Resist Chasing Past Performance: Principle 3 in Evidence-Based Investing

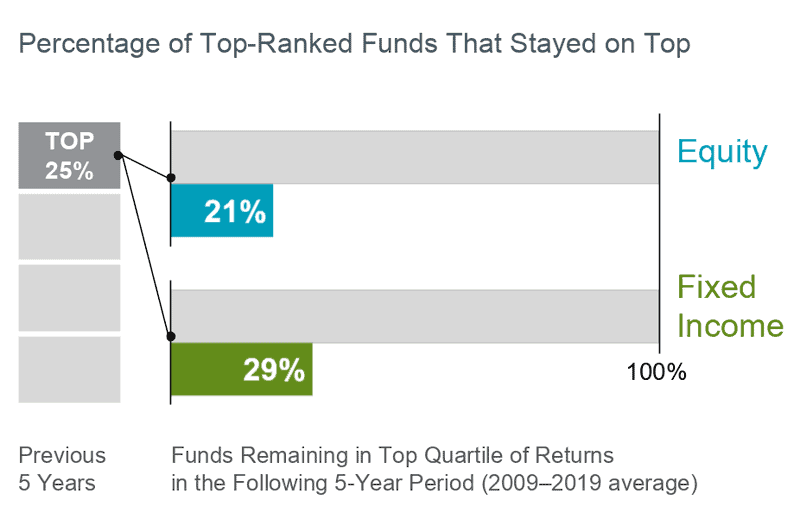

Some investors select mutual funds based on their past performance. Yet, past returns offer little insight into a fund’s future returns. For example, most funds in the top quartile (25%) of previous five-year returns did not maintain a top‐quartile ranking in the following five years.

Given how price-setting occurs in capital markets, investors should avoid trying to outguess the market by reacting to breaking news. The cost and competition hurdles are just too tall. Now, let’s explain why you’re also ill-advised to pick a pinch-hitting expert who has delivered exciting past performances to compete for you.

In his Berkshire Hathaway 2017 Shareholders Letter, Warren Buffett described his take on investment “experts” when he wrote: “Performance comes, performance goes. Fees never falter.”

Instead of chasing past performance, Buffett suggests, “Seizing the opportunities then offered does not require great intelligence, a degree in economics or a familiarity with every bit of Wall Street jargon. What investors then need instead is an ability to both disregard mob fears or enthusiasms and to focus on a few simple fundamentals.”

Group Intelligence Wins Again

As we covered in “Embrace Market Pricing,” independently thinking groups (like capital markets) are usually better at arriving at accurate answers than even the smartest individuals in the group. That’s in part because their wisdom is already bundled into prices, which adjust with fierce speed and relative accuracy to any new, unanticipated news.

Thus, even experts who specialize in analyzing all the market-related information face the same challenges you do. They too find it tough to beat a largely efficient market. To do so, they must forecast an uncertain reaction to unexpected news not yet known. For them too, particularly after costs, group intelligence remains a prohibitively tall hurdle to overcome. In other words, any above-average past performance they exhibit may be a result of random luck rather than dependable skills.

The Proof Is in the Pudding

But maybe you know of an extraordinary stock broker, fund manager, or TV personality who has made the leap. Maybe they have stellar past performance, impeccable credentials, a secret sauce, or brand-name recognition. Should you turn to them for the latest market tips, instead of settling for “average” returns?

Let’s set aside market theory for a moment and consider what has actually been working. Bottom line, if investors could come out ahead by heeding experts’ amazing past performance, we should expect to see credible evidence of it.

Not only is such data lacking, but the body of evidence to the contrary is also overwhelming. Star performers – “active managers” – often fail to survive, let alone persistently beat their benchmarks over the long run.

To cite one of many sources, Morningstar publishes a semiannual Active/Passive Barometer report. It compares the past performance of actively managed funds to that of their passively managed peers. In its August 2020 report, Morningstar found:

“In general, actively managed funds have failed to survive and beat their benchmarks, especially over longer time horizons; only 24% of all active funds topped the average of their passive rivals over the 10-year period ended June 2020; long-term success rates were generally higher among foreign-stock, real estate, and bond funds and lowest among U.S. large-cap funds.”

Dimensional Fund Advisors finds similar results in its independent analysis of 10-year mutual fund performance through year-end 2019. Only 21% of the best-performing funds during the first five years continued to outperform in the next five years.

Consider the Evidence

Through the decades, academics have looked at the past performance of actively managed funds and found it lacking.

- Among the earliest such studies is Michael Jensen’s 1967 paper, “The Performance of Mutual Funds in the Period 1945–1964.” He concluded there was “very little evidence that any individual fund was able to do significantly better than that which we expected from mere random chance.”

- More recently, Eugene Fama and Kenneth French published a 2010 Journal of Finance study, “Luck Versus Skill in the Cross Section of Mutual Fund Returns,” demonstrating that “the high costs of active management show up intact as lower returns to investors.”

- In the decades between and since there have been dozens of similar studies into fund managers’ past performances. In 2016, a pair of professors from the University of North Florida published “A Review of Studies in Mutual Fund Performance, Timing, and Persistence,” scrutinizing more than 60 of the “more widely cited works.” They concluded: “The basic results have not changed; it appears that: (1) mutual funds underperform the ‘market;’ (2) fund managers in the aggregate are incapable of timing the market; and (3) mutual fund investors are ill-advised to invest based on prior fund performance.”

Can You Hedge Your Bets?

Hedge fund managers and similar experts are unable to fare any better in their more rarified environments. For example, financial author Larry Swedroe provides a periodic hedge fund performance update on ETF.com. In April 2019, he reported, “over the 10-year period ending 2018, [hedge funds] underperformed every single major equity asset class by wide margins.”

Swedroe suggests that “the efficiency of the market, as well as the cost of the effort” are too tough to consistently overcome. So, even here, a high-end hedge fund manager’s past performance remains an unpredictable method for selecting their actively managed investment strategy.

Your Take-Home

So far, we’ve been assessing some of the investment foes you face. The good news is, that investors can nimbly sidestep rather than face such formidable foes. How so? Simply let the markets work for you. We’ll cover how that works in an upcoming post.

To see all 10 principles of Evidence-Based Investing at a glance, please visit our Evidence-Based Principles Guide. These principles inform our investing process.

About the Author Doug Finley

Douglas Finley, MS, CFP, AEP, CDFA founded Finley Wealth Advisors in February of 2006, as a Fiduciary Fee-Only Registered Investment Advisor, with the goal of creating a firm that eliminated the conflicts of interest inherent in the financial planner – advisor/client relationship. The firm specializes in wealth management for the middle-class millionaire.

Related Posts

Common Investing Mistakes (Part 3)

Common Investing Mistakes (Part 2)

Trying To Outguess the Market Has No Role: Principle 2 in Evidence-Based Investing

What Is Fiduciary Investment Advice, and Why Does It Matter (Now More Than Ever)?

How Has Market Behavior Evolved For Emerging Markets Investing?

Three Upside-Down Investment Insights

Earning Dividends Is Not The Only Way To Grow Income

What is the Purpose of Indexes and Index Funds? (Part IV)

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.