- You are here:

- Home »

- Blog »

- Financial Education & News »

- Mean Reversion in Expected Stock Returns a.k.a. Market Timing

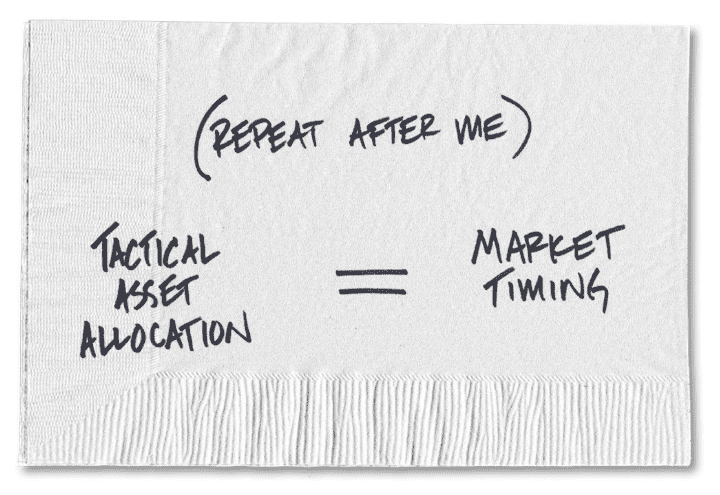

Mean Reversion in Expected Stock Returns a.k.a. Market Timing

This study looks for evidence of mean reversion in the equity, profitability, size, and value premiums. Regressions test for statistical evidence of mean reversion, and trading simulations examine whether mean reversion in historical premiums was strong enough to permit profitable trading strategies. Evidence of mean reversion is weak, and 780 simulated trading strategies show very limited evidence of reliably positive abnormal returns.

Introduction

While the evidence indicates that the equity, size, value, and profitability premiums have been reliably positive, their annual realizations have varied substantially. This variation leads some to wonder if the expected values of these premiums are constant over time. In particular, some have speculated that there may be mean reversion so that high premiums tend to be followed by low premiums and vice versa. There are at least two consequences of mean reversion in a return series. First, returns measured over long horizons are not as variable as they would be in the absence of mean reversion. Second, future values of the return are at least partially predictable. If high returns tend to be followed by low returns (and vice versa), investors can learn something about likely future returns by looking at past returns. However, it is not clear what the time horizon should be, nor is it clear what mean a premium should revert to, nor is it clear how strong the predictability in returns should be.

This study focuses on predictability in the US and 14 other markets. (1) Time series regressions look for statistical evidence of predictability, and trading simulations examine whether predictability was strong enough to generate reliable excess returns.

Key Findings

- Evidence of mean reversion found in the study is quite weak. While the presence of mean reversion in the historical sample cannot be ruled out, there is minimal evidence that it has been strong enough to permit profitable trading strategies. The proportion of simulations generating reliably positive excess returns was similar to what one would expect by random chance.

- The regressions in non-US markets indicate some ability to predict when the equity premium will be above or below average, but that is not enough for a successful trading rule. Such a rule requires an ability to predict when the premium is likely to be negative. The evidence suggests this is more difficult to do.

- If there is no mean reversion at all in the dimensions of return, about 5% of the 780 trading simulations in the study would likely show reliably positive excess returns just by random chance. The actual proportion is 5.8%. Overall, the evidence of predictability from these simulations is quite weak.

Conclusions

The procedure followed in this study—trying hundreds of different trading rules in search of some that work in the historical sample—is commonly called data mining. Dimensional has always cautioned investors not to rely on strategies that were found by data mining because the success of the strategies in historical data could be spurious. If one dredges through the data long enough, one will eventually find some strategies that perform well in the historical sample. That is not an interesting result. It becomes more interesting if the same rule generates reliable excess returns in multiple samples while underperforming in a few samples. The most interesting result of this study is that, in spite of vigorous historical data mining, no trading rule was found that consistently generated reliable excess returns across markets and premiums. To reliably capture the premiums, an investment strategy must maintain a systematic focus on the expected return dimensions—equity, size, relative price, and profitability—being pursued by the strategy. Dimensional’s investment approach provides a consistent focus on the dimensions and adds value through advanced portfolio design, management, and implementation.

Important Disclosures

Strategies presented herein are for illustrative purposes only and do not represent actual investments or strategies available during the periods represented. The data does not reflect advisory fees, trading costs, or other expenses associated with the management of an actual portfolio. The securities held in the simulated model may differ significantly from those held in an actual account. The actual management of these types of simulated strategies may result in lower returns than the back-tested results achieved with the benefit of hindsight. Investing involves risks such as fluctuating value and possible loss of principal invested. Past performance of a simulated strategy is no guarantee of future results.

This information is provided for registered investment advisors and institutional investors and is not intended for public use. All expressions of opinion are subject to change. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Past performance is no guarantee of future results. International investing involves special risks such as currency fluctuation and political instability. Investing in emerging markets may accentuate these risks. Diversification does not protect against loss in declining markets. There are no guarantee strategies will be successful. The material in this publication is provided solely as background information for registered investment advisors and institutional investors and is not intended for public use. 1. For a complete discussion of the methodology and results request a copy of the full white paper, “Mean Reversion in the Dimensions of Expected Stock Returns”.

About the Author Doug Finley

Douglas Finley, MS, CFP, AEP, CDFA founded Finley Wealth Advisors in February of 2006, as a Fiduciary Fee-Only Registered Investment Advisor, with the goal of creating a firm that eliminated the conflicts of interest inherent in the financial planner – advisor/client relationship. The firm specializes in wealth management for the middle-class millionaire.

Related Posts

Cost of Capital: A Gut Check on High-Flying Stock Returns

Exciting Returns May Not Be Expected Returns

Pensions & Investments: Dimensional Co-CIO Talks ETFs and Going Beyond Indexing

Small Cap, Big Difference

Financial Goals: Your Tickets To Ride

Looking for the Next Nvidia May Shrink Your Return

What’s Baked into Your Credit Exposure?

Top 500 Stocks, Give or Take $2.1 Trillion

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.