- You are here:

- Home »

- Blog »

- Financial Education & News »

- Reading Fed Tea Leaves? Watch Market Prices Instead

Reading Fed Tea Leaves? Watch Market Prices Instead

Fed watching is once again one of the markets’ favorite pastimes. Fed officials continue to signal that they would favor tapering of bond purchases in 2021, in line with recent announcements from the European Central Bank. When and how remain to be seen. With ample speculation about the Fed, unemployment, and inflation, it might be a good time for a reminder about what Fed announcements can, and cannot, tell us about the future of fixed income markets.

Yields reflect the aggregate expectations of all market participants, including opinions on how and when the Fed will act. And even if a crystal ball could reveal the timing and direction of the Fed’s actions, we would not know how broader interest rates would react. The Fed is one of many market participants in a larger ecosystem that impacts yield curves at large.

Fed Says ‘Jump,’ Market Says ‘Not So Fast’

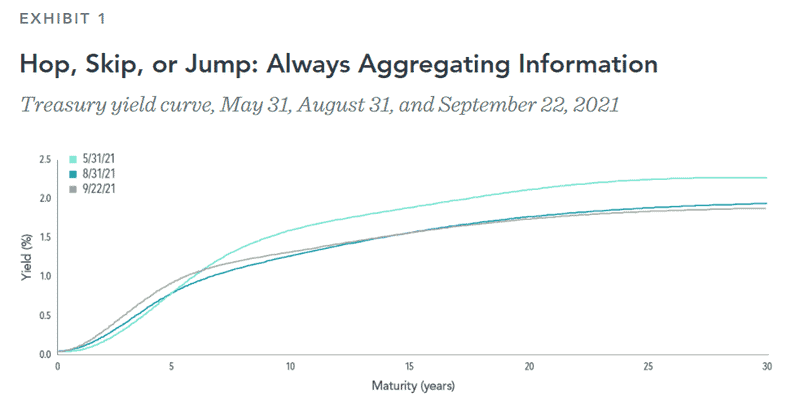

At the Federal Open Market Committee meeting in July, Fed officials strongly suggested they would soon slow bond purchases, and they confirmed their intentions at the Jackson Hole Symposium in August. Fed Chair Jerome Powell announced that “a moderation in the pace of asset purchases may soon be warranted.”1 But fixed income markets have responded tepidly, perhaps because market participants already priced in a potential tapering. Exhibit 1 shows that interest rates generally decreased during the last three months, as opposed to increasing like they did when the Fed announced tapering in the wake of the Global Financial Crisis (“GFC”). This movement may suggest that market dynamics and participants in aggregate, not the Fed alone, determine the level and shape of the yield curve.

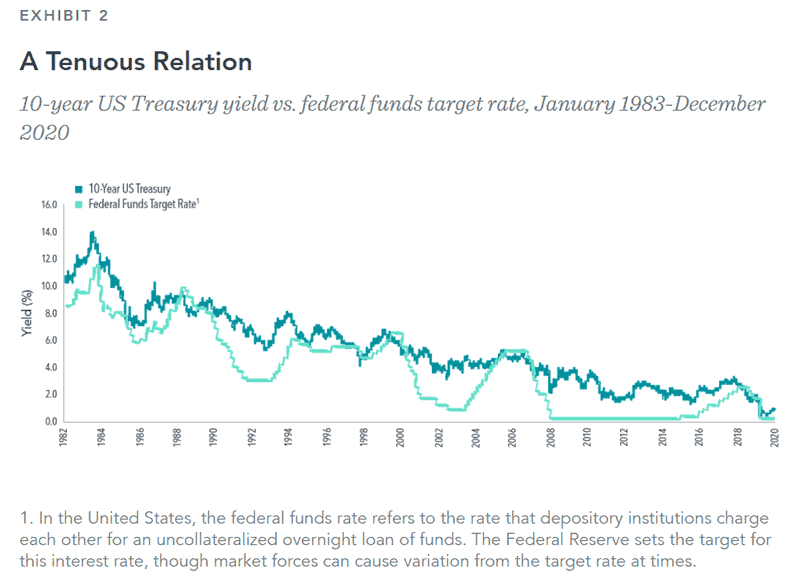

While shorter-term yields rose, longer-term yields fell, a reminder that longer-term yields do not always move in lockstep with changes in the federal funds target rate. Exhibit 2 shows there have been instances when the Fed increased the federal funds target rate, yet longer-term interest rates decreased. From January 1983 to December 2020, there were 70 months in which the federal funds rate increased. About a third of the time, the increase coincided with a decrease in the 10-year US Treasury yield. The lack of a consistent relation between movements in long-term yields and the federal funds rate reinforces the notion that yield curves reflect all available market information, including any Fed action.

Investors should not discount the importance of the Fed and its role in the global financial markets, however. The Fed has many powerful tools to simulate the economy during times of economic distress, as evidenced by its response to the GFC and the COVID-19 pandemic. Still, the Fed does not act in a vacuum. Prices across the broader yield curve are set in conjunction with the aggregate expectations of numerous other market participants.

No Reliable Way to Predict Future Interest Rates

Investors don’t need to dedicate time or resources to predicting the Fed’s next move. Rather, decades of empirical research provide a framework for understanding how to use information in market prices and diversification to pursue higher expected returns and improve the reliability of outcomes.

Larger differences in forward rates among bonds of different durations, credit qualities, or currencies of issuance can indicate larger differences in expected returns. Using market information available in global yield curves is a more reliable way to improve expected returns than trying to read the Fed’s tea leaves.

FOOTNOTES

- “Federal Reserve Issues FOMC Statement,” Federal Reserve, September 22, 2021.

DISCLOSURES

This material is in relation to the US market and contains analysis specific to the US.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

About the Author Doug Finley

Douglas Finley, MS, CFP, AEP, CDFA founded Finley Wealth Advisors in February of 2006, as a Fiduciary Fee-Only Registered Investment Advisor, with the goal of creating a firm that eliminated the conflicts of interest inherent in the financial planner – advisor/client relationship. The firm specializes in wealth management for the middle-class millionaire.

Related Posts

Small Cap, Big Difference

Financial Goals: Your Tickets To Ride

Looking for the Next Nvidia May Shrink Your Return

What’s Baked into Your Credit Exposure?

Top 500 Stocks, Give or Take $2.1 Trillion

Japan in the News, But It’s Nothing New

Curve Your Enthusiasm with Fed Activity

Bringing Order to Your Investment Universe Part 2: Transitions and Taxes

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.