Category Archives for Investment Advice

Pursuing a Better Investment Experience (Part 5)

Welcome to the pursuing a better investment experience series. We are going to review two topic points regarding market headlines and what you can control, let’s get started.

Continue reading...

Pursuing a Better Investment Experience (Part 4)

Welcome to the pursuing a better investment experience series. We are going to review two topic points regarding market timing and emotions, let’s get started. The First Point – Avoid

Continue reading...

Pursuing a Better Investment Experience (Part 3)

Welcome to the pursuing a better investment experience series. We are going to review two topic points regarding market returns and diversification, let’s get started. The First Point

Continue reading...

Pursuing a Better Investment Experience (Part 2)

Welcome to the pursuing a better investment experience series. We are going to review two topic points regarding market performance facts, let’s get started. The First Point – Resist

Continue reading...

Pursuing a Better Investment Experience (Part 1)

Welcome to the pursuing a better investment experience series. We are going to review two topic points regarding market facts, let’s get started. The First Point – Embrace Market

Continue reading...

Rising Rates: Short-Term Pain for Long-Term Gain?

Investors have likely noticed the improved opportunity set in fixed income due to higher yields. And yet some investors may be hesitant to take advantage of higher yields because of concerns about

Continue reading...

What is Sudden Wealth Syndrome?

C’mon, admit it… Even if you’re super savvy financially, I’m sure you’ve occasionally bought a lottery ticket (or several). I know I have, when the jackpot is so astronomically high that it more

Continue reading...

Market Timing Traps and Temptations

Decades of tracking and analyzing investment portfolio returns keep telling the same story., market timing behaviors are traps. Even though we should know it was just dumb luck, can we get a round of applause

Continue reading...

The ABCs of Behavioral Biases – Conclusion

We’ll wrap our series, the ABCs of Behavioral Biases, by repeating our initial premise: Your own behavioral biases are often the greatest threat to your financial well-being. We hope we’ve demonstrated

Continue reading...

Ideal Investment Portfolio Management: Principle 10 in Evidence-Based Investing

We wrap our 10-part series on the principles of evidence-based investing with how a fiduciary financial advisor can add value to your investment portfolio management. Most importantly, by combining financial

Continue reading...

Six Hacks for Maintaining Investment Discipline: Principle 9 in Evidence-Based Investing

Investment discipline is all about being able to see past the daily market distractions to maintain a long-term perspective. A big challenge here is knowing how to identify and ignore your own emotional

Continue reading...

Emotional Investing Is Risky Investing: Principle 8 in Evidence-Based Investing

Many people struggle with emotional investing. That is, they find it difficult to make consistent, rational investment decisions, instead of reacting to current market conditions out of fear, excitement,

Continue reading...

Why Stick with a Globally Diversified Portfolio? Principle 7 in Evidence-Based Investing

Why buy and hold a globally diversified portfolio instead of reacting to breaking news? Political, social, and economic headlines come and go. But you never know which market segments will outperform from

Continue reading...

Diversify Your Investment Universe: Principle 6 in Evidence-Based Investing

Holding securities across many market segments, expanding your investment universe, can help manage overall risk. But diversifying within your home market may not be enough. Global diversification can

Continue reading...

What Really Drives Higher Expected Returns? Principle 5 in Evidence-Based Investing

There is a wealth of academic research into what really drives higher expected returns. Simply put, expected returns = current market prices + expected future cash flows. Investors can use this basic equation

Continue reading...

Understanding How Markets Work for You: Principle 4 in Evidence-Based Investing

Attending to how markets work is important for you and your investment portfolio. Should you buy, sell, or hold tight? Before the news tempts you to jump into or flee from breaking trends, it’s critical

Continue reading...

Resist Chasing Past Performance: Principle 3 in Evidence-Based Investing

Some investors select mutual funds based on their past performance. Yet, past returns offer little insight into a fund’s future returns. For example, most funds in the top quartile (25%) of previous

Continue reading...

Trying To Outguess the Market Has No Role: Principle 2 in Evidence-Based Investing

Wouldn’t it be great to hold only top selections in your investment portfolio, with no disappointments to detract from your success? Of course it would. It would also be nice to hold a $100 million winning

Continue reading...

Embrace Market Pricing: Principle 1 in Evidence Based Investing

Market pricing is about you, the market, and the prices you pay. When it comes to investing it helps to know what you’re facing. In this case, that’s “the market.” How do you achieve every investor’s

Continue reading...

Investing in Uncertain Times

After taking a closer look at interest rates and inflation we come to the heart of the matter: When interest rates, inflation, or both are on the rise, what’s an investor to do?

Continue reading...

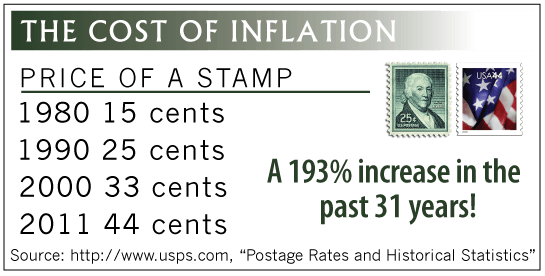

Has rising inflation got you down?

Inflation is the rate at which money loses its purchasing power over time. As you might guess, there are many ways to measure such a squishy figure. There are various economic sectors, such as energy,

Continue reading...

Fed Takes Center Stage

At its March 15–16 Federal Open Market Committee (FOMC) meeting, the U.S. Federal Reserve raised its federal target funds rate by a quarter-point. It was the first increase since December 2018, but it

Continue reading...

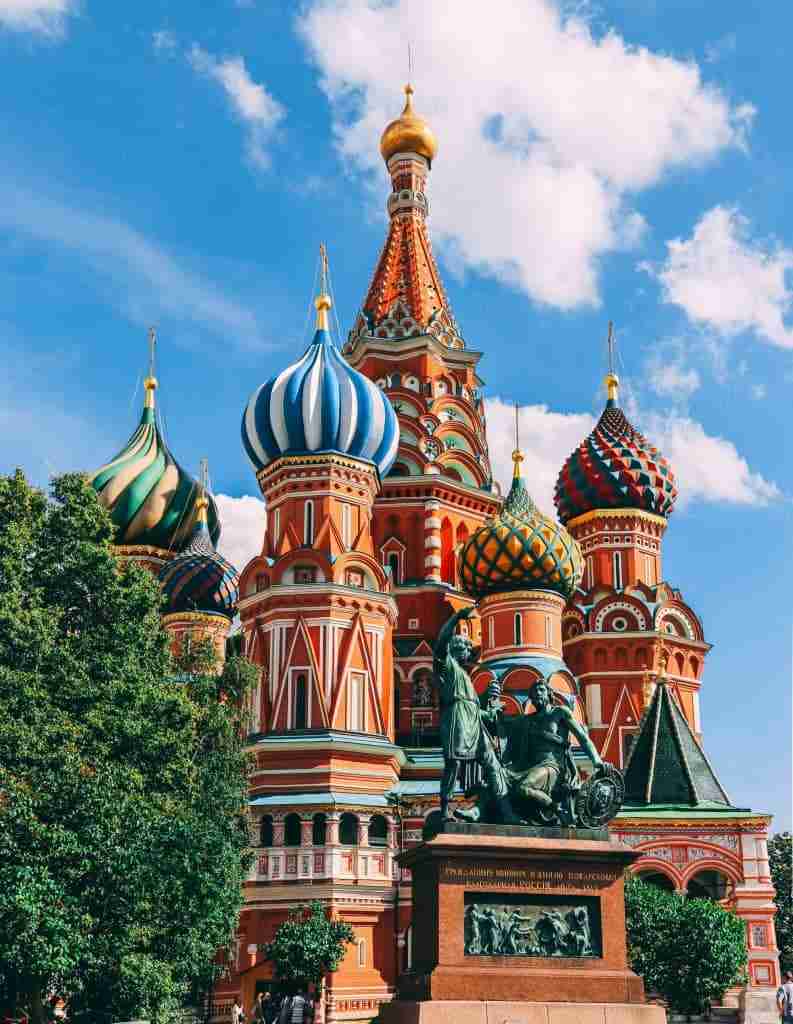

Ukraine

Despite our fervent hopes that Ukraine’s sovereign rights would prevail over tyrannical aggression, it’s now clear that Vladimir Putin has doubled down on the latter.

Continue reading...

Navigating Geopolitical Events

The recent conflict between Russia and Ukraine is an important reminder that geopolitical risk is a part of investing in global markets. Navigating geopolitical events requires expertise and flexibility.

Continue reading...

The Small Caps That May Be Holding Back Your Portfolio’s Returns

The underperformance of small caps in 2021 was driven by poor returns of small growth companies with low profits. These companies have underperformed historically. An approach that excludes small growth

Continue reading...

The Bumpy Road to the Market’s Long-Term Average

Since 1926, the US stock market has rewarded investors with an average annual return of about 10% – the market’s long term average. But it’s important to remember that returns in any given

Continue reading...

You Want the Size, Value, and Profitability Premiums … But How?

Capturing the size, value, and profitability premiums in real-world portfolios requires expertise. Investors should be cautious about favoring one premium over another or one region over another based

Continue reading...

Fighter Planes and Market Turmoil

Have you been reading the daily headlines—watching markets stall, recover, and dip once again? If so, you may be wondering whether there’s anything you can do to avoid the motion sickness.

Continue reading...

Market Review 2021: A Recovery Amid Challenges

It was a year of uncertainty and anticipation, of hopes for a return to a degree of normalcy following the onset of the COVID-19 pandemic in 2020. And it was a year that showed, again, the difficulty of

Continue reading...

A New Year Conversation

This is no surprise. The world is enormous. To cope with information overload, we engage in what behavioral psychologists refer to as heuristics. These are rules of thumb or mental shortcuts that take

Continue reading...