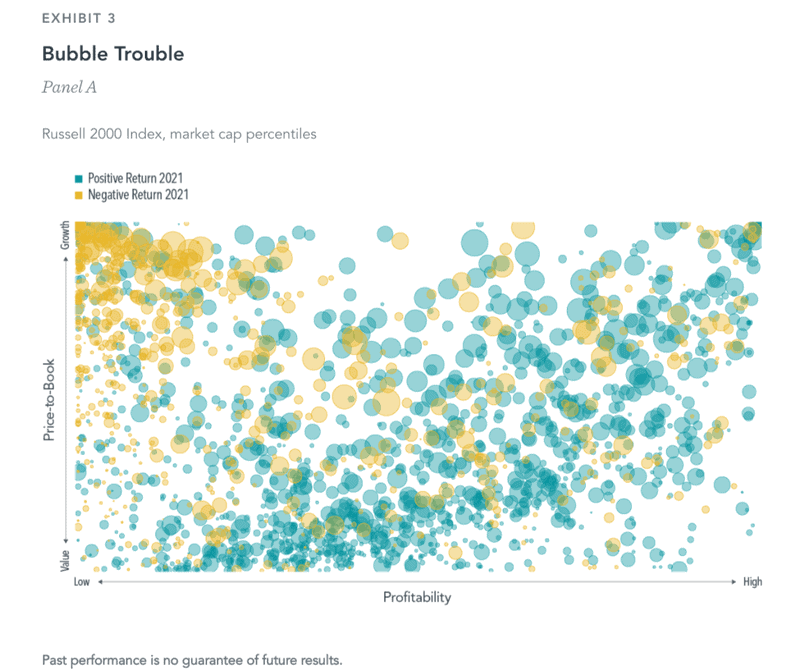

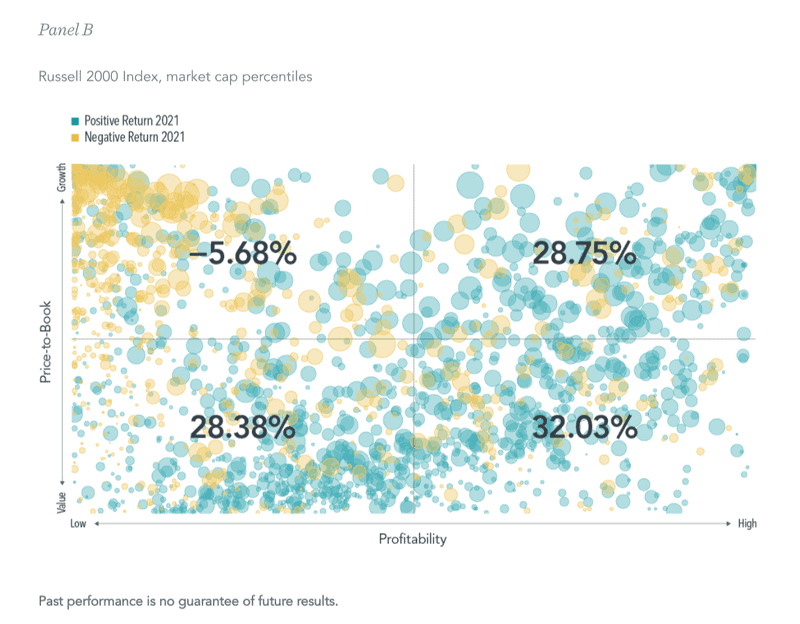

Looking more broadly, we can see negative 2021 returns across many small caps with low profitability—particularly growth stocks with low profitability, as shown in Panels A and B of Exhibit 3.

These stocks were the worst-performing segment by far among small caps in 2021. This follows a four-year streak when these names outperformed other small caps, which led some investors to wonder whether looking to valuation and profitability to make investment decisions was outmoded.

However, looking broadly across decades of returns in global markets, we observe that small-cap growth stocks with low profitability tend to underperform over the long run. And for good reason. From a valuation perspective, paying a lot for a company that earns little profit is a good sign of a very low discount rate, and therefore a low expected investor return. Research has shown that when examining stocks by their size, price-to-book, and profitability characteristics, small-cap stocks with the lowest profitability and highest relative price have experienced the lowest historical returns. (1) By seeking to avoid these stocks, one can improve the expected return of a small-cap portfolio. Commenting on the body of research examining these stocks, Professor Robert Novy-Marx said, “The small unprofitable growth portfolios are … way less than the sum of their parts. They just do so badly in the data.”(2)

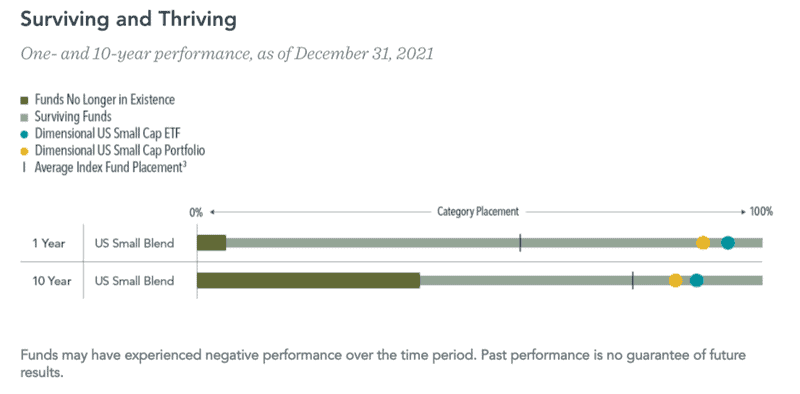

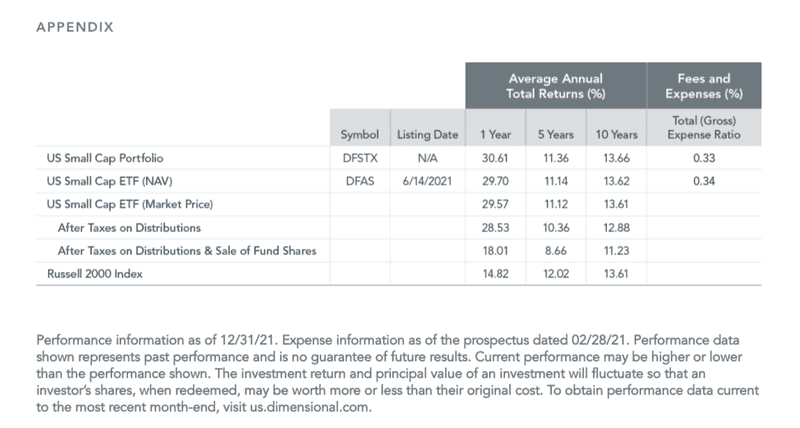

Dimensional seeks to avoid these stocks in our portfolios that invest in small caps, such as those shown in Exhibit 4. And while this is not the only way our small-cap funds may seek to add long-term value, 2021 adds another year to our long-run track record of delivering small-cap solutions that have outperformed both peers and index funds.

FOOTNOTES

- See Eugene F. Fama and Kenneth R. French, “A Five-Factor Asset Pricing Model,” Journal of Financial Economics 116, no.1 (2015): 1-22.

- “Episode 149: Professor Robert Novy-Marx—The Other Side of Value,” May 13, 2021, in Rational Reminder, podcast.

- Average Index Fund Placement is provided where index fund(s) with a Morningstar 1 or 10-Year Total Return Absolute Category Rank exist in the category as of the period ending date.

GLOSSARY

Price-to-book ratio (P/B): The ratio of a firm’s market value to its book value, where market value is computed as price multiplied by shares outstanding and book value is the value of stockholder’s equity as reported on a company’s balance sheet.

This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions.

Risks include loss of principal and fluctuating value. Investment value will fluctuate, and shares, when redeemed, may be worth more or less than the original cost. Small-cap investments are subject to greater volatility than those in other asset categories.

About the Author Doug Finley

Douglas Finley, MS, CFP, AEP, CDFA founded Finley Wealth Advisors in February of 2006, as a Fiduciary Fee-Only Registered Investment Advisor, with the goal of creating a firm that eliminated the conflicts of interest inherent in the financial planner – advisor/client relationship. The firm specializes in wealth management for the middle-class millionaire.

Related Posts

Bringing Order to Your Investment Universe Part 1: The Beauty of Being Organized

The Next BlackBerry?

Exciting Returns May Not Be Expected Returns

Market Behavior and the Weather

What’s Baked into Your Credit Exposure?

Top 500 Stocks, Give or Take $2.1 Trillion

Japan in the News, But It’s Nothing New

Curve Your Enthusiasm with Fed Activity

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.