Avoid These Investing Mistakes to Reach Your Retirement Goals (Part 1)

Have you started thinking about retirement and begun to worry about what life in retirement will be like if you don’t build a whopping big nest egg? Experts estimate a comfortable retirement requires $1.04 million dollars saved up. Factor in even a few years of high inflation and a couple of decades of average inflation, and that million could easily quadruple! That’s a tall order, but if you’re smart about it and avoid major investing mistakes, it’s very doable. In this article, we’ll detail several of the worst investing mistakes that could derail your retirement dreams and how to overcome them to achieve your savings goals.

Too Little Too Late

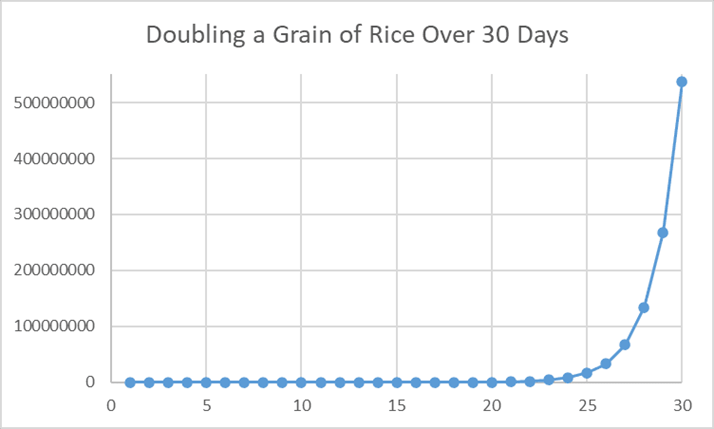

Compound interest has been called “the 8th wonder of the world,” “mankind’s greatest invention,” and “the strongest force in the universe.” Possibly the most famous story about compounding is the fable of a grain of rice. Briefly, a clever young girl outsmarts a miserly old man. When he offers her a reward for a good deed, she asks for just a single grain of rice, and then each day for 29 more days, double the previous day’s rice. On Day 2, she got 2 grains. Day 3, 4 grains. Day 4, 8 grains. Day 5, 16 grains. On Day 30, … the young girl received over 500 million grains, for a total of over a billion.

Adapting the story to more modern times by changing the grain of rice to starting with a single penny, by the end of a month, the total is over $10 million! Of course, doubling your money every day, or even every year, is pure fantasy. Still, the story demonstrates how compound interest can turn small sums into a major fortune. The flip side is that if you delay investing for retirement by 10 years, starting at age 32 instead of 22, you need to nearly double your annual investment to reach the same amount. Delay to age 42, and the required annual investment more than doubles again. That’s why starting “Too Late” is a major mistake. The “Too Little” part is self-explanatory.

Playing It Safe

Many people look at the stock market with fear. They hear about (or experienced first-hand) losses of 50% or more in a single year. As a result, they play it “safe” with their retirement savings, keeping them in cash or bonds. The problem is that over a 45-year investing career, assuming the 3.5% long-term average annual inflation, your investment would lose nearly half its value. Set aside $1000 each year for 45 years for a total of $45,000 saved, and keep it in cash, and you’d end up with less than $23,000. Bonds are a bit better, with a 1.9% average inflation-adjusted annual return. Here, $45,000 invested over a 45-year period would get you over $70,000. Not bad, right? Compare it to stocks though, with a historic average inflation-adjusted return of 6.6%. Here, your $45,000 turns into over a quarter-million dollars! This means that if you don’t want to have to set aside 3.6x more each year (if you even could), keeping your money “safe” in bonds would cut your retirement income by more than 70% compared to stocks!

Ignoring the Nickel-and-Diming of Fees

Erroneously attributed to Mark Twain, an often-repeated quip says the surest way to get rich during a gold rush isn’t to prospect for gold but to sell overpriced picks and shovels to those pursuing unsure fortunes. This is what some financial institutions, wealth managers, and investment advisors do. They provide investment advice to people seeking an uncertain fortune through investments and charge a fee for that service. While there’s absolutely nothing wrong with doing so (in effect, selling shovels at a fair price), some charge unjustifiably high fees that come out of your pocket, whether their advice adds value or not.

Letting Emotions Rule You

A humorous, but highly instructive story was reported in 2014 by Business Insider. In a Bloomberg Radio show, a guest related the following: “Fidelity had done a study as to which accounts had done the best at Fidelity. And what they found was…“ “They were dead,” interjected the interviewer. “…No, that’s close though!” responds the guest. “They were the accounts of people who forgot they had an account at Fidelity.“ Numerous studies show time and time again that mutual fund investors underperform the very funds in which they invest. How is this possible? Simple. Investors act on fear, panic selling when they should hold on. They then act on greed, buying a “hot fund” after it’s run up a lot and is poised for losses. That’s how emotion-driven trading can hurt your long-term results.

Putting All Your Eggs in the Same Basket

Twenty years ago, energy trader Enron, then the nation’s 7th-largest company, became an object lesson in the folly of putting all your eggs in the same basket. The company loaded its employee’s pensions with Enron stock. When the company’s accounting tricks couldn’t hide massive losses anymore, shares dropped from $80 to pennies. As NPR reported, “All told, Enron employees [were] out more than $1 billion in pension holdings.” On top of that, 14 thousand employees lost their job as the company imploded. Most money managers will tell you to avoid holding more than 10% of your portfolio in a single company (if it’s your own company, things may be different). How much more so, when your portfolio is invested 20%, 30%, or more in your employer’s stock? There, if the company goes under, your portfolio suffers a massive “haircut,” your pension, if any, may become worthless, and you lose your job, all at the same time.

The Bottom Line

Personal finance, as I often point out, is exactly that – personal. What’s right for me could be completely wrong for you. However, as the well-known quip goes, “The race isn’t always to the swift, nor the battle to the bold. But that’s the way to bet.” You may choose to go against any or all of the above recommendations, and may even be better off for it. However, in my experience, the odds will be against you.

About the Author Doug Finley

Douglas Finley, MS, CFP, AEP, CDFA founded Finley Wealth Advisors in February of 2006, as a Fiduciary Fee-Only Registered Investment Advisor, with the goal of creating a firm that eliminated the conflicts of interest inherent in the financial planner – advisor/client relationship. The firm specializes in wealth management for the middle-class millionaire.

Related Posts

Financial Goals: Your Tickets To Ride

Common Investing Mistakes (Part 3)

Common Investing Mistakes (Part 2)

Common Investing Mistakes (Part 1)

Looking for the Next Nvidia May Shrink Your Return

What’s Baked into Your Credit Exposure?

Top 500 Stocks, Give or Take $2.1 Trillion

Japan in the News, But It’s Nothing New