- You are here:

- Home »

- Blog »

- Financial Education & News »

- Earning Dividends Is Not The Only Way To Grow Income

Earning Dividends Is Not The Only Way To Grow Income

Earning dividends aren’t the only way a stock investor can generate income.

Investors often see earning dividends as a way to grow income. But dividend strategies are not the only way to produce cash, and investors should be aware of the potential tradeoffs that accompany a focus on dividends. For stockholders who own dividend-paying shares, those payments arrive on a schedule (quarterly, in many cases). The cash to fund a dividend must come from somewhere, however.

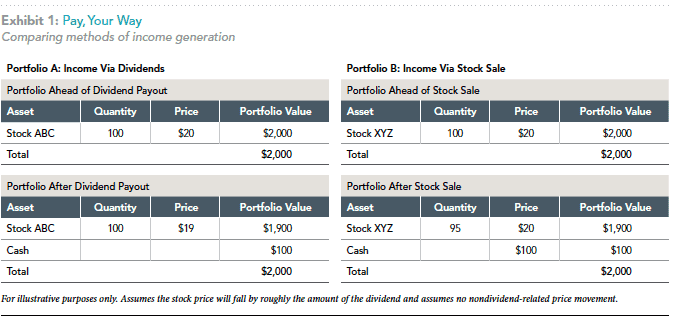

We know the price of a stock is potentially influenced by all expected future cash flows to shareholders. If cash is paid today in the form of a dividend, the stock price—and total market capitalization—of the issuing company may therefore fall, as the hypothetical Portfolio A in Exhibit 1 (below) shows. That means, all else being equal, an investor who receives a dividend may also be left with a less valuable equity holding.

Cash Considerations

An alternative method of raising cash is to simply sell shares. Exhibit 1 (above) compares the two methods of generating income by contrasting Portfolio A with the similarly valued hypothetical Portfolio B. While Portfolio A receives income through a dividend payout, Portfolio B generates it through a stock sale. The investor in Portfolio A, in which a dividend is issued, ends up holding the same number of shares as were held prior to the dividend payout, but we assume that those shares have declined in value. The investor in Portfolio B holds a reduced number of shares that haven’t seen their value decrease as a result of earning dividends and reaping a payout.

The two approaches arrive at the same place—both investors end up with $100 in cash and $1,900 in stock, notwithstanding potential trading costs or tax implications. But there are potential downsides to the earning dividends approach when contrasted with the stock-sale approach. First, the average proportion of firms paying dividends in the US was about 52% from 1963 through 2019,1 meaning an investor focusing only on those stocks is missing out on nearly half of investible US companies. A second consideration is that a dividend’s value, while not subject to the same degree of fluctuation as a stock price, isn’t guaranteed.

Just 10 years ago, more than half of dividend-paying firms cut or eliminated those payouts following the financial crisis.2 More recently, a company that had consistently paid dividends for more than a century, General Electric, slashed its payout to just one cent a share,3 and the UK’s Vodafone Group cut its full‑year dividend for the first time in two decades.4 Thirdly, investors may give up flexibility in terms of the timing and the size of the payout when they rely on company-issued dividends. With stock sales, an investor determines the amount and schedule of the income.

Total Return

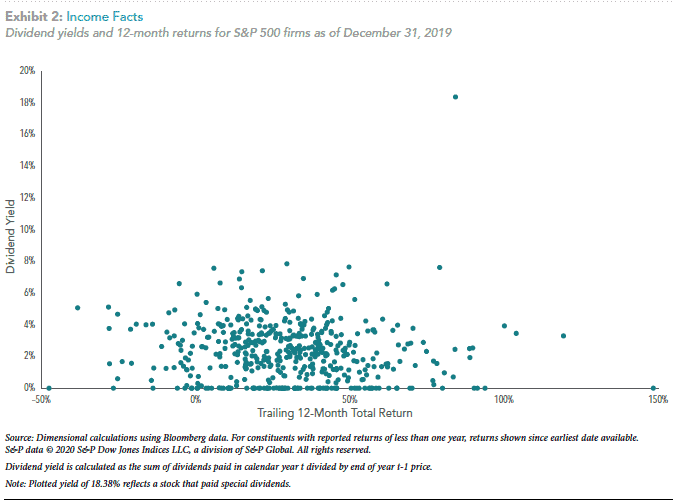

When considering an investment, it is also important to assess total return, which accounts for capital appreciation (or loss) alongside dividend income. High dividend yields may not lead to high total returns. Exhibit 2 (above) plots the trailing 12-month returns of S&P 500 Index constituents as of December 31, 2019, with each dot representing a company.

It’s clear that companies with greater dividend yields, the dots located higher up the vertical axis, weren’t consistently those with a higher total return over that period. Income generation may be a priority for some investors, but other important investment considerations, such as diversification and flexibility, needn’t fall victim to that aim. While the use of stock sales instead of dividends to create cash flow may involve trading costs and tax considerations, those concerns may be offset by the benefits of investing in companies that don’t currently pay dividends. An approach focused on income derived through dividends may not be the most desirable choice when weighing broader investment goals.

Notes

- Source: Dimensional, using data from CRSP. Stocks are sorted at the end of each June based on whether a dividend was issued in the preceding 12 months.

- Stanley Black, “Global Dividend-Paying Stocks: A Recent History” (white paper, Dimensional Fund Advisors, March 2013).

- Janet Babin, “GE cuts dividend to a penny per share. Why bother keeping it at all?” Marketplace, American Public Media, October 30, 2018.

- Adrià Calatayud, “Vodafone cuts dividend after swinging to 2019 loss.” MarketWatch, May 14, 2019.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Investors should talk to their financial advisor prior to making any investment decision. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit.

Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss.

All expressions of opinion are subject to change. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

About the Author Doug Finley

Douglas Finley, MS, CFP, AEP, CDFA founded Finley Wealth Advisors in February of 2006, as a Fiduciary Fee-Only Registered Investment Advisor, with the goal of creating a firm that eliminated the conflicts of interest inherent in the financial planner – advisor/client relationship. The firm specializes in wealth management for the middle-class millionaire.

Related Posts

Bringing Order to Your Investment Universe Part 1: The Beauty of Being Organized

The Cost of Trying to Time the Market

Pursuing ETF Share Classes: The Right Thing to Do for Investors

Common Investing Mistakes (Part 2)

Resist Chasing Past Performance: Principle 3 in Evidence-Based Investing

Trying To Outguess the Market Has No Role: Principle 2 in Evidence-Based Investing

What Is Fiduciary Investment Advice, and Why Does It Matter (Now More Than Ever)?

How Has Market Behavior Evolved For Emerging Markets Investing?

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.