Category Archives for Investment Advice

Myth-Busting with Momentum: How to Pursue the Premium

While both simulated and real-world data suggest momentum may not be suitable as a driver of long-term asset allocations, we believe momentum considerations can be integrated in a cost-effective way to

Continue reading...

When It Comes to SMAs, How Do You Measure the Impact of Personalization?

Many investors want their portfolios to do more than just pursue reliable premiums. They may also want to seek tax efficiency; reflect their environmental, social, and governance (ESG) values; respect

Continue reading...

Reading Fed Tea Leaves? Watch Market Prices Instead

Yields reflect the aggregate expectations of all market participants, including opinions on how and when the Fed will act. And even if a crystal ball could reveal the timing and direction of the Fed’s

Continue reading...

The Ever Changing World Goes On

“News is, by definition, something that doesn’t last. It exists for only a moment before it changes. … It’s not important to living a good life. It’s not going to help you make better decisions.

Continue reading...

Tuning Out the Noise

For investors, it can be easy to feel overwhelmed by the relentless stream of news about markets. Being bombarded with data and headlines presented as affecting your financial well-being can evoke strong

Continue reading...

Which Country Will Outperform? Here’s Why It Shouldn’t Matter.

Investment opportunities exist all around the globe, but the randomness of global stock returns makes it exceedingly difficult to figure out which markets are likely to be outperformers. How should investors

Continue reading...

When Everything Screams Inflation

After last year’s economic shocks, we shouldn’t be surprised to see prices rebounding. But the potential for inflation is one among many factors investors take into account when agreeing on a price

Continue reading...

Swing in Small Value Stocks Shows Benefits of Staying the Course

Value stocks, or those with low relative prices, have outperformed higher-priced growth stocks in the US over the long term. Similarly, the stocks of smaller companies have fared better than the stocks

Continue reading...

Is Inflation Haunting Your Financial Dreams? (Part 2)

The Federal Reserve has been suggesting rising rates should wane. We hope they’re right. But we also know the future remains uncharted. Nearly any outcome is possible, and none is inevitable. This means

Continue reading...

Is Inflation Haunting Your Financial Dreams? (Part 1)

Recent headlines have been reporting a noticeable uptick in inflation. Superlatives like “best” and “worst” grab the most attention, so outlets have been abuzz with reports of how a 5% May consumer

Continue reading...

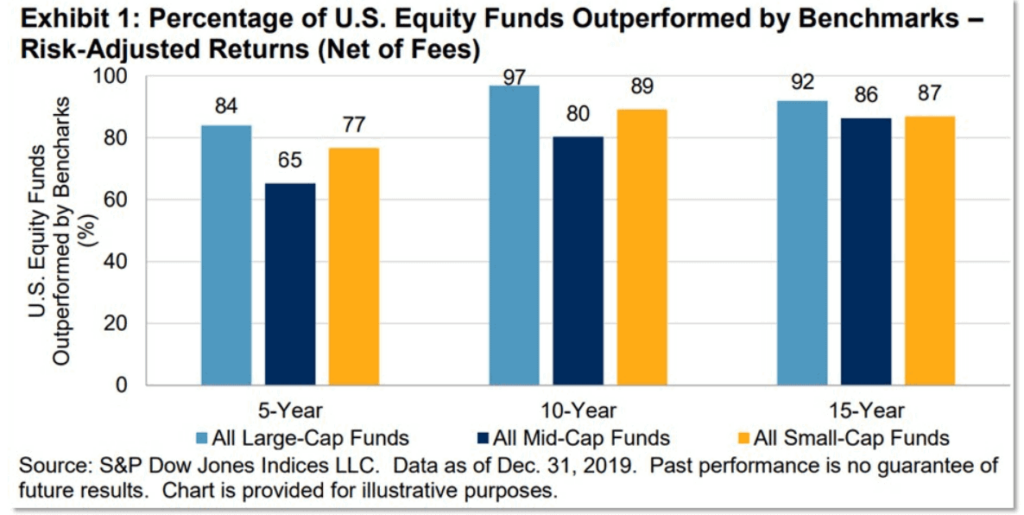

Don’t Let A Market Timer Gamble with Your Life Savings

The prediction game may be a losing one for many investors, and each year there are published reports that highlight the difficulties conventional managers face.

Continue reading...

Why Investors Might Think Twice About Chasing the Biggest Stocks

As companies grow to become some of the largest firms trading on the US stock market, the returns that push them there can be impressive. But not long after joining the Top 10 largest by market cap, these

Continue reading...

The More Things Change

“If there is a unifying theme to all this, it is that investors big and small showed no fear of risk-taking to start 2021. In fact, they embraced it.” – Wall Street Journal

Continue reading...

How Has Market Behavior Evolved For Emerging Markets Investing?

Understanding market behavior and evolution are just as important for emerging markets as for developed markets, as emerging markets are an important part of a well-diversified global equity portfolio.

Continue reading...

When It’s Value Stocks vs. Growth Stocks, History Is on Value’s Side

Recently, growth stocks have enjoyed a run of outperformance vs. their value counterparts. But while disappointing periods emerge from time to time, the principle that lower relative prices lead to higher

Continue reading...

Strategic vs. Tactical Asset Allocation: Does It Matter?

Strategic vs. tactical asset allocation … they both sound pretty good as an investment strategy, don’t they? There’s only one problem: I may have left you guessing as to what I’m even talking

Continue reading...

Choosing Between a Fee-Only or Fee-Based Advisor

in your search for a dependable financial advisor, you might assume fee-only advisor vs. fee-based advisor are one and the same. Unfortunately, fee-only and fee-based advisors are not interchangeable.

Continue reading...

Three Upside-Down Investment Insights

A trio of weird, but wonderful “upside-down” investment ideas in this post. Often, all you need to be an excellent investor is a healthy dose of common sense: A penny saved is a penny earned. Buy low,

Continue reading...

Cost of Investment Decisions And Why They Matter

Much of what impacts your investment decisions is beyond your control. That said, you do have a big say on how much you spend on investing. By tending to the costs of your investment decisions, you can

Continue reading...

Lessons for Long-Term Investors – Tale of Two Decades

The first two decades of the 21st century have reinforced important lessons for long-term investors. Holding a broadly diversified portfolio can help smooth out the swings. Having a sound strategy built

Continue reading...

A Financial Index Overview: Part I – Indexes Defined

When a popular financial index like the Dow is on a tear, up or down, what does it really mean to you and your investments?

Continue reading...

A simple equation that effects your investments.

When fundamental facts grow harder to discern, investments grow more volatile, and that’s what’s been happening lately, especially with the widespread misperception of the yield curve inversion.

Continue reading...

How to React to Recent Market Volatility

Market volatility can be nerve-racking for investors. Reacting emotionally and changing long-term investment strategies in response to short-term declines could prove more harmful than helpful.

Continue reading...

3 Key Steps to Protect Your Assets (While You’re Alive)

Taking action to protect your assets and what’s yours while you’re still alive and in sane mind makes such good sense. There are many ways in which you might be unavailable to make critical

Continue reading...

What is the Total Cost of Ownership?

A question worth finding answers to is ‘what is the total cost of ownership?’ The costs you expect to pay are likely to be an important factor in making any investment decision, including major

Continue reading...

Value Premium Investing – How Viable Is It Today?

It’s no secret that in U.S. markets, value stocks have been underperforming relative to growth stocks for around a decade. Has the Value Premium Lost its Mojo? Are the underwhelming returns a temporary,

Continue reading...

The Randomness of Global Equity Returns

Investment opportunities for over 15,000 publicly traded companies exist all around the globe. Fluctuations in performance from year to year add to the complexity of investing globally, and provide little

Continue reading...