Global diversification can increase the reliability of outperformance for strategies pursuing higher than market returns because premiums, like the value premium, do not always move in lockstep across markets. Positive outcomes for a premium in one region can offset underperformance in another.

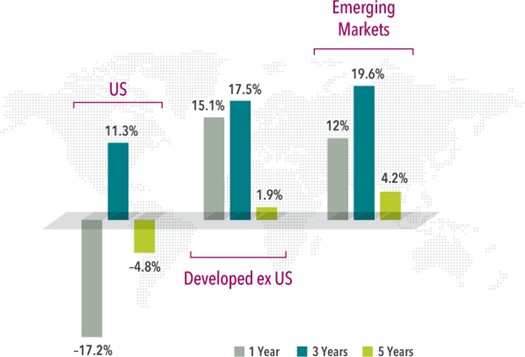

A global perspective on recent relative returns for value stocks emphasizes this point. While value underperformed growth in the US over the past 12 months,1 value outperformed sharply within both developed ex US and emerging markets. Going back five years, including a difficult stretch for the premiums leading into the pandemic, value beat growth in both non-US segments.

While we expect positive value premiums every day, realized returns are uncertain. A globally diversified approach to value may increase the odds of outperforming.

Exhibit 1 Thinking Globally Annualized value premiums as of September 30, 2023

Past performance is not a guarantee of future results.

Source: Dimensional using data provided by Ken French. Value in each region defined respectively as the Fama/French US Value Research Index, Fama/French International Value Index, and Fama/French Emerging Markets Value Index. Growth in each region defined as Fama/French US Growth Research Index, Fama/French International Growth Index, and Fama/French Emerging Markets Growth Index. The Fama/French indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. See “Index Descriptions” for descriptions of the Fama/French index data.

FOOTNOTES

- Ending September 30, 2023.

DISCLOSURES

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. Please click here to read the full text of the Dimensional Fund Advisor Disclaimer.