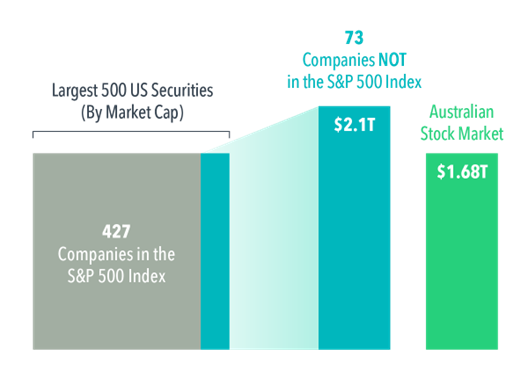

Investors who assume the “500” in an S&P 500 Index fund means the 500 largest US stocks are in for a surprise. As of February 29, 73 companies ranking in the top 500 on market capitalization were excluded from the S&P 500. These stocks represent $2.1 trillion USD in combined market value, which is 25% more than Australia’s entire stock market.1 Crikey!

Companies may be excluded from the S&P 500 due to index construction criteria. S&P has a litany of eligibility requirements. For example, companies are required to have positive earnings over the past four quarters for inclusion. That’s an important point about index fund investing. Indices are representations of the market, not the market itself. The construction of indices reflects a series of decisions that may not always prioritize risk and return for investors. And, as the S&P example demonstrates, index rules may cloud investors’ understanding of what’s in their portfolio.

Exhibit 1 – G’day Mate, Seen Any Top Stocks?

Largest 500 US-listed securities by market cap as of February 29, 2024

Market values in USD. Source: Dimensional using data from Russell, S&P, and MSCI.

Companies not in the S&P 500 Index are those in the top 500 stocks by market capitalization in the Russell 3000 Index as of February 29, 2024, but missing from the S&P 500 Index. The Russell 3000 is a market-cap-weighted index.

Indices are not available for direct investment. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security.

Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. All rights reserved. © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. MSCI data © MSCI 2024, all rights reserved.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. Please click here to read the full text of the Dimensional Fund Advisor Disclaimer.