- You are here:

- Home »

- Blog

What is the Purpose of Indexes and Index Funds? (Part II)

A Few Points About Index Points As we covered in our last piece, indexes have their uses. They can roughly gauge the mood of a market and its participants. If you’ve got an investment strategy that’s

Continue reading...

What is the Purpose of Indexes and Index Funds?

This post, Indexes Defined, is the first in a series of four designed to give you a clearer understanding of indexes and index funds and their uses. Since nearly every media outlet on the planet reported

Continue reading...

Make the Most of Spousal and Survivor Benefits from Social Security

Even after the crackdown, special rules can pay off handsomely for husbands and wives as survivor benefits come into play. Social Security smiles on married couples, with special rules that can richly

Continue reading...

How to Save Taxes in Retirement

When you take money from savings for retirement, you’re generally advised to tap taxable accounts first, then tax-deferred retirement accounts, and finally your Roth IRA. Here’s why: If you hold an

Continue reading...

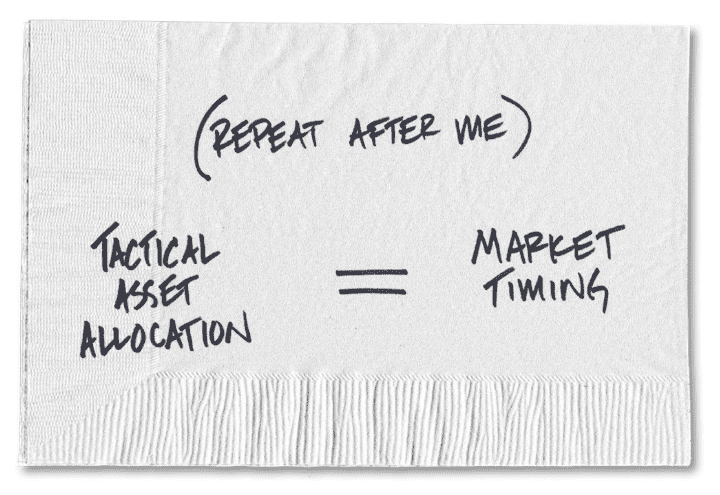

Mean Reversion in Expected Stock Returns a.k.a. Market Timing

This study looks for evidence of mean reversion in the equity, profitability, size, and value premiums. Regressions test for statistical evidence of mean reversion, and trading simulations examine whether

Continue reading...

Investment Shock Absorbers

Ever ridden in a car with worn-out shock absorbers? Every bump is jarring, every corner stomach-churning, and every red light an excuse to assume the brace position. Owning an undiversified portfolio can

Continue reading...

Taxes Never Retire, but Benefits Escape

Congress’s complicated rules for the taxation of Social Security benefits open the door to opportunities to save. It used to be so simple. From the time the first checks were issued in 1937 through the

Continue reading...

The Truth About the Earnings Test

You need to know how continuing to work will affect your benefits. The good news is that the reality isn’t nearly as nefarious as critics complain. It sounds like a cruel joke: After a lifetime of working,

Continue reading...

Portfolio Diversity Creates the Most Beautiful Music

As US stocks have outperformed developed ex US and emerging markets stocks over the last few years, some investors might consider reevaluating the benefits of investing outside the US. From January 1,

Continue reading...

Smart Social Security Strategies for Married Couples

Figuring out the best time to file for your Social Security benefits can be surprisingly simple or hellishly complex. If you’re retired—voluntarily or not—and need the money to live on, you may have

Continue reading...

Did Your Market Timing Broker Disappoint You?

Every year brings its share of surprises. But how many of us could have imagined that 2016 would see the Chicago Cubs win the World Series, Bob Dylan receive the Nobel Prize in Literature, Donald Trump

Continue reading...

The Power of Markets

The mundane pencil—and the ability to purchase it for a “trifling” sum—is the result of an extraordinary process driven by the knowledge of market participants and the power of market prices.

Continue reading...

Structured CDs: Buyer Beware!

Most investors are familiar with Certificates of Deposit (CDs). You purchase one, and the bank pays you a bit of interest on it, plus your principal back. They don’t yield much, but they’re nearly

Continue reading...

Parenting Your Wealth in Uncertain Markets

In the face of political drama at home and abroad, it’s certainly been a summer for trying our patience, hasn’t it? For anyone who has ever been a parent or a child – that is, for everyone – there

Continue reading...

Reflections on Real Estate Investing

Just as the natural world around us comes from the elements found in the periodic table of elements, capital markets are made up of asset classes, broadly organized into stocks, bonds, and hard assets

Continue reading...

Start a New Tradition: Family Wealth Planning Conversations

Whether it’s gathering for an annual reunion, recounting an anecdote about quirky Uncle Jim, or simply being there for one another during difficult times, family traditions are the comfort food that

Continue reading...

What To Do in Lieu of Chasing Yield

With a total-return approach, we typically want you to reserve your fixed income/bond investments for their primary purpose in life, which is to provide a stabilizing counterbalance to your equity/stock

Continue reading...

Is It You Versus The Federal Reserve?

Since December 2008, the U.S. Federal Reserve (the Fed) has held the federal funds rate at zero percent, seeking to bolster an ailing economy in the aftermath of the Great Recession. Economists agree that

Continue reading...