Why Stick with a Globally Diversified Portfolio? Principle 7 in Evidence-Based Investing

Why buy and hold a globally diversified portfolio instead of reacting to breaking news? Political, social, and economic headlines come and go. But you never know which market segments will outperform from day to day, or even year to year. This makes global diversification your best strategy for seeking market returns, wherever and whenever they appear.

Breaking News and Globally Diversified Portfolio Views

We happen to be posting this Evidence-Based Investing Principles installment at the height of a shift in Washington, with the January 20th inauguration day fast approaching. Will Biden’s wealth-based tax proposals come to pass? Will stock markets rise or fall? What else is about to change? Hordes of professionals and amateurs continuously speculate on what all this and more will mean to investors.

Too bad for them, the more surprising the news may be, the more erratically prices might swing in response. That’s the markets for you. Like a bucking bronco, near-term market returns usually exhibit more periods of wild volatility than a steady-as-she-goes trot.

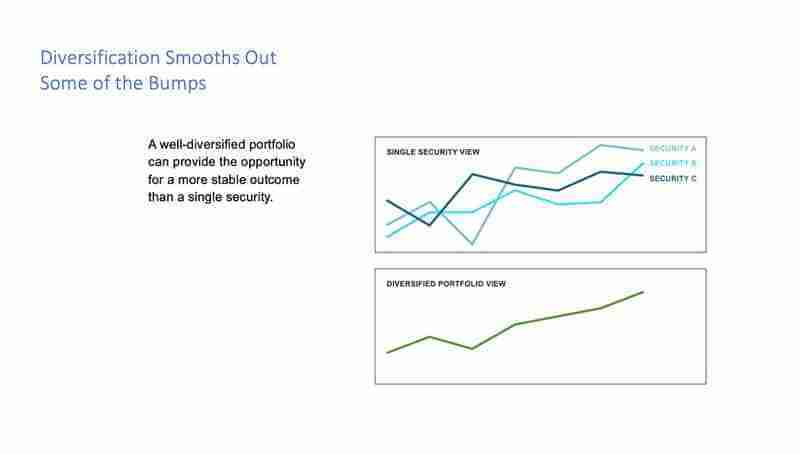

In short, hanging tight to a globally diversified portfolio helps tame the beast. It can smooth some of the leaps and dives you must endure along the way to your expected returns.

If you’d like to see data-driven illustrations of how this works, check out “How to diversify your investments,” by financial author Larry Swedroe, and/or “When boring is good investing,” by financial author Craig L. Israelsen.

For a faster take, imagine several rough-and-tumble, upwardly mobile lines that represent several kinds of holdings. Individually, each represents a bumpy ride. Bundled together, the upward mobility remains, but the jaggedness along the way can be dampened (albeit never completely eliminated).

Covering the Market

A key reason a globally diversified portfolio helps is because different market components respond differently to price-changing events. When one type of investment may zig due to particular news, another may zag. Instead of trying to move in and out of favored components, remain diversified across a wide variety of them. This increases the odds that, when some of your holdings are underperforming, others will outperform or at least hold their own.

The results of diversification aren’t perfectly predictable. But it helps create a blanket of coverage for capturing market returns where and when they occur. This goes a long way toward replacing guesswork with a coherent, cost-effective strategy for managing desired outcomes.

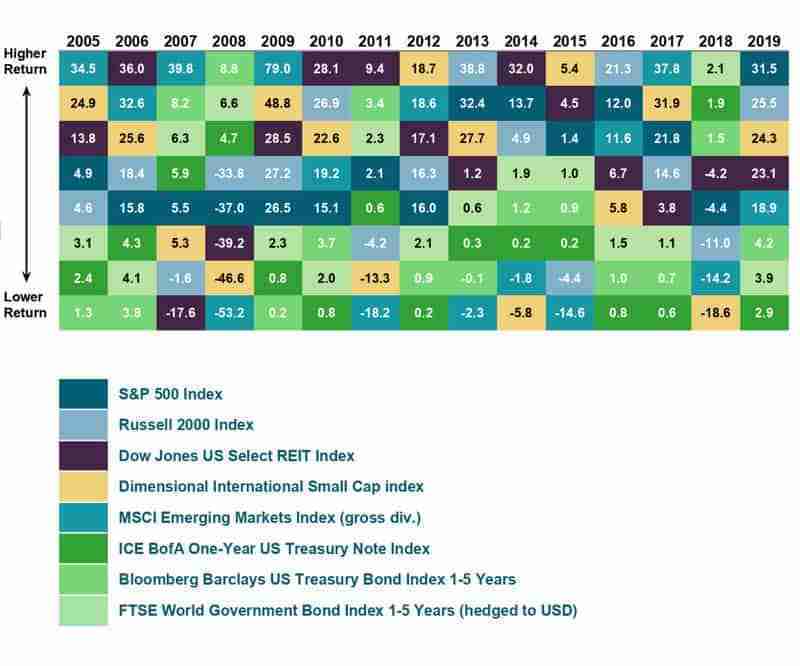

Diversification helps take the guesswork out of investing

The “Crazy Quilt Chart” below is a classic illustration of this concept. After viewing a color-coded layout of which market factors have been the winners and losers in past years, it’s clear there’s never been a consistent pattern.

In other words, if you can predict how each column of best and worst performers will stack up in years to come, your psychic powers are greater than ours. More realistically, it’s best to assume we never know which markets will outperform from year to year.

See additional disclosures below.*

Without a crystal ball, your best bet is to build that encompassing globally diversified portfolio, and stick with it over time. This positions you to capture returns wherever they occur. What does such a portfolio look like? In our last post, we covered how to Diversify Your Investment Universe.

Your Take-Home

A globally diversified portfolio offers you wide, more manageable exposure to the market’s long-term expected returns, as well as a smoother expected ride along the way. Perhaps most important, it eliminates the need to try to forecast future market movements. This, in turn, helps reduce the nagging self-doubts that throw so many investors off-course.

To see all 10 principles of Evidence-Based Investing at a glance, please visit our Evidence-Based Principles Guide. These principles inform our investing process.

* All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Dimensional Index data compiled by Dimensional. MSCI data © 2020, all rights reserved. ICE BofA index data © 2020 ICE Data Indices, LLC. Bloomberg Barclays data provided by Bloomberg. FTSE fixed income indices © 2020 FTSE Fixed Income LLC. All rights reserved. See “Index Descriptions” in the appendix for descriptions of Dimensional’s index data. Diversification does not eliminate the risk of market loss. Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect expenses associated with the management of an actual portfolio.

About the Author Doug Finley

Douglas Finley, MS, CFP, AEP, CDFA founded Finley Wealth Advisors in February of 2006, as a Fiduciary Fee-Only Registered Investment Advisor, with the goal of creating a firm that eliminated the conflicts of interest inherent in the financial planner – advisor/client relationship. The firm specializes in wealth management for the middle-class millionaire.

Related Posts

Diversify Your Investment Universe: Principle 6 in Evidence-Based Investing

The More Things Change

How Has Market Behavior Evolved For Emerging Markets Investing?

Strategic vs. Tactical Asset Allocation: Does It Matter?

Three Upside-Down Investment Insights

Playing the Prediction Game – Hindsight Is 20/20. Foresight Isn’t.

Why “Safe Harbors” Can Be Risky Business And How You Can Mitigate

Lessons for Long-Term Investors – Tale of Two Decades

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.