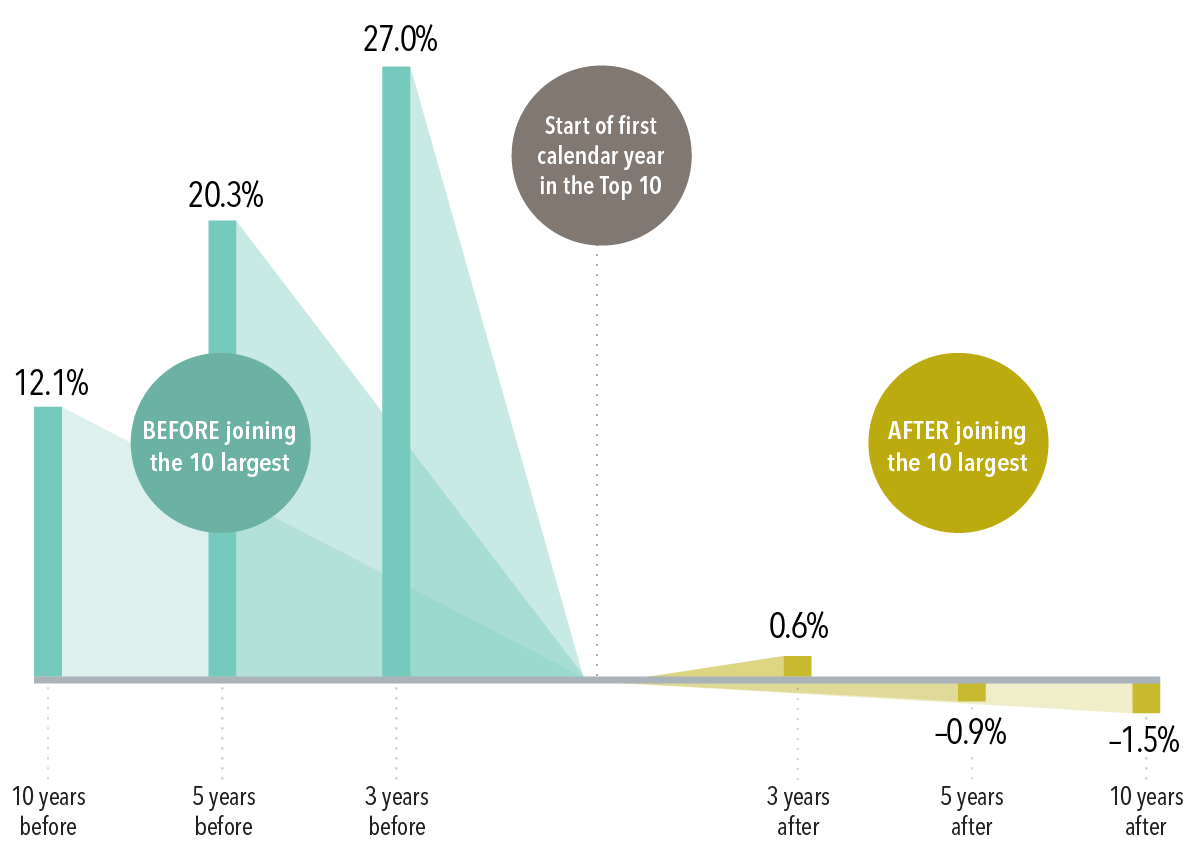

The Magnificent 7 stocks1 continue to capture the focus of investors as these large growth names have outpaced the bulk of global equities. Their outperformance is notable because eye-popping returns for top stocks tend to occur before they reach the top of the market. Once there, subsequent returns tend to lag the market.

This is a cautionary tale for investors expecting continued outperformance from the Magnificent 7. In fact, rather than seeking additional exposure to these mega cap stocks, investors should ensure their portfolios are broadly diversified to capture the returns of whatever companies ascend to the top in the future.

EXHIBIT 1

Annualized returns in excess of the US market before and after joining the top 10 largest US stocks, January 1927–December 2022

Past performance is not a guarantee of future results.

In USD. Data from CRSP and Compustat. Companies are sorted every January by beginning-of-month market capitalization to identify first-time entrants into the top 10.

The market is defined as the Fama/French Total US Market Research Index. The Fama/French indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. See “Index Description” for a description of the Fama/French index data.

Indices are not available for direct investment. The index has been included for comparative purposes only.

FOOTNOTES

- 1The Magnificent 7 stocks include Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla. Named securities may be held in accounts managed by Dimensional.

DISCLOSURES

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. Please click here to read the full text of the Dimensional Fund Advisor Disclaimer.