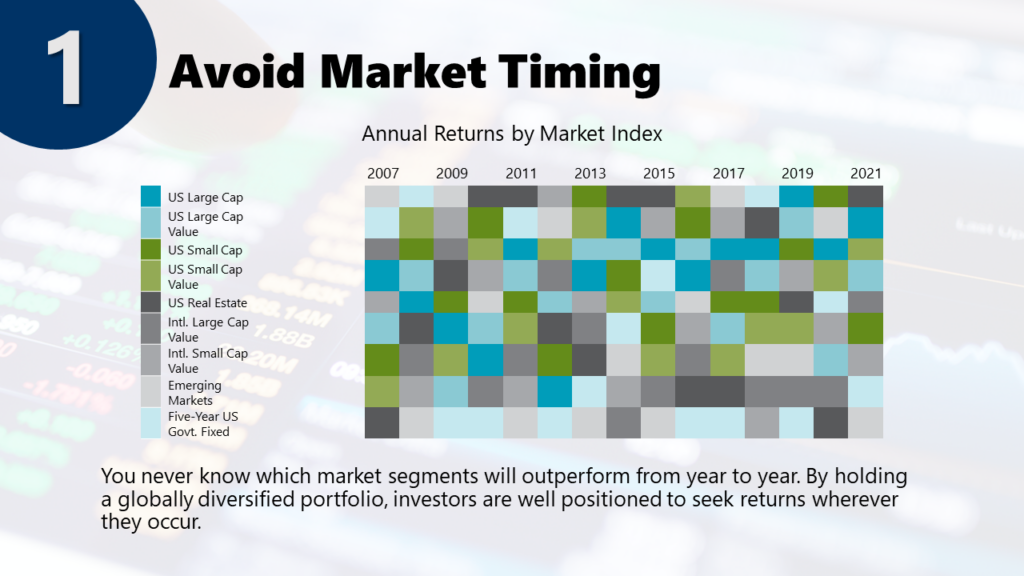

The First Point – Avoid Market Timing

You never know which market segments will outperform from year to year. By holding a globally diversified portfolio, investors are well positioned to seek returns wherever they occur.

- Even with a globally diversified portfolio, market movements can tempt investors to switch asset classes based on predictions of future performance.

- This slide features annual ranked performance of major asset classes in the US and international markets over the past 15 years. The asset classes are represented by corresponding market indices. The patchwork dispersion of colors shows that the relative performance of asset classes is unpredictable across periods.

- Investors who follow a structured, diversified approach are well positioned to seek returns whenever and wherever they occur. Diversification also reduces the risk of being heavily invested in an underperforming asset group in any given year.

The Second Point – Manage Your Emotions

Many people struggle to separate their emotions from investing. Markets go up and down. Reacting to current market conditions may lead to making poor investment decisions.

- The 2008–2009 global market downturn offers an example of how the cycle of fear and greed can drive an investor’s reactive decisions. Some investors fled the market in early 2009, just before the rebound began. They locked in their losses and then experienced the stress of watching the markets climb.

- Staying disciplined through rising and falling markets can pose a challenge, but it is crucial for long-term success.

Overall, the two key points to remember are:

- Avoid Market Timing and

- Manage Your Emotions thinking about making an investment decision.

This concludes the fourth video of the Pursuing a Better Investment Experience series. To learn more, check out our other videos!

Disclosures

Relative price is measured by the price-to-book ratio; value stocks are those with lower price-to-book ratios. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Diversification does not eliminate the risk of market loss.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. Please click here to read the full text of the Dimensional Fund Advisor Disclaimer.