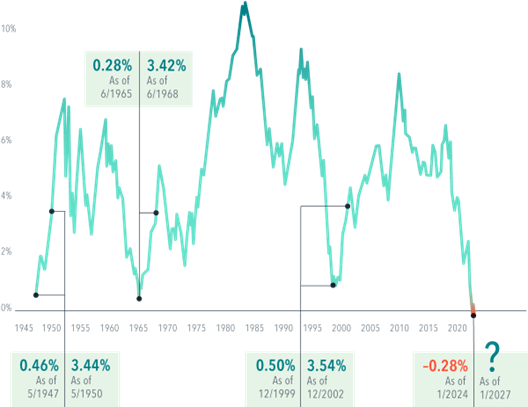

The 20-year relative return of US small cap value stocks versus the S&P 500 Index dipped negative recently for the first time in US stock market history. Two decades is a long time for an expected premium not to show up. Outliers on the negative side are never pleasant, but we can look to other previous outliers for some positive encouragement.

Many in the industry will recall the disappointing stretch at the end of the 1990s when US small cap value’s trailing 20-year return was statistically indistinguishable from the S&P 500’s. Less familiar might be the periods in 1947 and 1965 when the trailing 20-year premium was similarly flat. In all three cases, small value staged a rapid turnaround. We can see this by measuring each of the trailing 20-year return spreads again three years later. For example, we compare the observation on December 31, 1999, with the trailing 20-year return difference as of December 31, 2002. In all three previous cases, small cap value’s advantage jumped to more than three percentage points annualized.

No one can say if we’ll get a similar turnaround this time. But history suggests giving up on small cap value after its worst stretches would have been a mistake. Past performance doesn’t upend the logic of expecting a higher return for stocks with low prices relative to their book equity. And, for any remaining skeptics, it’s worth noting that small value’s struggles in the US have not been shared by developed ex US or emerging markets, where small cap value stocks have outperformed their large cap counterparts by 2.7%1 and 4.0%2 , respectively, over the past 20 years.

Exhibit 1

Better Days Ahead? 20-year rolling return difference between the Dimensional US Small Cap Value Index and the S&P 500 Index, May 1947–January 2024

Past performance is no guarantee of future results.

The Dimensional indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. See “Index Descriptions” for descriptions of the Dimensional index data.

S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. Please click here to read the full text of the Dimensional Fund Advisor Disclaimer.