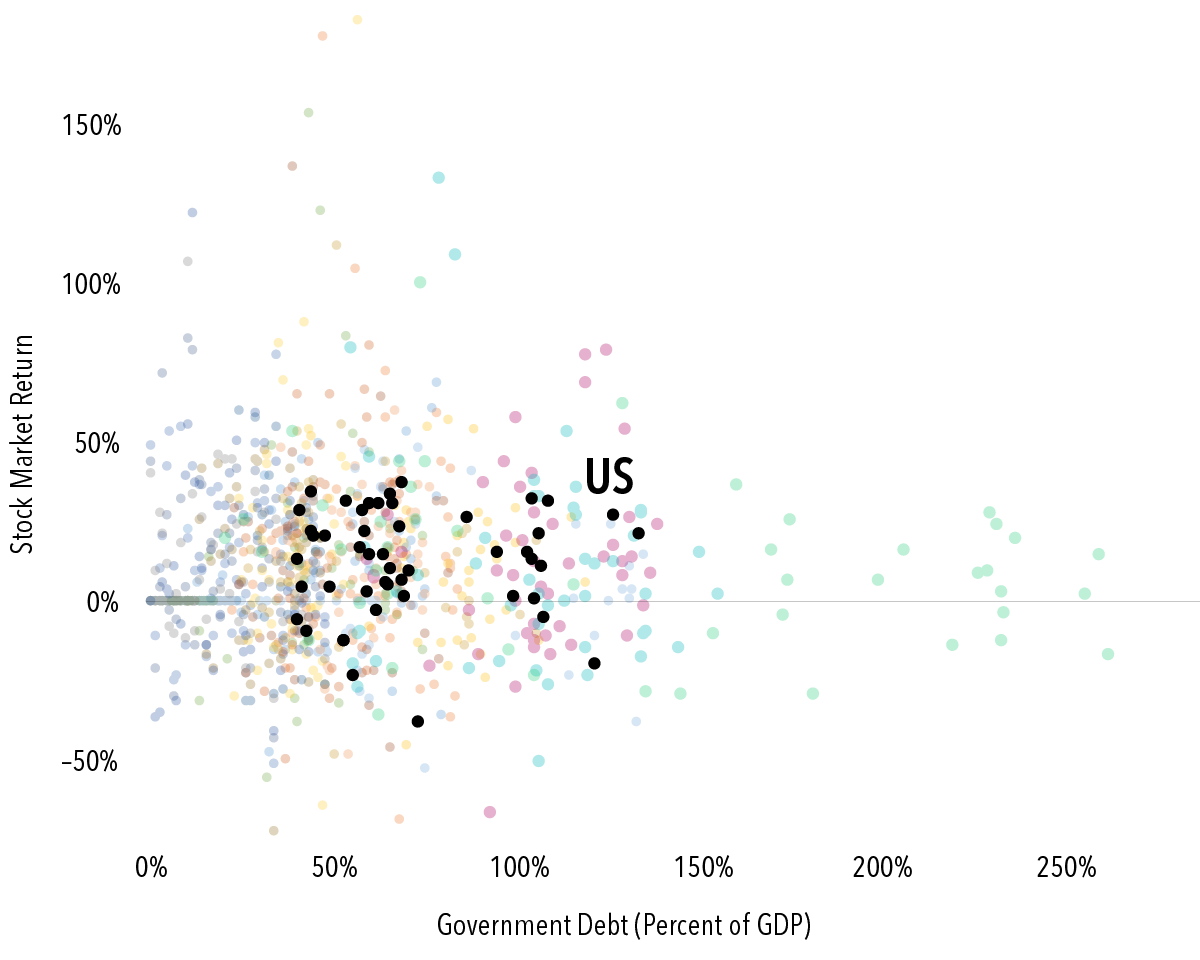

US government debt reached 121% of the value of the country’s gross domestic product (GDP) last year.1 Many investors have expressed concern over the impact that servicing this level of debt could have on the stock market. But the historical data show little relation between the two. Since 1975, there have been 153 observations of a country exceeding 100% debt/GDP for a year. Stocks were up for that country/year in 104 of the 153, or about two-thirds of the time.

There are numerous examples of countries carrying high debt for extended periods. Italy and Belgium have both been over 100% debt/GDP in more than 30 of the past 48 years. Meanwhile, their stock markets have returned an average of 10.8% and 12.0% per year, respectively. Japan has been over 200% since 2010 while its market averaged close to 6% per year over that period.

Stock markets set prices to the point where investors have a positive expected return given current information. Country debt is a slow-moving variable, so it’s sensible that current prices reflect expectations about the effect of government debt. And it’s unsurprising to see stock performance has generally been positive even amid high-debt conditions.

EXHIBIT 1 – Indebted

General government debt, percent of GDP vs. stock market return for developed markets, 1975–2022

Past performance is not a guarantee of future results.

Debt figures are based on General Government Debt data from the Global Debt Database published by the International Monetary Fund. MSCI index returns are net dividends, in USD. MSCI data © MSCI 2023, all rights reserved.

FOOTNOTES

- 1“General Government Debt,” Global Debt Database, International Monetary Fund, September 2023.

DISCLOSURES

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. Please click here to read the full text of the Dimensional Fund Advisor Disclaimer.