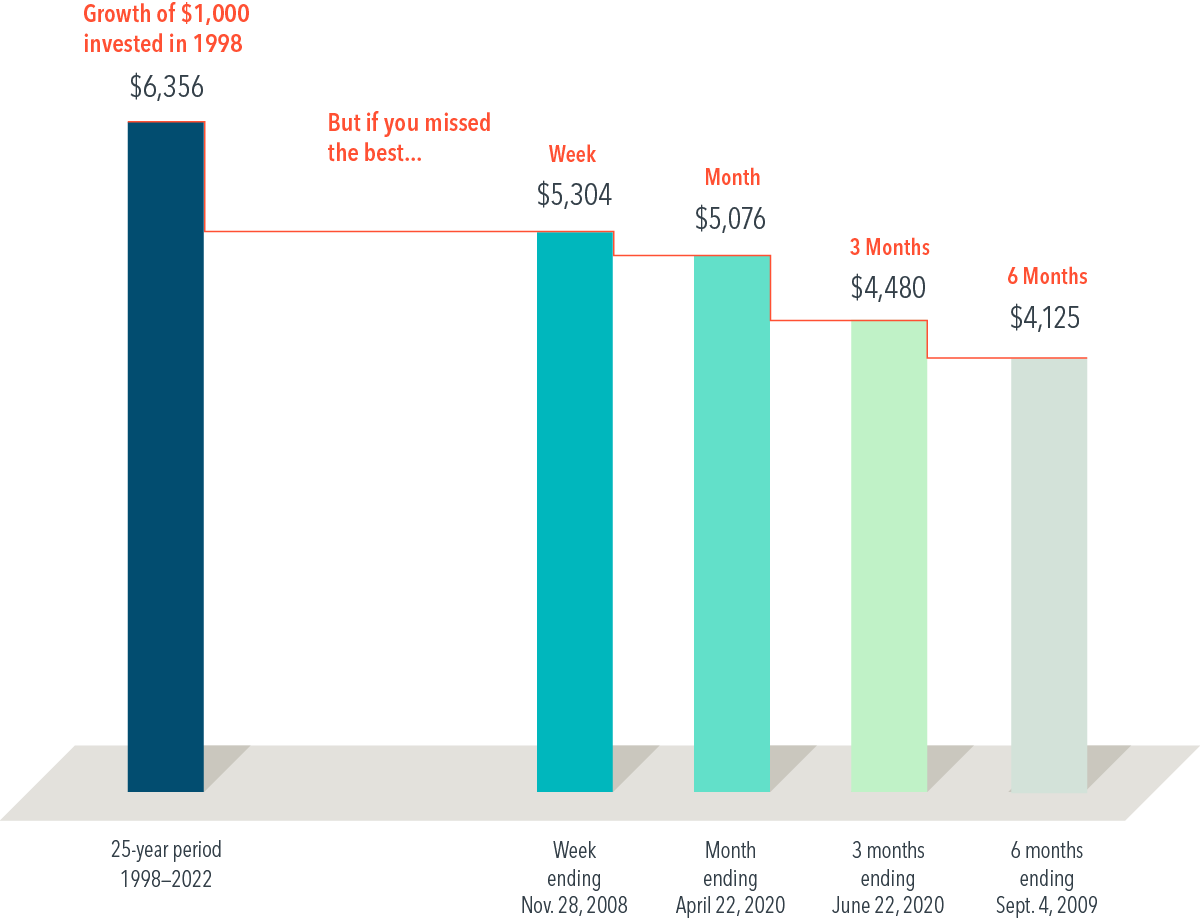

The impact of being out of the market for just a short period of time can be profound, as shown by this hypothetical investment in the stocks that make up the Russell 3000 Index, a broad US stock market benchmark.

A hypothetical $1,000 investment made in 1998 turns into $6,356 for the 25-year period ending December 31, 2022. Over that same period, if you miss the Russell 3000’s best week, which ended November 28, 2008, the value shrinks to $5,304. Miss the three best months, which ended June 22, 2020, and the total return dwindles to $4,480.

There’s no proven way to time the market—targeting the best days or moving to the sidelines to avoid the worst—so the evidence suggests staying put through good times and bad. Missing only a brief period of strong returns can drastically impact overall performance. We believe that investing for the long term helps ensure that you’re in position to capture what the market has to offer.

DISCLOSURES

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. Please click here to read the full text of the Dimensional Fund Advisor Disclaimer.