What do vacations and bond portfolios have in common? Expanding beyond opportunities in your home country may be the ticket to enhanced experiences.

Yield curves for bonds issued in different currencies do not move in lockstep. That means portfolio volatility arising from changes in one market’s interest rates may be mitigated through global diversification. Since September 2000, global bond indices have had markedly lower standard deviations than US indices, whether for the markets in aggregate or separately within the government and credit segments.

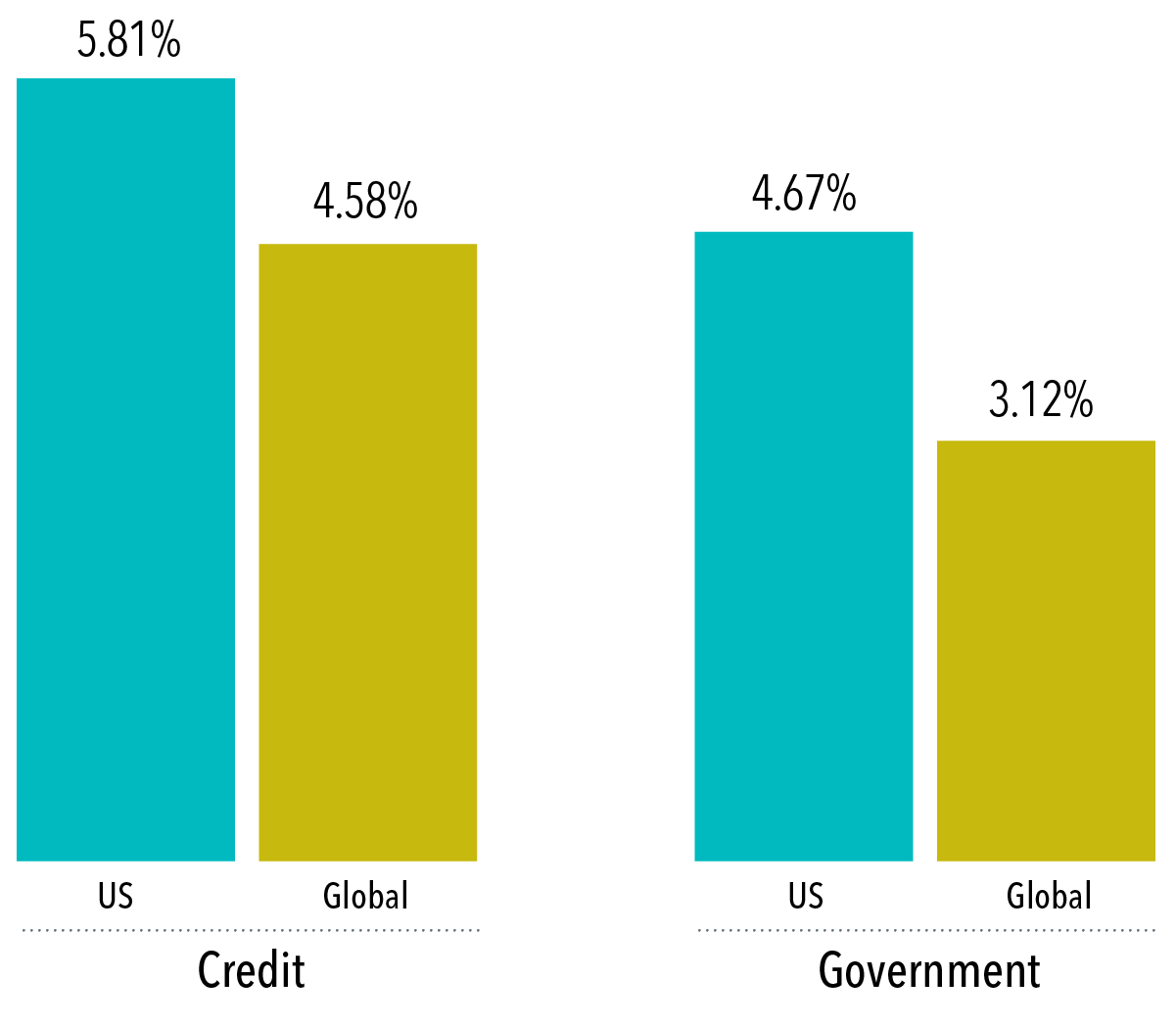

EXHIBIT 1 – Global Path to a Smoother Ride

Annualized standard deviation, September 1, 2000–October 31, 2023

DISCLOSURES

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. Please click here to read the full text of the Dimensional Fund Advisor Disclaimer.