This Has Been a Test: Developing a Financial Plan You Can Stick With

Think back to December 2019. The economy was humming. Unemployment, interest rates, and inflation were at historically low levels. But then what happened?

- A global pandemic hit. By the end of March, the S&P 500 had dropped nearly 20% in value.

- Later in the year, scientists announced that they’d developed a vaccine, and markets roared back. FAANG stocks soared … before giving up a lot of gains.

- Meme stocks shot way up … and fell back down.

- Bitcoin and other cryptocurrencies reached record highs … and then crashed.

- Inflation spiked to the highest levels most of us have ever experienced.

- And Russia invaded Ukraine, sparking a humanitarian crisis and geopolitical uncertainty.

I don’t know anyone who predicted all of that back in December 2019. But what if someone had? What would you have done?

Next question: What if that person told you that, despite all that news, the Russell 3000 would average a return of 10% a year over the next three years? Would you have believed them? Would you have stayed in the market?

Because that’s what happened. A yearly return of 10%! That’s pretty darn close to the stock market’s historical average over the past century.

The conclusion I hope you reach is that it’s unrealistic to think you can outguess markets. You’re probably better off expecting that markets do their job of capturing the human ingenuity taking place every day across thousands of publicly traded companies around the world.

What do I mean by markets doing their job? When news of the pandemic hit, markets adjusted and prices went down. In other words, when uncertainty peaked around March 2020, investors demanded a higher return to jump into the market. Then, when news of a vaccine spread, the market adjusted its expectations accordingly. In the short term, there are often wild swings up or down. Making a change during either can be dangerous.

The past three years were a good test of whether or not you had an investment plan that was sensible to stick with. So take a moment to think about why you did what you did, and prepare for next time. Because the next three years may be just as uncertain.

First, make sure your investment plan is sensible and based on financial science. Second, make sure it’s realistic for you and your own unique situation. Even the greatest plan is no good if you can’t stick with it during tough times. Invest in markets in whatever asset mix is right for you. If you’re not sure, talk with a financial advisor who can help you.

What has stayed constant throughout my life is the power of people to make progress in the face of challenges.

I don’t make predictions, but I do believe in the power of human ingenuity to fix problems big and small, innovating the whole way. What has stayed constant throughout my life is the power of people to make progress in the face of challenges.

We’ve seen it in the fight against COVID-19, where vaccines developed at lightning speed are now being administered around the world. We’ve seen it in the continued progress of gene therapy, which is revolutionizing the treatment of multiple diseases. So as we start 2023, let’s remember the lessons of the past three years. Let’s develop—and stick to—plans that take us through the short-term ups and downs of market fluctuations so we can capture the long-term benefits of human ingenuity.

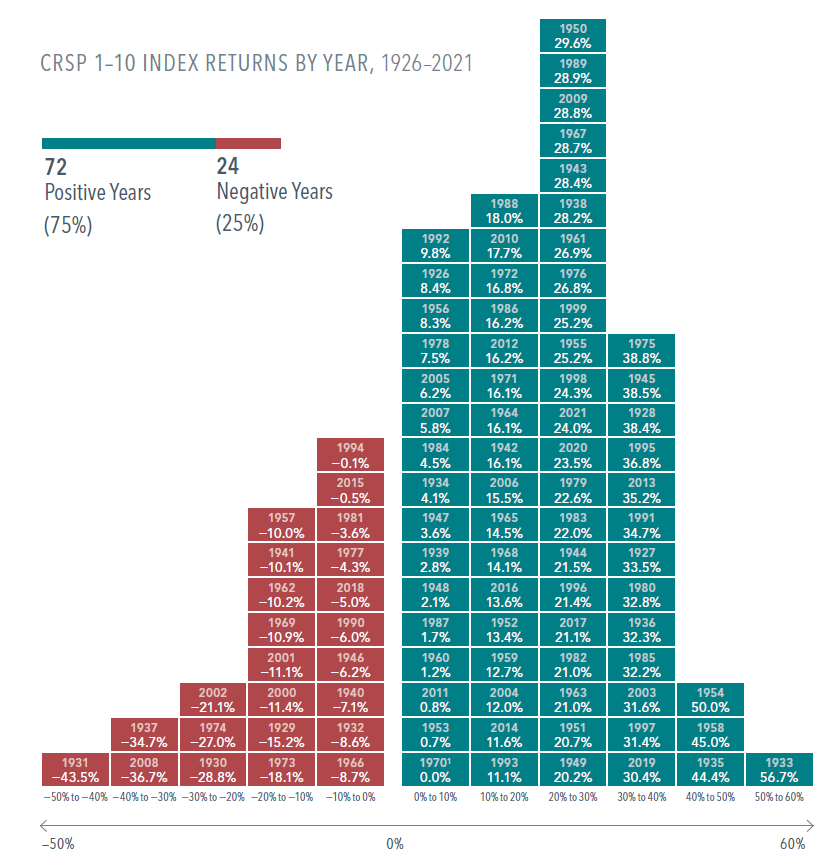

The Rewarding Distribution of US Stock Market Returns

Annual stock market returns are unpredictable, but “up” years have occurred much more frequently than “down” years in the US. That may be reassuring to investors, especially if they find market downturns unsettling.

- The US stock market posted positive returns in 75% of the calendar years from 1926 through 2021.

- The market gained an annualized average of 10.2% during this period. Yet nearly two-thirds of yearly observations were at least 10 percentage points above or below the average.

- Another noteworthy trend: More than two-thirds of the down years were followed by up years. The most recent example: a 5.0% loss in 2018 followed by a 30.4% gain in 2019.

The stock market tends to reward investors who can weather annual ups and downs and stay committed to a long-term plan.

FOOTNOTES

- S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual Decrease of 19.6% was from Jan. 1, 2020–March 31, 2020.

- Facebook-parent Meta, Amazon, Apple, Netflix, and Google-parent

- Gwynn Guilford, “U.S. Inflation Hit 7% in December, Fastest Pace Since 1982,” Wall Street Journal, January 12,

- In US Russell 3000 Index annual returns December 2019–November 2022. Copyright © FTSE Russell. All rights reserved.

- In US dollars. S&P 500 Index annual returns 1926–2021. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

AUTHORS

David Booth

Executive Chairman and Founder

DISCLOSURES

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. Please click here to read the full text of the Dimensional Fund Advisor Disclaimer.

About the Author Doug Finley

Douglas Finley, MS, CFP, AEP, CDFA founded Finley Wealth Advisors in February of 2006, as a Fiduciary Fee-Only Registered Investment Advisor, with the goal of creating a firm that eliminated the conflicts of interest inherent in the financial planner – advisor/client relationship. The firm specializes in wealth management for the middle-class millionaire.

Related Posts

Curve Your Enthusiasm with Fed Activity

What’s Baked into Your Credit Exposure?

Top 500 Stocks, Give or Take $2.1 Trillion

Japan in the News, But It’s Nothing New

Bringing Order to Your Investment Universe Part 2: Transitions and Taxes

Bringing Order to Your Investment Universe Part 1: The Beauty of Being Organized

Protecting Women’s Wealth

What I See When I Watch Basketball