- You are here:

- Home »

- Blog »

- Financial Education & News »

- What Happens When You Fail at Market Timing

What Happens When You Fail at Market Timing

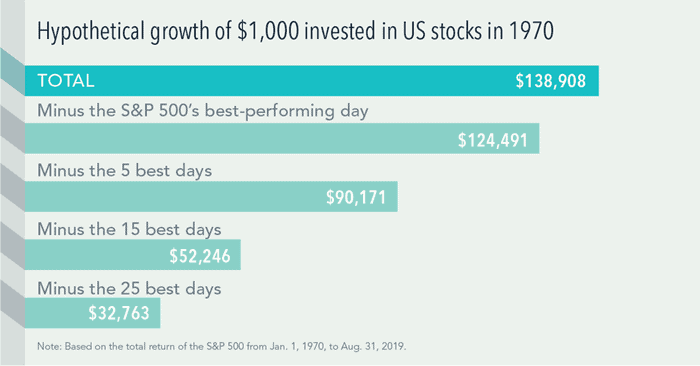

The impact of missing just a few of the market’s best days can be profound. How to understand market timing is explained below. Take a look at the following example of a hypothetical investment in the stocks that make up the S&P 500 Index.

A hypothetical $1,000 turns into $138,908 from 1970 through the end of August 2019.

- Miss the S&P 500’s five best days and that’s $90,171

- Miss the 25 best days and the return dwindles to $32,763

There’s no proven way to time the market—targeting the best days or moving to the sidelines to avoid the worst. History argues for staying put through good times and bad.

Investing for the long term helps to ensure that you’re in the position to capture what the market has to offer.

Good Market Timing Means Long-term Investing

Assumptions For This Hypothetical Portfolio

The missed best day(s) examples assume the following:

- the hypothetical portfolio fully divested its holdings at the end of the day before the missed best day(s)

- held cash for the missed best day(s) and reinvested the entire portfolio in the S&P 500 at the end of the missed best day(s)

Annualized returns for the missed best day(s) were calculated by substituting actual returns for the missed best day(s) with zero.

- Performance data for January 1970-August 2008 provided by CRSP

- Performance data for September 2008-August 2019 provided by Bloomberg

- S&P data provided by Standard & Poor’s Index Services Group

- Indices are not available for direct investment

Past performance is no guarantee of future results.

About the Author Doug Finley

Douglas Finley, MS, CFP, AEP, CDFA founded Finley Wealth Advisors in February of 2006, as a Fiduciary Fee-Only Registered Investment Advisor, with the goal of creating a firm that eliminated the conflicts of interest inherent in the financial planner – advisor/client relationship. The firm specializes in wealth management for the middle-class millionaire.

Related Posts

What’s Baked into Your Credit Exposure?

What I See When I Watch Basketball

When Should You Take Your Social Security?

Ideal Investment Portfolio Management: Principle 10 in Evidence-Based Investing

Why Stick with a Globally Diversified Portfolio? Principle 7 in Evidence-Based Investing

Diversify Your Investment Universe: Principle 6 in Evidence-Based Investing

Understanding How Markets Work for You: Principle 4 in Evidence-Based Investing

Resist Chasing Past Performance: Principle 3 in Evidence-Based Investing

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.