Six Hacks for Maintaining Investment Discipline: Principle 9 in Evidence-Based Investing

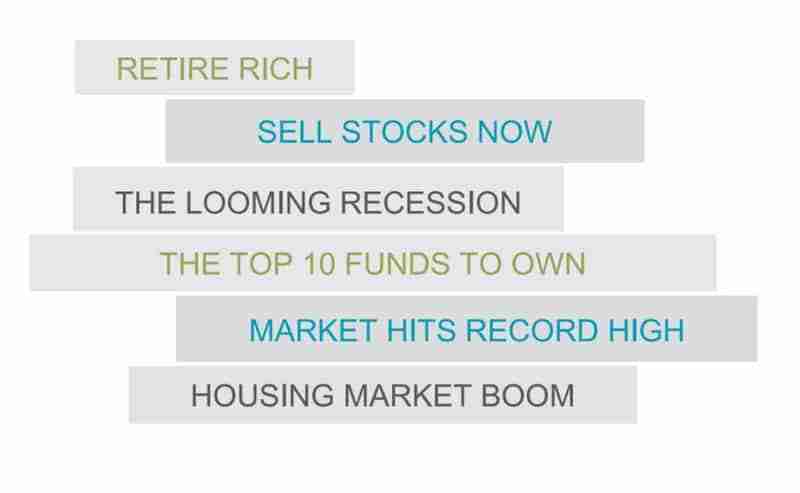

Investment discipline is all about being able to see past the daily market distractions to maintain a long-term perspective. A big challenge here is knowing how to identify and ignore your own emotional investing biases. They can otherwise stir up excessive anxiety about the future. They can also trick you into chasing the latest fads, or otherwise veering from your true financial aim. What can you do about them? Read on.

In “Emotional Investing Is Risky Investing,” we explored how a number of deep-seated “fight or flight” instincts generate an array of behavioral biases that trick us into losing our investment discipline, which in turn can trigger significant money-management mistakes. Here, we’ll familiarize you with six of the most potent biases, and how you can avoid sabotaging your own best-laid investment plans by recognizing these biases when they’re happening to you.

Behavioral Bias #1: Herd Mentality

Herd mentality is what happens to you when you see a market movement, and you decide to join the stampede. The herd may be hurtling toward what seems like a hot stock market run. Or it may be fleeing a widely feared risk. Either way, as we covered in “Understanding How Markets Work for You,” following the herd puts you on a dangerous path toward buying high, selling low, and incurring unnecessary expenses along the way.

Behavioral Bias #2: Recency

Your investment discipline is also at risk if you give recent information greater weight than the long-term evidence warrants. From our earlier post, “What Really Drives Higher Expected Returns,” we know that stocks have historically delivered premium returns over bonds. And yet, whenever stock markets dip downward, we typically see recency bias at play, with droves of investors rushing to sell out of the market in search of “safe harbor.” On the flip side, the same bias spurs investors to pile back in when bull markets are on a tear (when many stocks are already overpriced).

Behavioral Bias #3: Confirmation Bias

Confirmation bias is the tendency to favor evidence that supports our beliefs, and to disregard that which refutes them. We’ll notice and watch news shows that confirm our belief structure; we’ll skip over those that would require us to radically change our views if we are proven wrong.

Confirmation bias explains why the rigorous, peer-reviewed approach we described in this earlier post is so critical to objective decision-making. Our mind want us to be right so badly, it will rig the game for us, even when it’s against our best financial interests.

Behavioral Bias #4: Overconfidence

In “Your Money & Your Brain,” Jason Zweig describes overconfidence in action when he asks: “How else could we ever get up the nerve to ask somebody out on a date, go on a job interview, or compete in a sport?” In these and similar scenarios, a degree of overconfidence can be beneficial. But in the financial arena, it often puts our investment discipline at risk. It tricks us into believing we can consistently beat the market by being smarter or luckier than average. In reality, as we described in an earlier post, it’s best to patiently participate in the market’s expected returns, instead of trying to go for broke – potentially literally.

Behavioral Bias #5: Loss Aversion

The opposite of overconfidence, we also have an oversized dose of loss aversion. The thought of losing money hurts significantly more than the prospect of gaining it excites us. As Zweig states, “Doing anything – or even thinking about doing anything – that could lead to an inescapable loss is extremely painful.”

One way that loss aversion attacks your investment discipline is by convincing you to flee to cash or bonds during bear markets – or even when stocks are going up, but a correction “feels” overdue. The evidence clearly demonstrates: You should end up with higher long-term returns by consistently holding, if not bulking up on stocks over time. And yet, even the potential for a future loss can impact your decision-making more than the likelihood of long-term returns.

Behavioral Bias #6: Sunken Costs

We investors also have a terrible time admitting defeat. When we buy an investment and it sinks lower, we tell ourselves we don’t want to sell until it’s at least back to what we paid. This sort of sunken-cost logic leads people to throw good money after bad. Do you find it difficult to let go of past losses once a position no longer suits your investment plan? That may suggest your investment discipline has become hobbled by emotional choices and debilitating distractions.

Your Take-Home for Investment Discipline

So, there you have it. Six behavioral biases, with many more worth exploring in Zweig’s and others’ books on emotional investing. It’s not only a fascinating field of inquiry, it can help you strengthen your investment discipline muscles. As a bonus, the insights are likely to enhance other aspects of your life as well.

But be forewarned. Even once you’re aware of your behavioral biases, it can still be hard to ignore them. They tend to fire off lightning-fast reactions in your brain well before your logic has any say. That’s why we suggest working with an objective advisor, to help you see and avoid collisions with yourself that your own myopic vision might miss.

To see all 10 principles of Evidence-Based Investing at a glance, please visit our Evidence-Based Principles Guide. These principles inform our investing process.

About the Author Doug Finley

Douglas Finley, MS, CFP, AEP, CDFA founded Finley Wealth Advisors in February of 2006, as a Fiduciary Fee-Only Registered Investment Advisor, with the goal of creating a firm that eliminated the conflicts of interest inherent in the financial planner – advisor/client relationship. The firm specializes in wealth management for the middle-class millionaire.

Related Posts

Understanding How Markets Work for You: Principle 4 in Evidence-Based Investing

SPACS, NFTs, and Flourishing in the Economic Jungle

Curve Your Enthusiasm with Fed Activity

Bringing Order to Your Investment Universe Part 2: Transitions and Taxes

Bringing Order to Your Investment Universe Part 1: The Beauty of Being Organized

Protecting Women’s Wealth

What I See When I Watch Basketball

Encouraging Data from Value’s Past and Present

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.