Category Archives for Blog

Financial Planning for Women: The Best Tips for Success

You might be suprised to learn that when it comes to the big earners — those earning more than $1 million a year — women now take the cake over men. Also, the millionaire club is getting a

Continue reading...

Market Index Mechanics – Interesting Idiosyncrasies (Part III)

Market indexes and market index mechanics, you read about them all the time. In Part III of this series, we take a closer look at market index mechanics to gain a better understanding of why they do,

Continue reading...

Index Points and What they Mean (Part II)

Checking an index point at any given time is like dipping your toe in the water to see how the ocean is doing. You may have good reasons to do that toe-check, but as with any approximation, be careful

Continue reading...

A Financial Index Overview: Part I – Indexes Defined

When a popular financial index like the Dow is on a tear, up or down, what does it really mean to you and your investments?

Continue reading...

A simple equation that effects your investments.

When fundamental facts grow harder to discern, investments grow more volatile, and that’s what’s been happening lately, especially with the widespread misperception of the yield curve inversion.

Continue reading...

How to React to Recent Market Volatility

Market volatility can be nerve-racking for investors. Reacting emotionally and changing long-term investment strategies in response to short-term declines could prove more harmful than helpful.

Continue reading...

3 Key Steps to Protect Your Assets (While You’re Alive)

Taking action to protect your assets and what’s yours while you’re still alive and in sane mind makes such good sense. There are many ways in which you might be unavailable to make critical

Continue reading...

What is the Total Cost of Ownership?

A question worth finding answers to is ‘what is the total cost of ownership?’ The costs you expect to pay are likely to be an important factor in making any investment decision, including major

Continue reading...

Timing Markets Isn’t Everything

The lure of getting in at the right time or avoiding the next downturn may tempt even disciplined, long-term investors. The reality of successfully timing markets, however, isn’t as straightforward as

Continue reading...

Value Premium Investing – How Viable Is It Today?

It’s no secret that in U.S. markets, value stocks have been underperforming relative to growth stocks for around a decade. Has the Value Premium Lost its Mojo? Are the underwhelming returns a temporary,

Continue reading...

The Randomness of Global Equity Returns

Investment opportunities for over 15,000 publicly traded companies exist all around the globe. Fluctuations in performance from year to year add to the complexity of investing globally, and provide little

Continue reading...

Good Advice For Your Personal Financial Planning

In today’s world of one-page financial plans, bargain-basement fund pricing and automated investing tools, you don’t just need advice. You need good advice.

Continue reading...

What Are Liquid Investments?

What are Liquid Investments? When a holding is liquid, it simply means you can sell it anytime the market in which it trades is open for business, without losing your proverbial shirt in the exchange.

Continue reading...

The Uncommon Average

The US stock market has delivered an average annual return of around 10% since 1926. But short-term results may vary, and in any given period stock returns can be positive, negative, or flat. When setting

Continue reading...

6 Tax Planning Strategies to Optimize Your Retirement Wealth

You’ll benefit from the tax planning strategies in this post, whether you are currently retired or are still counting down the years, months, or days until retirement. Being deliberate about your

Continue reading...

Earning The Equity Risk Premium

A rubric of modern portfolio theory taught at colleges and universities holds that investors get paid extra return for taking risk. The risk premium is the amount you get paid for owning a risky asset.

Continue reading...

Five Financial Adages for Thriving in Volatile Markets

Sometimes the best, most rigorously developed financial advice is so obvious, it’s become cliché. And yet, investors often end up abandoning this same advice when volatile markets are on the rise. Why

Continue reading...

Understanding How Investments are Taxed Differently

Taxes in retirement can have serious impacts and different investments are taxed differently. Retirees should be aware their taxable income could have an impact on more than their investment portfolio...

Continue reading...

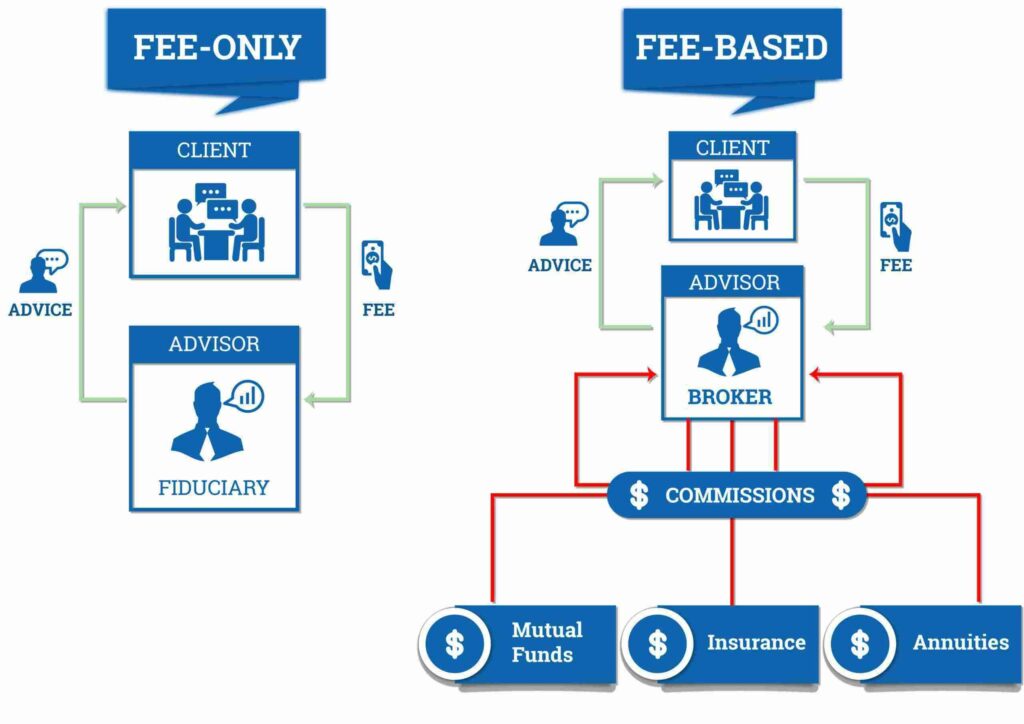

Understanding How Fee Only Advisors Work [Infographic]

The vast majority of employees of banks, brokerage firms, and insurance companies charge a management fee part of the time and are commissioned salespeople at other times. These brokers call themselves

Continue reading...

Alternative Reality

Diversification has been called the only free lunch in investing. This idea is based on research showing that diversification, through a combination of assets like stocks and bonds, could reduce volatility

Continue reading...

10 Steps to Easing Financial Anxiety During Major Life Changes

Life happens and, sometimes, it can be incredibly worrisome from a financial standpoint. You’ve struggled through a divorce. Perhaps you’ve faced a life-threatening illness. And, you look at your bank

Continue reading...

The Tao of Wealth Management

The path to success in many areas of life is paved with continual hard work, intense activity, and a day-to-day focus on results. However, for many investors who adopt this approach to managing their wealth,

Continue reading...

What You Pay, What You Get: Connecting Price and Expected Returns

It has been more than 50 years since the idea of stock prices containing all relevant information was put forth. Information might come in the form of data from a company’s financial statements, news

Continue reading...

The Impact of Inflation

This erosion of the real purchasing power of wealth is called inflation. Inflation is an important element of investing. In many cases, the reason for saving today is to support future spending. Therefore,

Continue reading...

Models, Uncertainty, and the Importance of Trust

Models are approximations of the world. They are simplifications of reality. Models can be useful for gaining insights that help us make good decisions. But they can also be dangerous if someone is overconfident

Continue reading...

What Is Correlation (and Why Would You Care)?

Here at Finley Wealth Management, we try to keep the financial jargon to a minimum. But even where we may succeed, you’re likely to encounter references elsewhere that can turn valuable information into

Continue reading...

Tuning Out the Noise

For investors, it can be easy to feel overwhelmed by the relentless stream of news about markets. Being bombarded with data and headlines presented as impactful to your financial well-being can evoke

Continue reading...

A Focus on Fixed Income

It’s been approximately a decade since the Great Recession began. By year-end 2008, the U.S. Federal Reserve (the Fed) had lowered the target federal funds rate to near-zero and embarked on an aggressive

Continue reading...

What’s Social Security Got for You?

Building the best strategy starts with pinpointing your benefit at different ages. Back in the late 1980s, when much like today there was mounting concern about the future of Social Security, Congress

Continue reading...

Doing Well and Doing Good?

Growing interest in the impact of fossil fuels on the global climate may spark questions about whether individuals can integrate their values around sustainability with their investment goals and, if so,

Continue reading...