- You are here:

- Home »

- Blog »

- Investment Advice »

- When It’s Value Stocks vs. Growth Stocks, History Is on Value’s Side

When It’s Value Stocks vs. Growth Stocks, History Is on Value’s Side

When it comes to evaluating value stocks vs growth stocks, there is pervasive historical evidence that value stocks outperform growth stocks. Logic and data provide the basis for a positive expected value premium, offering a guide for investors targeting higher potential returns. Data covering nearly a century in the US, and nearly five decades of market data outside the US, support the notion that value stocks— those with lower relative prices—have higher expected returns.

Value Stocks Vs Growth Stocks Over Time

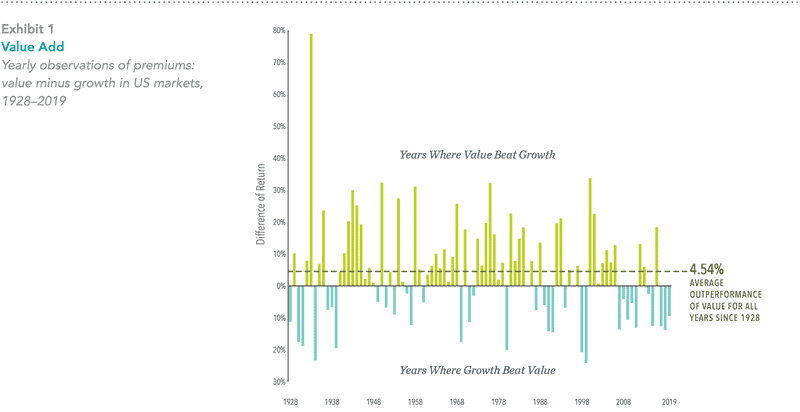

Recently, growth stocks have enjoyed a run of outperformance vs. their value counterparts. But while disappointing periods emerge from time to time, the principle that lower relative prices lead to higher expected returns remains the same. On average, value stocks have outperformed growth stocks by 4.54% annually in the US since 1928, as Exhibit 1 shows.

Some historical context is helpful in providing perspective for growth stocks’ recent outperformance. As Exhibit 1 demonstrates, realized premiums are highly volatile. While periods of underperformance are disappointing, they are also within the range of possible outcomes.

- Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

- In US dollars. Yearly premiums are calculated as the difference in one-year returns between the two indices described. Value minus growth: Fama/French US Value Research Index minus the Fama/French US Growth Research Index.

- Fama/French US Value Research Index: Provided by Fama/French from CRSP securities data. Includes the lower 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and Nasdaq equivalents since 1973).

- Fama/French US Growth Research Index: Provided by Fama/French from CRSP securities data. Includes the higher 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and Nasdaq equivalents since 1973).

Appreciating Research and Empirical Data

We believe investors are best served by making decisions based on sound economic principles supported by a preponderance of evidence. Value investing is based on the premise that paying less for a set of future cash flows is associated with a higher expected return. That’s one of the most fundamental tenets of investing. Combined with the long series of empirical data on the value premium, our research shows that value investing continues to be a reliable way for investors to increase expected returns going forward. For this reason, appreciate the foundational principles, seriously consider investing in value stocks vs growth stocks.

GLOSSARY

Value Stock: A stock trading at a low price relative to a measure of fundamental value such as book equity.

Growth Stock: A stock trading at a high price relative to a measure of fundamental value such as book equity.

Value Premium: The return difference between stocks with low relative prices (value) and stocks with high relative prices (growth).

DISCLAIMER

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. Please click here to read the full text of the Dimensional Fund Advisor Disclaimer.

About the Author Doug Finley

Douglas Finley, MS, CFP, AEP, CDFA founded Finley Wealth Advisors in February of 2006, as a Fiduciary Fee-Only Registered Investment Advisor, with the goal of creating a firm that eliminated the conflicts of interest inherent in the financial planner – advisor/client relationship. The firm specializes in wealth management for the middle-class millionaire.

Related Posts

Encouraging Data from Value’s Past and Present

Bringing Order to Your Investment Universe Part 2: Transitions and Taxes

Bringing Order to Your Investment Universe Part 1: The Beauty of Being Organized

Protecting Women’s Wealth

What I See When I Watch Basketball

Cost of Capital: A Gut Check on High-Flying Stock Returns

David Booth on Pursuing a Better Investment Experience

Common Investing Mistakes (Part 3)

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.