- You are here:

- Home »

- Blog »

- Investment Advice »

- Market Timing: The Built-in Hurdle

Market Timing: The Built-in Hurdle

Market timing generally refers to approaches that seek to outperform a traditional static asset allocation by switching back and forth between asset classes. However, as shown in this article, these approaches are not without costs. Market timing may increase return volatility and add unnecessary uncertainty to an investor’s experience.

A Case Study

To understand the hurdle involved in market timing, consider an asset allocation that switches back and forth between equity (S&P 500 Index) and fixed income (One-Month US Treasury Bills) on a monthly basis, ultimately spending 60% of the time in all equity and 40% of the time in all fixed income. Using 1,000 market timing outcomes generated by randomly assigning months to be allocated in equity or fixed income, we can compare the results to a static allocation that remains 60% equity and 40% fixed income in all months. Even though both asset allocations have the same average exposure to equities and fixed income by construction, the compositions in any given month may look very different.

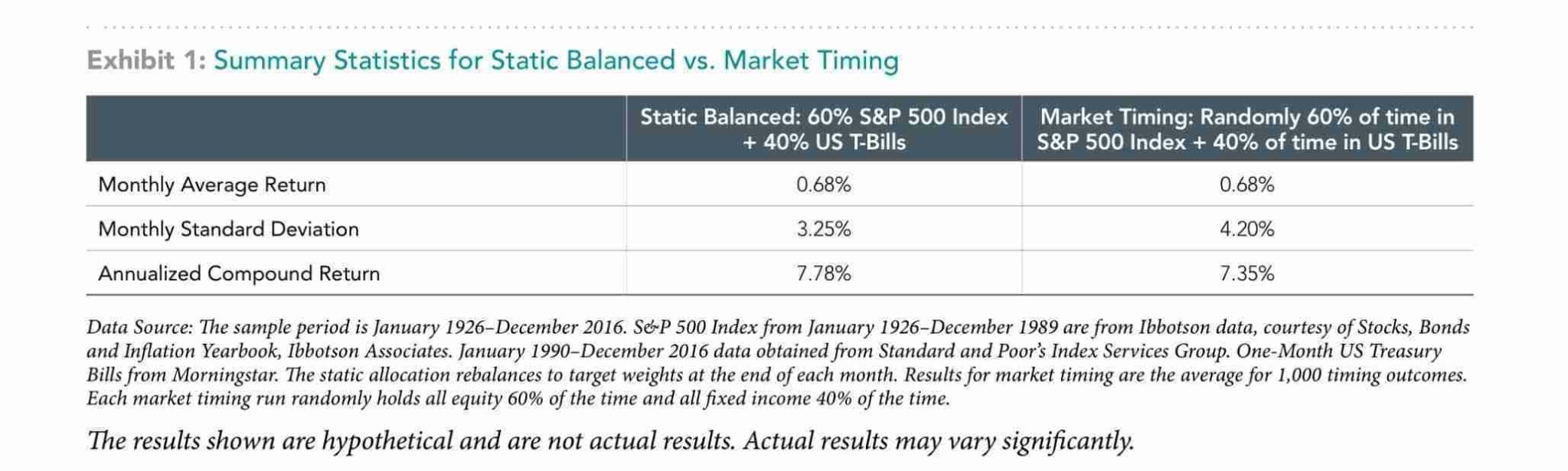

Exhibit 1 shows the average performance of 1,000 60/40 market timing outcomes, created by bootstrapping historical monthly returns vs. a static 60/40 combination. The results can also be derived analytically. As expected, the average returns were about the same at 0.68% per month. More interestingly, by randomly shifting asset classes over time, the market timing outcomes produced higher volatility on average, 4.20% compared with 3.25% for the static 60/40 allocation. The higher volatility acted as a performance hurdle, resulting in a lower compound return of about 43 basis points per year on average (7.35% vs. 7.78%).

These results suggest that switching back and forth between equity and fixed income may result in higher volatility and lower compound returns. For an investor, compound return is an important measure of performance as it equates to the growth of wealth.

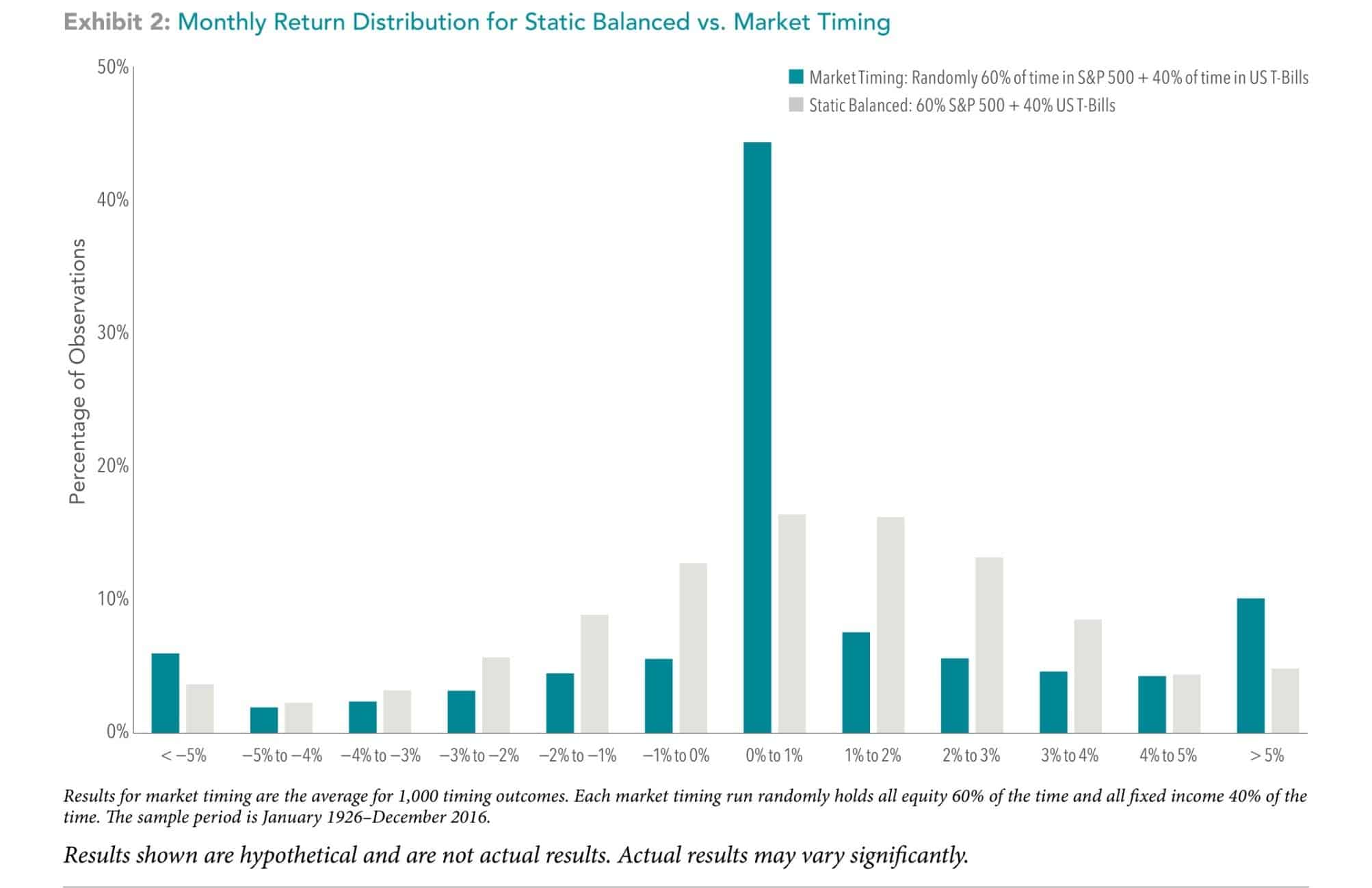

Market Timing

It is also worth noting the broadening of performance outcomes from market timing compared to a static asset allocation. As shown in Exhibit 2, since the market timing approach holds only T-bills 40% of the time, a substantial portion of the monthly returns fall into the 0%–1% bucket in the center. Market timing also produced more extreme returns, ranging from –29.73% to 42.56%, due to having all-equity exposure 60% of the time. Market timing, therefore, may expose investors to dramatic shifts in risk profiles over time and add uncertainty in the outcomes.

There are additional frictions that need to be considered with market timing. For example, relative to a static asset mix, market timing will typically incur higher turnover and trading costs from moving in and out of asset classes. Additionally, frequent trading, particularly

for shorter holding periods, can have implications for taxable accounts because of differences in the treatment of short-term and long-term capital gains. Trading costs and tax implications increase the performance hurdle required to make market timing worth pursuing.

Investor Takeaways

Research shows that the dimensions of expected returns have been reliably positive. Variation in their realization may lead investors to wonder if performance can be improved by timing markets. Market timing attempts to increase performance by switching in and out of asset classes through time. However, deviating from a consistent exposure is not without costs. As shown in this study, market timing may come with higher expected volatility, which is a performance hurdle. There is little evidence that investors can expect performance hurdles to be cleared. For example, between 2002 and 2016, the majority of mutual fund managers did not beat their benchmarks after costs.1 Maintaining a consistent exposure and staying disciplined is a more reliable investment approach for capturing what the market has to offer.

1. Source: Dimensional Fund Advisors, Mutual Fund Landscape 2017. The study examined the performance of US-based mutual funds between 2002 and 2016. The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein. All figures contained within the material are in USD. RISKS Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful. Results shown herein are not representative of actual strategies or accounts, do not reflect costs and fees associated with an actual investment and are no guarantee of future results. Market timing strategies typically seek to allocate between equity and fixed income based on predictions or changes in market or economic outlook. The 1,000 market timing outcomes represented above do not reflect asset allocation decisions a market timing manager might have made due to economic or market factors. Results attained by bootstrapping samples may vary for each use and over time.

About the Author Doug Finley

Douglas Finley, MS, CFP, AEP, CDFA founded Finley Wealth Advisors in February of 2006, as a Fiduciary Fee-Only Registered Investment Advisor, with the goal of creating a firm that eliminated the conflicts of interest inherent in the financial planner – advisor/client relationship. The firm specializes in wealth management for the middle-class millionaire.

Related Posts

The Power of the Market, the Ultimate AI

The Cost of Trying to Time the Market

Market Behavior and the Weather

Japan in the News, But It’s Nothing New

Curve Your Enthusiasm with Fed Activity

Bringing Order to Your Investment Universe Part 2: Transitions and Taxes

Bringing Order to Your Investment Universe Part 1: The Beauty of Being Organized

Protecting Women’s Wealth

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.