Swing in Small Value Stocks Shows Benefits of Staying the Course

Value stocks, or those with low relative prices, have outperformed higher-priced growth stocks in the US over the long term. Similarly, the stocks of smaller companies have fared better than the stocks of bigger ones in the US. But the performance of these stocks has varied at different points in history.

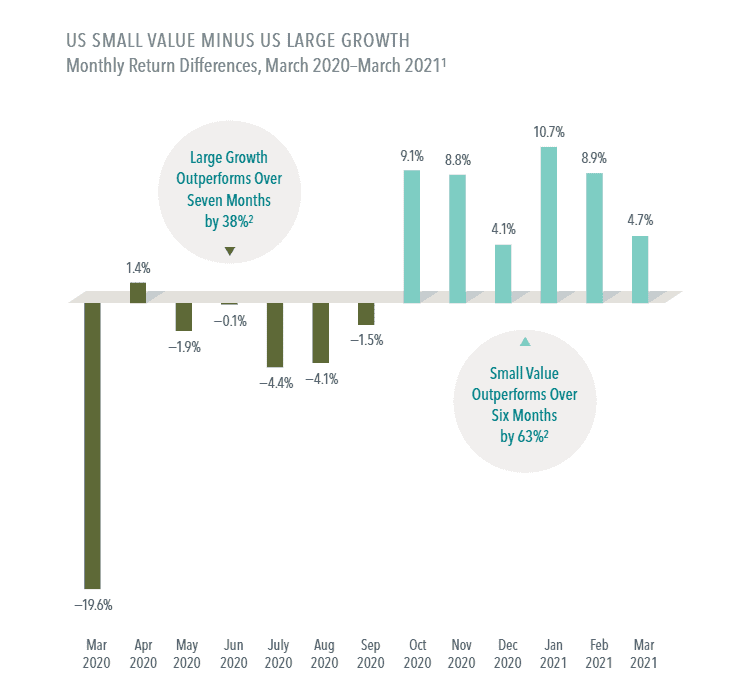

• As the global pandemic rocked markets in March 2020, large growth stocks outdid small value stocks by 19.6%, the greatest monthly margin on record. From March through September, the large growth index beat small value by a cumulative 38%.

• But history has shown that a disappointing period for a premium can be followed by a quick turnaround, and that’s what happened beginning in October 2020. Through March 2021, the small value index saw its own noteworthy outperformance: 63% over that span, among the best stretches since the 1920s.3

History hasn’t presented a reliable way to predict when small value stocks will outperform. Swings can be swift and sharp—staying invested is the best way to capture expected gains over the long term.

About the Author Doug Finley

Douglas Finley, MS, CFP, AEP, CDFA founded Finley Wealth Advisors in February of 2006, as a Fiduciary Fee-Only Registered Investment Advisor, with the goal of creating a firm that eliminated the conflicts of interest inherent in the financial planner – advisor/client relationship. The firm specializes in wealth management for the middle-class millionaire.

Related Posts

Small Cap, Big Difference

Financial Goals: Your Tickets To Ride

Looking for the Next Nvidia May Shrink Your Return

What’s Baked into Your Credit Exposure?

Top 500 Stocks, Give or Take $2.1 Trillion

Japan in the News, But It’s Nothing New

Curve Your Enthusiasm with Fed Activity

Bringing Order to Your Investment Universe Part 2: Transitions and Taxes

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.