Aggregate stock market valuation ratios have not been strong predictors of broad market returns. And yet, high stock valuations sit near the top of concerns cited by investors about the state of equity markets. However, this perception stems from a subset of stocks, and investors should be careful not to throw the baby out with the bathwater by ascribing this characteristic to the global stock market.

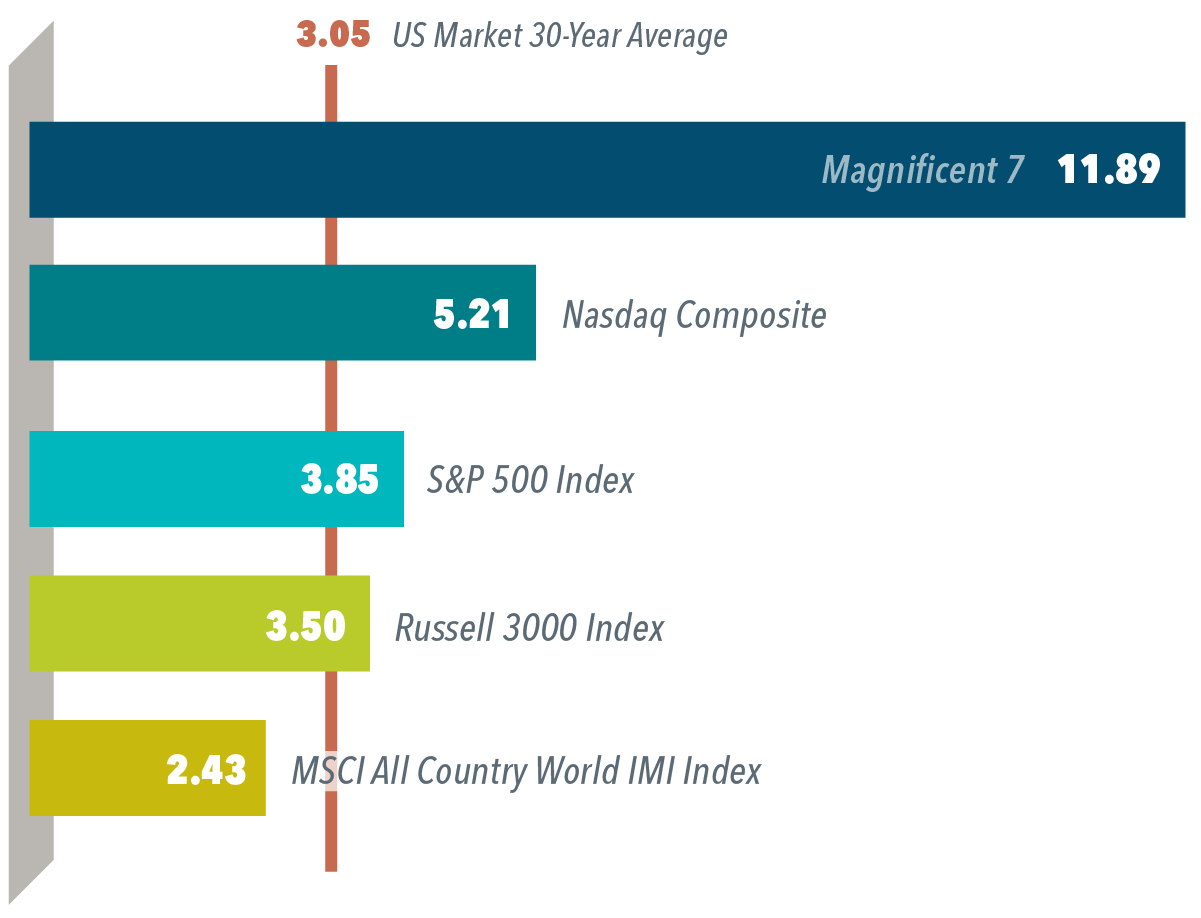

The poster child for high valuations—the so-called Magnificent Seven (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla)—had an aggregate price-to-book (P/B) ratio of 11.89 as of September 30 (despite six of the seven having lower profitability than the S&P 500 index). To put that in perspective, the average for the US market over the past 30 years is 3.05.1

These stocks helped push up the P/B ratio of the tech-heavy Nasdaq Composite to 5.21.

But broader market indices, especially those with non-US stocks, have substantially lower

valuations. For example, the global MSCI All Country World IMI Index P/B is less than

half that of the Nasdaq.

Exhibit 1

Shopping Around

Aggregate price-to-book ratios as of September 30, 2023

Indices are not available for direct investment. S&P data © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © 2023, all rights reserved.

FOOTNOTE

1. Average P/B ratio for the Fama/French Total US Market Research Index from October 1998 through September 2023.

DISCLOSURES

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. Please click here to read the full text of the Dimensional Fund Advisor Disclaimer.