Judging by the CME FedWatch Tool, market participants expect the Fed to start cutting rates sometime in 2024. Some investors may be tempted to make duration decisions within their bond allocations because they assume other interest rates will follow federal funds rate movements.

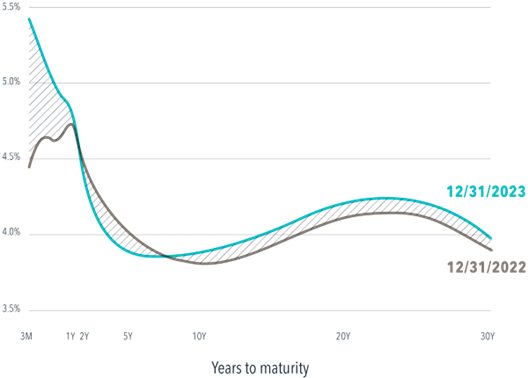

However, it’s not a given that the whole yield curve will move in lockstep with any Fed rate cuts. The interest rate environment in 2023 is a good example. At the start of the year, most investors were expecting rate hikes before year-end. These hikes eventually came—four increases totaling 1% by August. But looking at the full yield curve, most rates ended the year very close to where they started.

Bond prices reflect expected events, such as rate cuts, and yield curves are impacted by many other events outside of Fed activity. That’s why interest rate predictions are so challenging. Rather than attempting to time these changes, investors are better served making bond allocation decisions based on long-term goals rather than short-term predictions.

Exhibit 1: A Long Year, US nominal yield curve

Past performance is no guarantee of future results.

Source: ICE BofA government yield. ICE BofA index data © 2024 ICE Data Indices, LLC. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. Please click here to read the full text of the Dimensional Fund Advisor Disclaimer.