- You are here:

- Home »

- Blog »

- Financial Education & News »

- Earning The Equity Risk Premium

Earning The Equity Risk Premium

The plunge in stock prices means it’s time to earn the equity risk premium. Here’s a reminder about this important fundamental financial concept.

Earning The Equity Risk Premium: What Does That Mean?

A rubric of modern portfolio theory taught at colleges and universities holds that investors get paid extra return for taking risks. The risk premium is the amount you get paid for owning a risky asset.

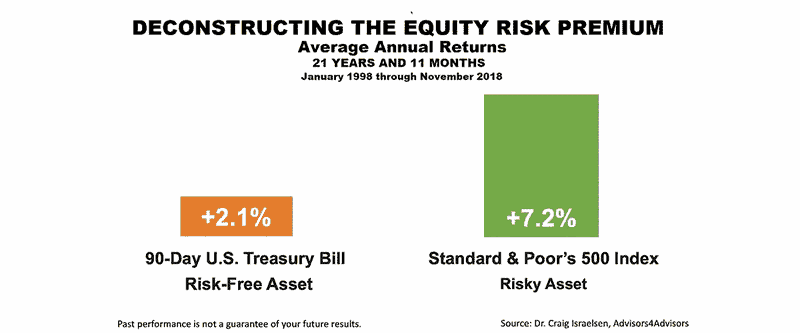

To quantify the equity risk premium, here are the numbers:

Over the 21 years and 11 months ended on November 30, 2018, the risk-free 90-day U.S Treasury Bill averaged an annual return of 2.1%, compared to a 7.2% annualized return on the S&P 500 stock index.

Two full economic and bear market cycles

This period of nearly 22 years encompasses two full economic and bear market cycles — the tech-bubble bursting in 1999 and the global financial crisis of 2008 — so it is a fair period to examine in illustrating the equity risk premium.

The difference between the 7.2% average annual return on the S&P 500 index and the 2.1% return on a risk-free T-Bill is 5.1%. The extra return annually averaged on equity invested in America’s 500 largest publicly-held companies in the 21-year, 11-month period ended November 30, 2018 — is the equity risk premium, 5.1%.

The current plunge followed a spectacular bull market run and was predictable

In the context of the equity risk premium, the recent plunge in stock prices has been no huge surprise. The plunge followed a spectacular bull market run — nine consecutive calendar years of positive returns and a 10.8% return through the first three quarters of 2018.

Conclusion

Times of painful stock market losses are when investors actually earn the equity risk premium — and that’s an important financial fundamental to remember in times like these.

About the Author Doug Finley

Douglas Finley, MS, CFP, AEP, CDFA founded Finley Wealth Advisors in February of 2006, as a Fiduciary Fee-Only Registered Investment Advisor, with the goal of creating a firm that eliminated the conflicts of interest inherent in the financial planner – advisor/client relationship. The firm specializes in wealth management for the middle-class millionaire.

Related Posts

The Randomness of Global Equity Returns

Financial Goals: Your Tickets To Ride

Looking for the Next Nvidia May Shrink Your Return

What’s Baked into Your Credit Exposure?

Top 500 Stocks, Give or Take $2.1 Trillion

Japan in the News, But It’s Nothing New

Curve Your Enthusiasm with Fed Activity

Bringing Order to Your Investment Universe Part 2: Transitions and Taxes

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.