- You are here:

- Home »

- Blog »

- Investment Advice »

- Strategic vs. Tactical Asset Allocation: Does It Matter?

Strategic vs. Tactical Asset Allocation: Does It Matter?

Strategic vs. tactical asset allocation … they both sound pretty good as an investment strategy, don’t they? There’s only one problem: I may have left you guessing as to what I’m even talking about. One of the terms is an accurate, if wordy way to describe asset allocation in general. The other is dangerously deceptive.

I won’t keep you in suspense: Strategic asset allocation is the real deal in portfolio management. Tactical asset allocation is a ticking time bomb called market-timing.

To understand the differences between strategic vs. tactical asset allocation, it helps to understand what asset allocation is to begin with.

What Is Asset Allocation?

Even if you’re new to investing, you’ve probably heard about diversification, or not putting all your investment eggs in one basket.

Asset allocation addresses this concern, and more. First, it helps you form a plan for diversifying your eggs (or assets) across multiple baskets (or asset classes). That way, you’re not betting too heavily on any one kind of investment (such as only U.S. large company stocks).

Second, asset allocation makes it easier to manage the given level of risk involved in pursuing your personal financial goals. This is just as important, because every investor must balance the following:

- Over the long-term: Different asset classes are expected to deliver higher or lower returns, based on how relatively risky or safe they are as investments. But also remember that …

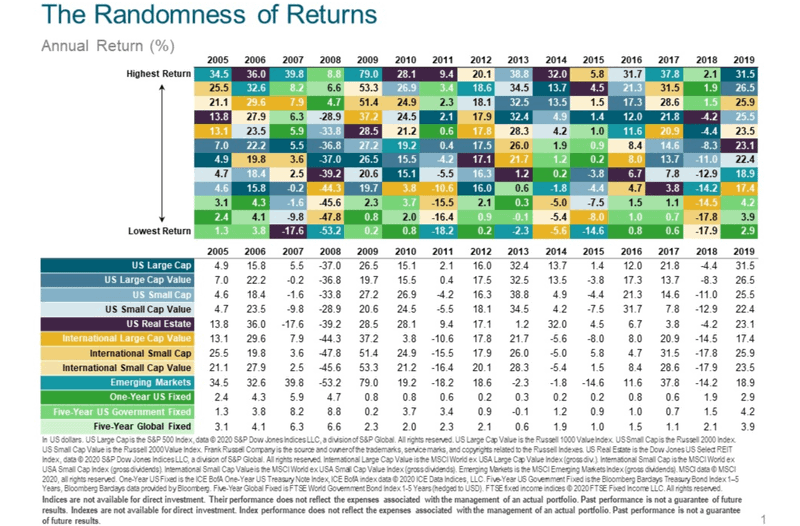

- Over the short-term: Returns are random. Different asset classes are ultimately expected to deliver higher or lower returns over time, but rarely in a predictable pattern.

Example 1: Short-Term Returns Are Random

How Does Asset Allocation Work?

Asset allocation is the act of assigning, investing in, and maintaining target weights across multiple asset classes. Each asset class has exhibited its own risk/reward “personality.” Together, they combine into a total portfolio optimized to reflect your personal goals and risk tolerances.

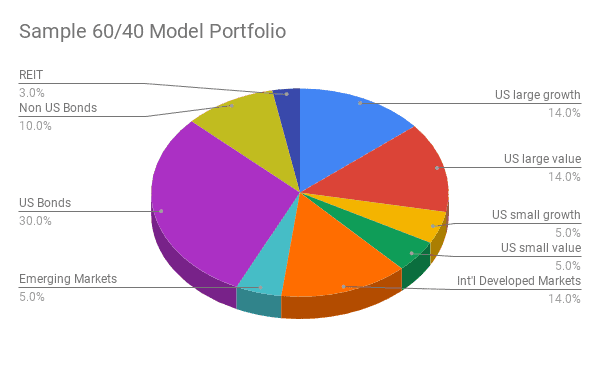

Let’s illustrate. Say you and your financial advisor have decided to allocate 60% of your investments to stocks and 40% to bonds, typically using mutual funds to do so. You also can allocate these two broad market asset classes across subcategories, for exposure to additional sources of expected returns. For example:

- Stocks can be allocated by domestic or international (U.S., international, or emerging markets); company size (small, medium, or large); and business metrics (value or growth).

- Bonds can be allocated by type (government, municipal or corporate); credit quality (high or low ratings); and term (short-, intermediate-, or long-term).

Example 2: A Model Investment Portfolio

Disclosures: Diversification does not eliminate the risk of market loss. There is no guarantee investment strategies will be successful. For illustrative purposes only.

Asset Allocation by Any Other Name

Technically, any thoughtful asset allocation as just described requires solid strategy and tactics to work. In that sense, we don’t usually describe asset allocation as being one or the other.

Unfortunately, the industry did not ask our opinion when it began using the terms anyway.

So, if a financial professional tells you they employ strategic asset allocation strategy, they are typically advocating an approach that aligns with our own. This includes:

- Over the long-term: Building and maintaining your optimal portfolio according to the asset allocations you’ve established for achieving your long-term financial goals.

- Over the short-term: Avoiding the temptation to veer off-course in reaction to the market’s inevitable mood swings.

That short-term temptation is called market-timing. Unfortunately, this is exactly what someone is suggesting you do if they recommend tactical asset allocation. This may also sometimes be called dynamic asset allocation. No matter what you call it, market-timing is a tactic best left undone.

Tactical Asset Allocation = Market-Timing

Tactical asset allocation involves using market-timing to switch back and forth between asset classes. In bear markets, this becomes a flight to “safer” holdings. In bull markets, it means piling into the latest popular picks. During volatile times, you may be doing a bit of both.

Unfortunately, as we’ve just seen, there has long been no pattern to predict in the near-term. Market movements are random. So, at best, the outcome of trying to accurately time them is expected to be random as well.

In fact, there is plenty of evidence suggesting that market-timing tactics usually cause more harm than good. As this 2019 Morningstar report describes:

“Tactical funds are tough to use because managers have wide discretion to change their asset allocations, which can lead to big fluctuations in their levels of risk. It is difficult to set risk/return expectations for a tactical fund and anticipate how it may behave relative to other funds. Ill-defined expectations can lead to bad behavior if investors add to funds after strong returns and take out money following poor returns.”

In other words, market timing may seem appealing, giving you the “freedom” to dodge in and out of markets when they become exciting or scary. But as soon as you do this, you’re abandoning the evidence-based reasons asset allocation is expected to work to begin with.

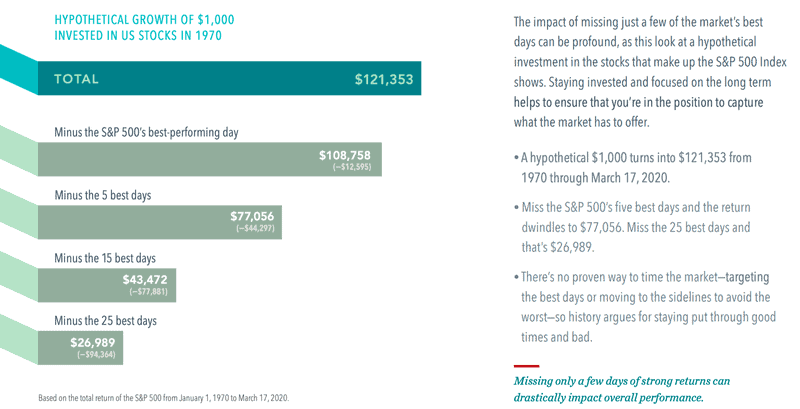

Strike One: Taking Your Eye Off the Ball

First, because an asset’s best-performing days often occur without warning during stressful times, market-timers are prone to paying steep prices when they happen to miss out on those stellar days.

Strike Two: Swinging High and Low

By loading up on the hottest asset classes when the market is surging, investors usually pay a premium price for the privilege. When markets plummet, a market-timer abandons their riskiest holdings, often unloading them at a loss. In other words, market-timing ultimately leads to a “buy high, sell low” strategy. This not only runs counter to effective asset allocation, it’s a tactic no sensible investor would intentionally embrace.

Strike Three: Playing To Lose

Last but not least, market-timing tactics can cause unnecessary confusion.

- How have your overall investments been performing?

- How near or far are you from achieving your personal financial goals?

- If you’re not doing as well as hoped for, what reasoned adjustments can you make to pick up the pace?

These and similar planning questions are relatively easy to address with strategic asset allocation. But what if an investor has instead been jumping in and out of hot and cold markets in the absence of any dependable game plan? It becomes much more challenging – and stressful – to decide how to proceed.

In short, tactical asset allocation is essentially the polar opposite of the “steady as she goes” approach most long-term investors would prefer.

Strategic Asset Allocation = Asset Allocation

At Finley Wealth Advisors, our strategy is to use asset allocation to help our clients with their personal finance while managing the risks involved. Our tactics look something like this:

Step 1: Plan

Define a set of personalized target allocations as described above.

Step 2: Implement

Allocate your assets according to the original asset allocation you’ve defined (as well as tax-efficiently managing them across taxable and tax-sheltered accounts).

Step 3: Manage and Maintain

Periodically rebalance your portfolio back to its carefully planned target allocations. Or, if your underlying goals have changed, start the process over again, beginning with step 1.

What do you call this? Call it strategic asset allocation. Call it just plain asset allocation. Either way, when considering strategic vs. tactical asset allocation, feel free to call us if we can help you achieve your financial goals. We offer advisory services to help you stay on course through ever-volatile markets, employing the best strategies and tactics for making it so.

About the Author Doug Finley

Douglas Finley, MS, CFP, AEP, CDFA founded Finley Wealth Advisors in February of 2006, as a Fiduciary Fee-Only Registered Investment Advisor, with the goal of creating a firm that eliminated the conflicts of interest inherent in the financial planner – advisor/client relationship. The firm specializes in wealth management for the middle-class millionaire.

Related Posts

What 2023 Teaches Us About Expectations vs. Reality

What’s Baked into Your Credit Exposure?

Top 500 Stocks, Give or Take $2.1 Trillion

Japan in the News, But It’s Nothing New

Curve Your Enthusiasm with Fed Activity

Bringing Order to Your Investment Universe Part 2: Transitions and Taxes

Bringing Order to Your Investment Universe Part 1: The Beauty of Being Organized

Protecting Women’s Wealth

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.