Trying To Outguess the Market Has No Role: Principle 2 in Evidence-Based Investing

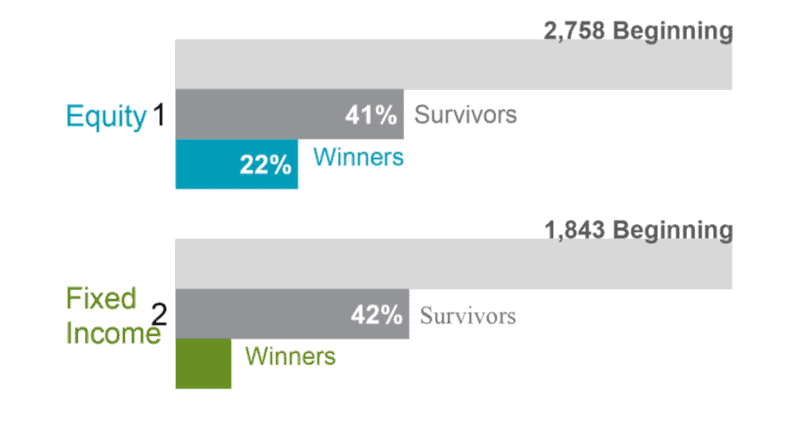

The market’s pricing power works against investors who try to outguess the market. As evidence, only 23% of US equity mutual funds and 8% of fixed income funds have survived and outperformed their benchmarks over the past 20 years.

Don’t Try To Outguess the Market

Wouldn’t it be great to hold only top selections in your investment portfolio, with no disappointments to detract from your success?

Of course it would. It would also be nice to hold a $100 million winning lottery ticket. But just as the lottery is no place to invest your life’s savings, neither is speculating on the razor-thin odds that you can consistently handpick which stars are next in line to shine. Historical evidence is clear. Funds trying to outguess the market rarely survive, let alone outperform their benchmarks.

It’s certainly understandable if you feel you (or your favorite active experts) have what it takes to beat the odds. But here are four important reminders on the perils of trying to time the market – at any time. Trying to outguess the market runs counter to your best strategies for building durable, long-term wealth.

1. Market-Timing Is Undependable

Bull and bear markets come and go. At times, it may feel especially “obvious” that the market is about to plummet or soar. But how often does the “obvious” actually occur? Market history has shown us time and again that seemingly sure bets often end up being losing ones instead.

As recently as March 2020, markets dropped precipitously almost overnight. Many investors assumed we should expect dismal returns for the rest of the year. Instead, markets not only recovered over the next two quarters, overall returns were remarkable. Many investors who tried to outguess the market by selling in March were left sitting on the sidelines.

2. The Odds Are Against You

Trying to outguess the market is not only a stressful strategy, it’s more likely to hurt than help your long-term returns.

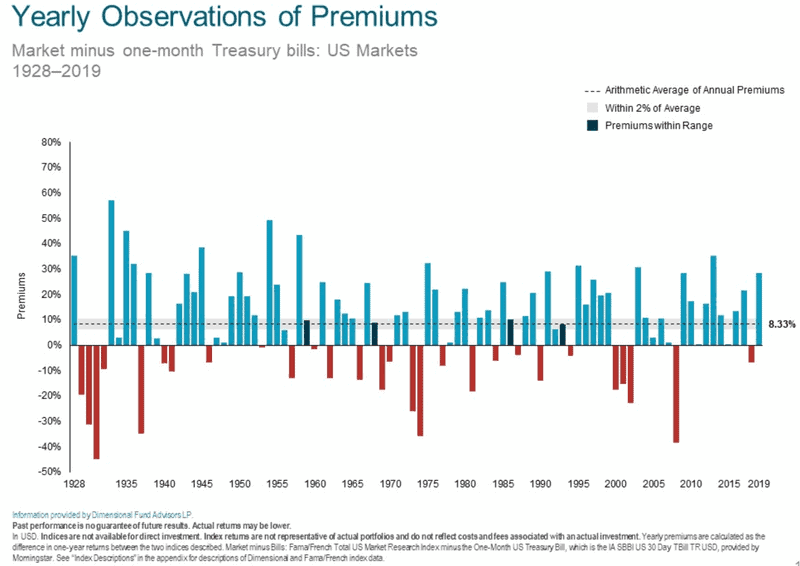

As the illustration below shows us, that’s in part because “average” returns aren’t the near-term norm; volatility is. From 1928–2019, the average annual return for U.S. markets has been 8.3%. But it was quite rare when any given year’s annual return was within a 2% range of this long-term average. This happened only four times, as depicted by the dark blue bars. Many years, annual returns were much higher, which more than made up for the years when they were much lower.

In other words, over time and overall, markets have generated real wealth. But they’ve almost always done so in fits and starts, with some of the best returns immediately following some of the worst. If you try to avoid the downturns, you’re essentially betting against the strong likelihood that the markets will eventually continue to climb upward as they always have before. You’re betting against everything we know about expected market returns.

3. Trying To Outguess the Market Is Expensive

Whether or not a market-timing gambit plays out in your favor, trading typically costs real money. To add insult to injury, if you make sudden changes that aren’t part of your larger investment plan, the extra costs generate no extra expectation that the trades will be in your best interest. If you decide to get out of positions that have enjoyed extensive growth, the tax consequences in taxable accounts could also be financially ruinous.

4. Market-Timing Is Guided by Instinct Over Evidence

Behavioral finance informs us, your brain excels at responding instantly – instinctively – to real or perceived threats. When market risks arise, these same basic survival instincts flood your brain with chemicals that induce you to take immediate fight-or-flight action. If the markets were an actual hurricane or forest fire, you might be wise to heed these instincts. But for investors, the real threats occur when your behavioral biases cause your emotions to run ahead of your rational resolve.

Your Take-Home

There’s a better way than trying to outguess the market. Instead of forever struggling against the market’s many efficiencies, we suggest building a broadly diversified portfolio covering a range of asset classes … and sticking with it over time. By always being already invested wherever the next big run is about to occur, you’re best positioned to earn market returns according to your risk tolerance.

To see all 10 principles of Evidence-Based Investing at a glance, please visit our Evidence-Based Principles Guide. These principles inform our investing process.

About the Author Doug Finley

Douglas Finley, MS, CFP, AEP, CDFA founded Finley Wealth Advisors in February of 2006, as a Fiduciary Fee-Only Registered Investment Advisor, with the goal of creating a firm that eliminated the conflicts of interest inherent in the financial planner – advisor/client relationship. The firm specializes in wealth management for the middle-class millionaire.

Related Posts

Top 500 Stocks, Give or Take $2.1 Trillion

Bringing Order to Your Investment Universe Part 2: Transitions and Taxes

Common Investing Mistakes (Part 2)

The Cost of Trying to Time the Market

Trying to Predict Interest Rates? Good Luck.

What is the Purpose of Indexes and Index Funds? (Part IV)

Index Points and What they Mean (Part II)

Financial Goals: Your Tickets To Ride

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.