Chasing Past Performance

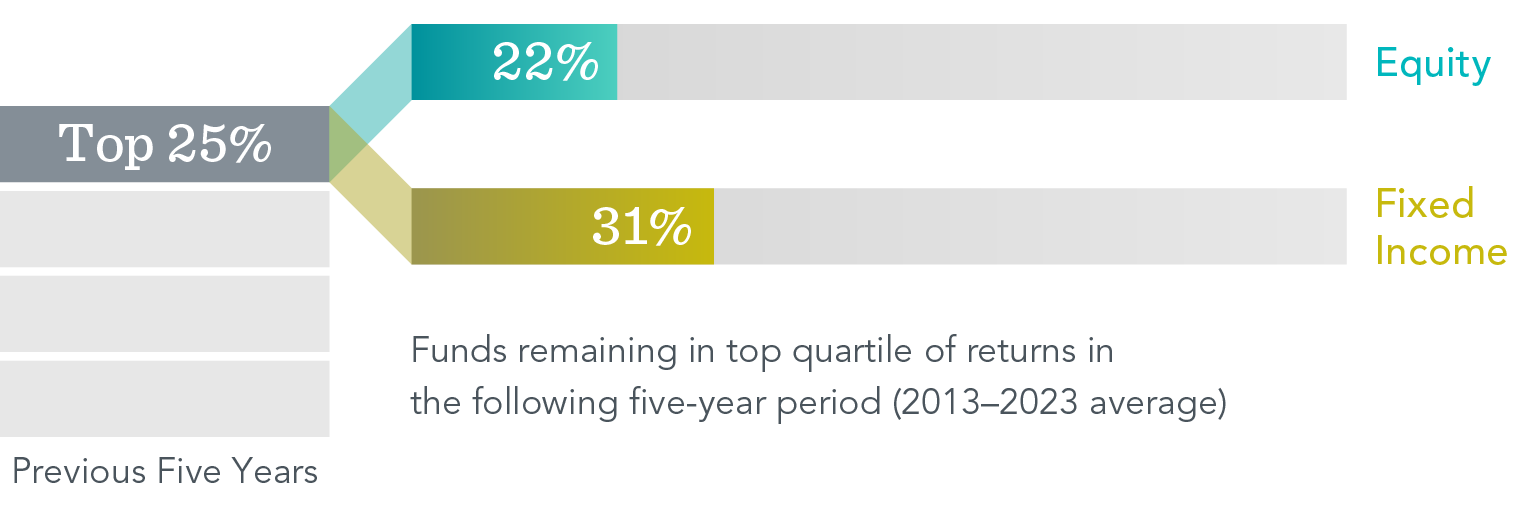

As we continue to build from the last blog, discussing common investing mistakes around focusing on headlines. You might be inclined to select investments based on past returns, expecting top-ranked funds to continue delivering the best performance. But can they maintain that outperformance? Research shows that most funds ranked in the top 25% based on five-year returns didn’t remain in the top 25% in the next five years. In fact, only about one in five equity funds stayed in the top-performing group, and only about a third of fixed-income funds did. The lesson? A fund’s past performance offers limited insight into its future returns.

Past performance is no guarantee of future results.

Working with an Advisor

Avoiding these mistakes can improve the odds of reaching your long-term investment goals. But, as a do-it-yourself investor, you’ll have to manage the challenge alone. A qualified financial advisor can offer deeper expertise and insights that lead to better financial habits.

But the potential benefits go beyond just helping you avoid a bad decision. An advisor can design a diversified, research-backed investment strategy based on your long-term goals and comfort level with risk. Equally important, you can look to a seasoned professional for guidance through different markets. By walking with you on the journey, an advisor can encourage the discipline essential to building wealth over time.

DISCLOSURES

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. Please click here to read the full text of the Dimensional Fund Advisor Disclaimer.