Category Archives for Investment Advice

How to React to Recent Market Volatility

Market volatility can be nerve-racking for investors. Reacting emotionally and changing long-term investment strategies in response to short-term declines could prove more harmful than helpful.

Continue reading...

3 Key Steps to Protect Your Assets (While You’re Alive)

Taking action to protect your assets and what’s yours while you’re still alive and in sane mind makes such good sense. There are many ways in which you might be unavailable to make critical

Continue reading...

What is the Total Cost of Ownership?

A question worth finding answers to is ‘what is the total cost of ownership?’ The costs you expect to pay are likely to be an important factor in making any investment decision, including major

Continue reading...

Value Premium Investing – How Viable Is It Today?

It’s no secret that in U.S. markets, value stocks have been underperforming relative to growth stocks for around a decade. Has the Value Premium Lost its Mojo? Are the underwhelming returns a temporary,

Continue reading...

The Randomness of Global Equity Returns

Investment opportunities for over 15,000 publicly traded companies exist all around the globe. Fluctuations in performance from year to year add to the complexity of investing globally, and provide little

Continue reading...

The Uncommon Average

The US stock market has delivered an average annual return of around 10% since 1926. But short-term results may vary, and in any given period stock returns can be positive, negative, or flat. When setting

Continue reading...

Five Financial Adages for Thriving in Volatile Markets

Sometimes the best, most rigorously developed financial advice is so obvious, it’s become cliché. And yet, investors often end up abandoning this same advice when volatile markets are on the rise. Why

Continue reading...

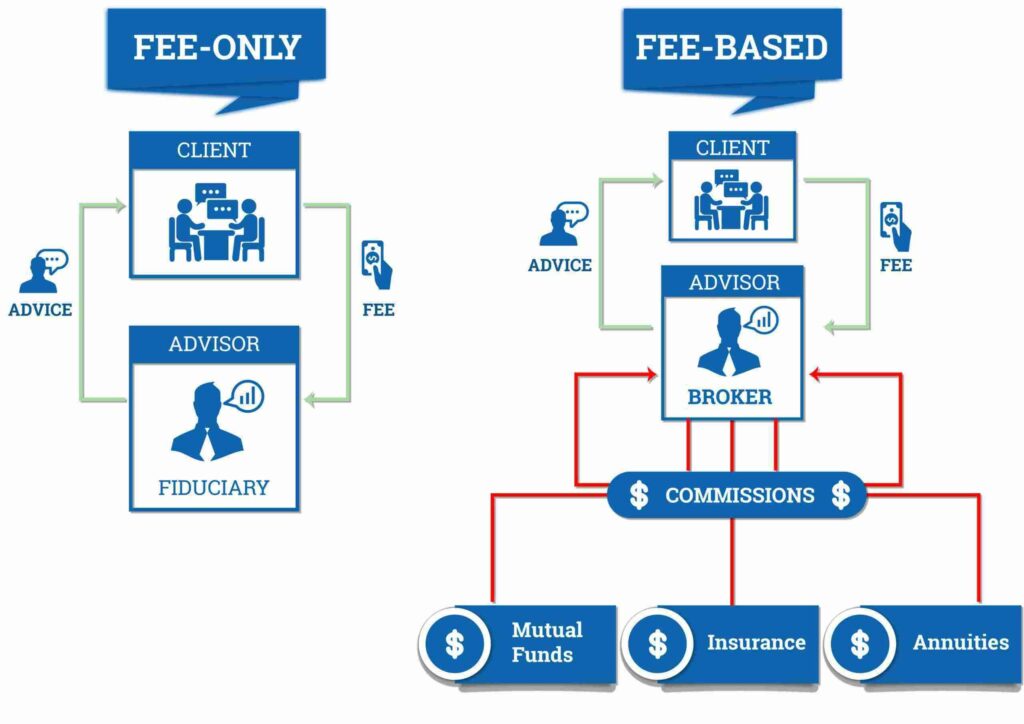

Understanding How Fee Only Advisors Work [Infographic]

The vast majority of employees of banks, brokerage firms, and insurance companies charge a management fee part of the time and are commissioned salespeople at other times. These brokers call themselves

Continue reading...

Alternative Reality

Diversification has been called the only free lunch in investing. This idea is based on research showing that diversification, through a combination of assets like stocks and bonds, could reduce volatility

Continue reading...

10 Steps to Easing Financial Anxiety During Major Life Changes

Life happens and, sometimes, it can be incredibly worrisome from a financial standpoint. You’ve struggled through a divorce. Perhaps you’ve faced a life-threatening illness. And, you look at your bank

Continue reading...

The Tao of Wealth Management

The path to success in many areas of life is paved with continual hard work, intense activity, and a day-to-day focus on results. However, for many investors who adopt this approach to managing their wealth,

Continue reading...

What You Pay, What You Get: Connecting Price and Expected Returns

It has been more than 50 years since the idea of stock prices containing all relevant information was put forth. Information might come in the form of data from a company’s financial statements, news

Continue reading...

The Impact of Inflation

This erosion of the real purchasing power of wealth is called inflation. Inflation is an important element of investing. In many cases, the reason for saving today is to support future spending. Therefore,

Continue reading...

Models, Uncertainty, and the Importance of Trust

Models are approximations of the world. They are simplifications of reality. Models can be useful for gaining insights that help us make good decisions. But they can also be dangerous if someone is overconfident

Continue reading...

What Is Correlation (and Why Would You Care)?

Here at Finley Wealth Management, we try to keep the financial jargon to a minimum. But even where we may succeed, you’re likely to encounter references elsewhere that can turn valuable information into

Continue reading...

Tuning Out the Noise

For investors, it can be easy to feel overwhelmed by the relentless stream of news about markets. Being bombarded with data and headlines presented as impactful to your financial well-being can evoke

Continue reading...

A Focus on Fixed Income

It’s been approximately a decade since the Great Recession began. By year-end 2008, the U.S. Federal Reserve (the Fed) had lowered the target federal funds rate to near-zero and embarked on an aggressive

Continue reading...

Doing Well and Doing Good?

Growing interest in the impact of fossil fuels on the global climate may spark questions about whether individuals can integrate their values around sustainability with their investment goals and, if so,

Continue reading...

Evidence-Based Investing vs. Indexing

Making a Good Thing Even Better As the public grows increasingly familiar with “passive” or “index” investing, it’s becoming easier for individual investors to gain cost-effective exposure to

Continue reading...

Sailing with the Tides

Embarking on a financial plan is like sailing around the world. The voyage won’t always go to plan, and there’ll be rough seas. But the odds of reaching your destination increase greatly if

Continue reading...

10 Things To Do When Markets Get Scary

“This is a test; this is only a test. Had this been an actual emergency …” The truth is, the markets are doing just what markets do from time to time, they correct themselves. In fact, overall market

Continue reading...

Our Jekyll-Hyde Relationship with Investment Risk

“What the imagination can’t conjure, reality delivers with a shrug.” – Trumbo (movie voice-over) Whether it’s the recent destruction wrought by Canada’s Fort McMurray oil sands wildfire, a

Continue reading...

Cost Control: An Investor’s Greatest Investment

In the mid-1800s, is a collection of essays entitled “Conduct of Life,” Ralph Waldo Emerson observed, “Money often costs too much.” More than 150 years later, his words remain well worth heeding,

Continue reading...

The Vital Role of Rebalancing

If there is a universal investment ideal, it is this: Every investor wants to buy low and sell high. What if we told you there is a disciplined process for doing just that and staying on track toward your

Continue reading...

Market Timing: The Built-in Hurdle

Market timing generally refers to approaches that seek to outperform a traditional static asset allocation by switching back and forth between asset classes. However, as shown in this article, these approaches

Continue reading...

Home Bias and Global Diversification

By pursuing a globally diversified approach to investing, one doesn’t have to attempt to pick winners to achieve a rewarding investment experience. Every day we enjoy the benefits of an interconnected

Continue reading...

The ABC’s of Behavioral Biases (F–H)

Let’s continue our alphabetic tour of common behavioral biases that distract otherwise rational investors from making the best choices about their wealth. Today, we’ll tackle: fear, framing, greed,

Continue reading...

Three Key Investment Strategies Hidden in Plain Sight: Part 3

In the first two installments of our three-part “hidden in plain sight” investment strategy series, we’ve covered the importance of staying invested to earn market returns, while managing the risks

Continue reading...

Three Key Investment Strategies Hidden in Plain Sight: Part 2

In our last piece, we described why most investors should ignore the never-ending onslaught of unpredictable financial investment news and tend to three strategies that can be much more readily managed

Continue reading...

Three Key Investment Strategies Hidden in Plain Sight: Part 1

If you’ve ever dabbled in graphic design, you’re familiar with the concept of white space. When viewing an illustration, we typically pay the most attention to the visible ink on the page, such as

Continue reading...