The First Point – Embrace Market Pricing

The market is an effective information-processing machine. Each day, the world equity markets process billions of dollars in trades between buyers and sellers—and the real-time information they bring helps set prices, so overall:

- With each trade, buyers and sellers bring new information to the market, which helps set prices. No one knows what the next bit of new information will be. The future is uncertain, but prices will adjust accordingly.

- This doesn’t mean that a price is always right—there’s no way to prove that. But investors can accept the market price as the best estimate of actual value. If you don’t believe that market prices are good estimates—if you believe that the market has it wrong—you are pitting your beliefs and hunches against the collective knowledge of all market participants.

- If you don’t believe that market prices are good estimates—if you believe that the market has it wrong—you are pitting your beliefs and hunches against the collective knowledge of all market participants.

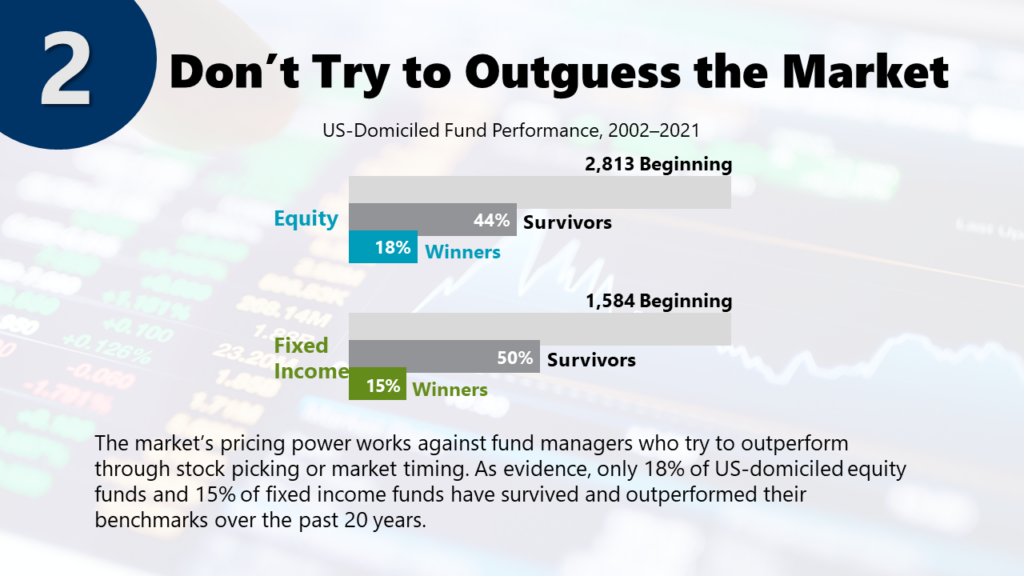

The Second Point – Don’t Try To Outguess The Market

The market’s pricing power works against fund managers who try to outperform through stock picking or market timing. As evidence, only 18% of US-domiciled equity funds and 15% of fixed income funds have survived and outperformed their benchmarks over the past 20 years;

- Many fund managers believe they can identify “mispriced” securities and convert that knowledge into higher returns. But fair market pricing works against such efforts, as indicated by the large proportion of mutual funds that have underperformed their benchmarks.

- In this chart, the light gray bars represent the number of US-domiciled equity and fixed income funds in operation during the past 20 years. These funds compose the beginning universe of that period. The dark gray areas show the percentage of equity and fixed income funds that survived the 20-year period. The blue and green bars show the smaller percentage of equity and fixed income funds that survived and outperformed their respective benchmarks during the period.

- Research shows that over both short and long-time horizons, the deck is stacked against mutual funds that attempt to outguess the market.

Overall, the two key points to remember are:

- Embrace Market Pricing and

- Don’t Try to Outguess the Market

This concludes the first video of the Pursuing a Better Investment Experience series. To learn more, check out our other videos!

Disclosures

In USD. Source: Dimensional, using data from Bloomberg LP. Includes primary and secondary exchange trading volume globally for equities. ETFs and funds are excluded. Daily averages were computed by calculating the trading volume of each stock daily as the closing price multiplied by shares traded that day. All such trading volume is summed up and divided by 252 as an approximate number of annual trading days.

The sample includes funds at the beginning of the 20-year period ending December 31, 2021. Each fund is evaluated relative to its primary prospectus benchmark. Survivors are funds that had returns for every month in the sample period. Winners are funds that survived and outperformed their benchmark over the period. Where the full series of primary prospectus benchmark returns is unavailable, non-Dimensional funds are instead evaluated relative to their Morningstar category index. Data Sample: The sample includes US-domiciled, USD-denominated open-end, and exchange-traded funds (ETFs) in the following Morningstar categories. Non-Dimensional fund data provided by Morningstar.

Dimensional fund data is provided by the fund accountant. Dimensional funds or subadvised funds whose access is or previously was limited to certain investors are excluded. Index funds, load-waived funds, and funds of funds are excluded from the industry sample. Morningstar Categories (Equity): Equity fund sample includes the following Morningstar historical categories: Diversified Emerging Markets, Europe Stock, Foreign Large Blend, Foreign Large Growth, Foreign Large Value, Foreign Small/Mid Blend, Foreign Small/Mid Growth, Foreign Small/Mid Value, Global Real Estate, Japan Stock, Large Blend, Large Growth, Large Value, Mid-Cap Blend, Mid-Cap Growth, Mid-Cap Value, Miscellaneous Region, Pacific/Asia ex-Japan Stock, Real Estate, Small Blend, Small Growth, Small Value, World Large-Stock Blend, World Large-Stock Growth, World Large-Stock Value, and World Small/Mid Stock.

Morningstar Categories (Fixed Income): Fixed income fund sample includes the following Morningstar historical categories: Corporate Bond, High Yield Bond, Inflation-Protected Bond, Intermediate Core Bond, Intermediate Core-Plus Bond, Intermediate Government, Long Government, Muni California Intermediate, Muni California Long, Muni Massachusetts, Muni Minnesota, Muni National Intermediate, Muni National Long, Muni National Short, Muni New Jersey, Muni New York Intermediate, Muni New York Long, Muni Ohio, Muni Pennsylvania, Muni Single State Intermediate, Muni Single State Long, Muni Single State Short, Muni Target Maturity, Short Government, Short-Term Bond, Ultrashort Bond, World Bond, and World Bond-USD Hedged.

Index Data Sources: Index data provided by Bloomberg, MSCI, Russell, FTSE Fixed Income LLC, and S&P Dow Jones Indices LLC. Bloomberg data provided by Bloomberg. MSCI data © MSCI 2022, all rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. FTSE fixed income indices © 2022 FTSE Fixed Income LLC. All rights reserved. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. US-domiciled mutual funds and US-domiciled ETFs are not generally available for distribution outside the US. There is no guarantee investment strategies will be successful. Past performance is no guarantee of future results

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. “Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. Please click here to read the full text of the Dimensional Fund Advisor Disclaimer.