You Have Already Achieved Financial Success. How Will You Benefit From Working With Finley for the Management of Your Wealth?

We Provide You With The Four Essentials For A Relationship Built On A Mutual Trust

We help you plan for the life events you expect and overcome those you don’t. Helping clients achieve all that is important to them through prudent wealth management is the highest goal a wealth advisor can aspire to. As Independent Fee-Only Fiduciaries, you can be comfortable in knowing we will be 100% transparent on the costs of investing. Our advice and recommendations will always be aligned with your best interests.

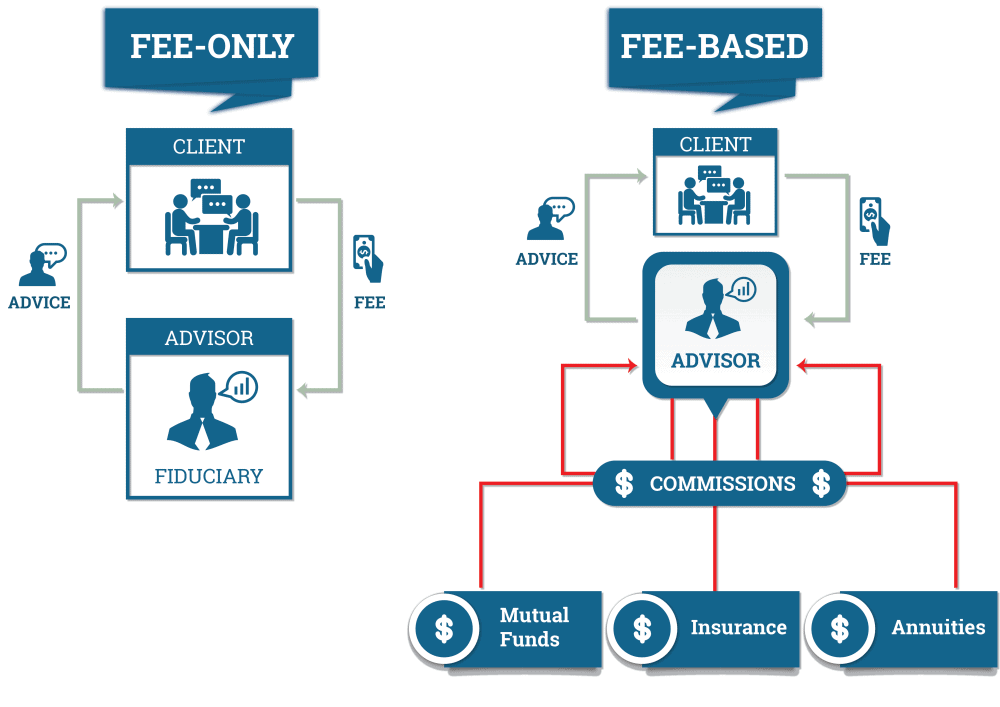

Fee-Only vs. Fee-Based Why It Matters

If you are looking for unbiased wealth management advice and not another well-rehearsed sales pitch, you are going to want a Fee-Only Fiduciary. This is the single most important step to remove the compensation conflicts of interest. It is these compensation conflicts that most often corrupt the advice you receive. At Finley, a promise of objective advice is more than just words, we are compensated exclusively by the fee paid to us by you. You simply pay for our expertise, with a transparent professional fee. We have no products to sell, commissions to attain, or quotas to meet. We are members of the National Association of Personal Financial Advisors or NAPFA.

It's our firm belief that professional financial advice and product sales are incompatible. Brokers very often sell products where compensation is the true motivation for the "advice" they give. The vast majority of employees of banks, brokerage firms, and insurance companies charge a management fee part of the time and are commissioned salespeople at other times. These brokers call themselves fee-based, attempting to confuse you into thinking they are fee-only.

Our Wealth Management Fee Schedule

0.80% on the first $2,000,000

0.50% on the next $3,000,000

0.25% on assets over $5,000,000

The all inclusive professional advisory fee will be calculated quarterly in advance as a percentage of the market value of all assets in Investor’s account on the last day of the month prior to the billing period. For new accounts, fees are prorated from inception through the end of the billing period. Additional contributions may be charged a prorated fee in the same manner. Finley Wealth Advisors (Finley) shall deduct all due and payable management fees automatically from Investor’s account(s).

The minimum household assets under the Wealth Management Agreement is $2,000,000, negotiable under special circumstances, (e.g., historical relationship, type of assets, anticipated future earning capacity, anticipated future additional assets, related accounts, account composition, negotiations with clients, family members, etc.). Although the Wealth Management Agreement is an ongoing agreement, the client or the wealth manager may at any time terminate an Agreement by written notice to the other party. At termination, fees will be credited on a pro rata basis for the portion of the quarter not completed. There is no additional termination fee.

Finley's compensation is solely from fees paid directly by clients. Finley does not receive any commission based on the client’s purchase of any financial product. No commissions in any form are accepted. No benefits are received from custodians/broker-dealers based on client securities transactions (“soft dollar benefits”). Finley does not sell any life insurance or annuities. Finley is compensated in the form of advisory fees alone.

Evidence-Based Investing Puts The Odds In Your Favor

At the end of the day, to make money in the markets, you must buy low and sell high. But what should you buy and sell? And when should you act? With no overarching strategy, your choices become a random search in an immense financial desert. You may still find your way if you are lucky. That’s a stressful way to go about managing your money.

Finley Wealth Advisors offers a model of investing based not on speculation but on financial science and Institutional-level investment advice from Nobel Prize-winning financial, economic, and academic research. There’s a quiet power in understanding how to already be there to capture available market returns – rather than forever chasing after them, as most investors do.

We have a clear strategy for managing the market’s ever-unfolding uncertainties. We stay focused on the right processes, the right tools, and the right mindset to guide you toward your most important goals. It is in the context of a low-cost, globally diversified solution, that we apply sound financial theory to your investment portfolio.

Your custom designed investment portfolio ensures that you are exposed to the appropriate mix of market factors, and designed to efficiently capture the market returns expected to contribute to your personal wealth over time.