Are you ready to become a better investor – to enhance your understanding of the most important principles that drive the creation of wealth – without it hurting a bit? Then WELCOME to our overview, “Evidence-Based Investment Management Explained.”

As you begin reading, you’ll find insights for building your wealth with evidence, not emotion, guiding your way. That’s because our insights are based on solid principles formed by nearly 70 years of peer-reviewed inquiry into how capital markets efficiently and effectively deliver long-term wealth to patient investors.

Don’t worry, unless you specifically ask us about it, we’ll skip the Greek calculations and multi-factor modeling. Instead, we’ll translate each insight into its meaningful essence.

You, the Market, and the Prices You Pay

When it comes to investment management (or anything in life worth doing well) it helps to know what you’re facing. In this case, that’s “the market.” How do you achieve every investor’s dream of buying low and selling high in a crowd of highly resourceful and competitive players? The answer is to play with rather than against the crowd, by understanding how market pricing occurs.

The Market represents an enormous crowd of participants who are individually AND collectively helping to set fair prices every day. That’s where things get interesting.

Group Intelligence: We Know More Than You and Me

Before the evidence showed us otherwise, it was commonly assumed that the best way to make money was by forecasting future prices. Research has revealed that the market is not so ungoverned after all. Yes, it’s chaotic, messy, and unpredictable when viewed up close. But it’s also subject to a number of important forces over the long run.

Understanding group intelligence and how it governs efficient market pricing is the first step. A step toward more consistently buying low and selling high in free capital markets. Instead of believing the discredited notion that you can regularly outguess the market's collective wisdom. You are better off concluding that the market is doing a better job than you can at forecasting prices. Your job then becomes efficiently capturing the returns that are being delivered.

News, Inglorious News

What causes market prices to change? It begins with the never-ending stream of news informing us of the good, bad, and ugly events that are forever taking place. But what does this mean to you and your investment portfolio? Should you buy, sell, or hold tight?

Hesitate before the news tempts you to jump into or flee from breaking trends. It’s critical to be aware of the evidence that tells us the most important thing of all. You cannot expect to consistently improve your outcomes by reacting to breaking news. How the market adjusts its pricing is why there’s not much you can do in reaction to breaking news. It’s not the news itself; it’s whether we saw it coming. Thus, it’s not just news, but unexpected news that alters future pricing. By definition, the unexpected is impossible to predict. As is how dramatically (or not) the market will respond to it. Once again, group intelligence gets in the way of those who might still believe they can outwit others by consistently forecasting future prices.

Financial Gurus and Other Fantastic Creatures

Group Intelligence Wins Again

Independently thinking groups (like capital markets) are usually better at arriving at accurate answers than even the smartest individuals in the group. That’s in part because their wisdom is already bundled into prices. Prices adjust with fierce speed and relative accuracy to any new, unanticipated news.

Even experts who specialize in analyzing business, economic, geopolitical or any other market-related information face the same challenges in investment management that you do. They try to beat the market by successfully predicting an uncertain reaction to unexpected news that is not yet known. For them too, particularly after costs, group intelligence remains a prohibitively tall hurdle to overcome.

The Proof Is in the Pudding

But maybe you know of an extraordinary stock broker or fund manager or TV personality who strikes you as being among the elite few who can make the leap. Maybe they have a stellar track record, impeccable credentials, a secret sauce, or brand-name recognition. Should you turn to them for the latest market tips, instead of settling for “average” returns?

Across the decades and around the world, a multitude of academic studies have scrutinized active investment management performance and consistently found it lacking. The good news is, there is a way to invest that enables you to nimbly sidestep rather than face such formidable foes. You can choose to simply let the market do what it does best on your behalf.

The Investment Management Cornerstone is Diversification

Among your most important financial friends is diversification. This single action can dampen your exposure to a number of investment management risks. While they may seem almost magical, the benefits of diversification have been well-documented. They have been widely explained by nearly 70 years of academic inquiry. Its powers are both evidence-based and robust.

Global Diversification: Quantity AND Quality

What is diversification? In a general sense, it’s about spreading your risks around. In investment management, that means that it’s more than just ensuring you have many holdings. It’s also about having many different kinds of holdings. If we compare this to the adage about not putting all your eggs in one basket. An apt comparison would be to ensure that your multiple baskets contain not only eggs but also a bounty of fruits, vegetables, grains, meats, and cheese.

While this may make intuitive sense, many investors come to us believing they are well-diversified when they are not. They may own a large number of stocks or stock funds across numerous accounts. But upon closer analysis, we find that what they really have is the undiversified equivalent of many basketsful of plain, white eggs. Diversification alone can help you have your cake and eat it too.

Diversification means more than just holding a large number of accounts or securities. It also calls for efficient, low-cost exposure to a variety of capital markets from around the globe. Let’s expand on the benefits of diversification, beginning with its ability to help you better manage investment management risks.

Managing the Market’s Risky Business

There’s Risk, and Then There’s Risk

Before we even have words to describe it, most of us learn about life’s general risks when we tumble into the coffee table or reach for that pretty cat’s tail. Investment risks aren’t as straightforward. Here, it’s important to know that there are two, broadly different kinds of risks: avoidable, concentrated risks and unavoidable market-related risks.

Avoidable Concentrated Risks

Concentrated risks are the ones that wreak targeted havoc on particular stocks, bonds or sectors. Even in a bull market, one company can experience an industrial accident, causing its stock to plummet. A municipality can default on a bond even when the wider economy is thriving. A natural disaster can strike an industry or region while the rest of the world thrives.

In the science of investment management, concentrated risks are considered avoidable. Bad luck still happens, but you can dramatically minimize its impact on your investments by diversifying your holdings widely and globally.

Unavoidable Market-Related Risks

If concentrated risks are like bolts of lightning, market-related risks are encompassing downpours in which everyone gets wet. They are the persistent risks that apply to large swaths of the market. At their highest level, they are the ones you face by investing in capital markets in any way, shape, or form. If you stuff your cash in a safety deposit box, it will still be there the next time you visit it. (It may be worth less due to inflation, but that’s a different risk, for discussion on a different day.) Invest in the market and, presto, you’re exposed to market risk.

Every investor faces market risks that cannot be “diversified away.” Those who stay invested when a market’s risks are on the rise can expect to eventually be compensated for their steely resolve with higher returns. But they also face higher odds that results may deviate from expectations, especially in the near-term. That’s why you want to take on as much, but no more market risk than is personally necessary.

The Essence of Evidence-Based Investment Management

Markets deliver wealth to those who invest their financial capital in human enterprise. As with any risky venture, there are no guarantees that you’ll earn the returns you’re aiming for. This leads us to why we so strongly favor evidence-based investing. Grounding your strategy in rational methodology helps you stay on a course when your emotional reactions threaten to take over the wheel.

So what does evidence-based investment management entail?

Alpha, Beta, and Sources of Returns: The Essence of Evidence-Based Investing

Since at least the 1950s, a “Who’s Who” body of scholars has been studying investment management to answer key questions such as this critical pair:

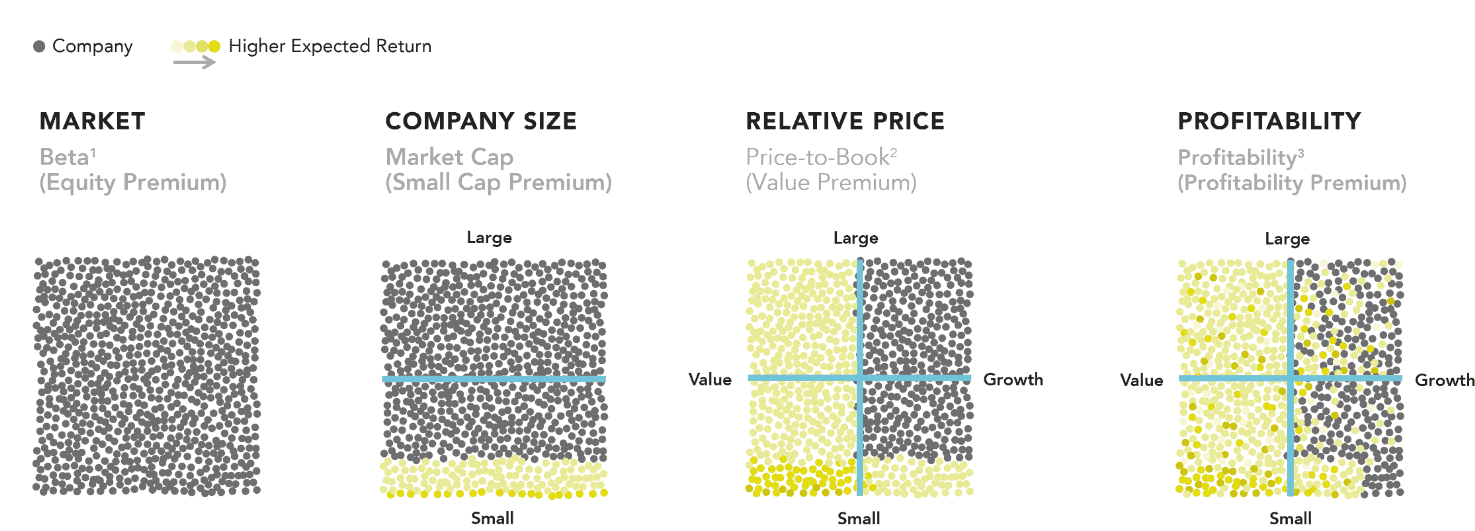

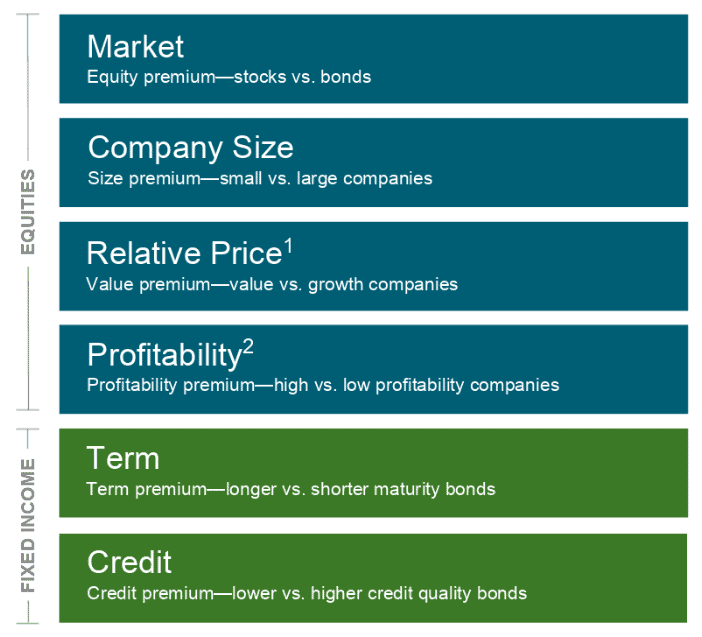

- What drives market returns (factors)? Which factors (sources of return) appear to have persisted over time, around the world, and through various market conditions? Once we’ve identified a potential factor, are there rational reasons for why it’s likely to persist moving forward? The more robust a factor appears to be, the more confidently we can tilt a portfolio toward or away from its risks and expected returns.

- What drives portfolio performance (alpha vs. beta)? When comparing the performance of one diversified portfolio to the next, how much of the difference can be explained by different exposures to these return factors – no matter which individual securities were involved? In financial parlance, that’s a portfolio’s beta. How much can be explained by the investment manager’s stock-picking or market-timing skills? That’s their value-added alpha.

The Three Factor Model

In 1992, Eugene Fama and Kenneth French published their landmark paper, “The Cross-Section of Expected Stock Returns,” in The Journal of Finance. The paper gave birth to the Fama-French Three-Factor Model, which laid the groundwork for most factor-based inquiry that has continued ever since (and earned Fama a Nobel Prize in Economics in 2013).

Building on an earlier, Capital Asset Pricing Market (CAPM) model, the Three-Factor Model increased our ability to use beta to explain the differences between different portfolios’ returns. While CAPM found market beta alone could explain around 70% of the differences, the Three-Factor Model, with three sources of beta, offered over 90% explanatory power. [Source]

Fama, French, and many others have since expanded on this early work. In 2014, they published “A five-factor asset pricing model” in the Journal of Financial Economics, which they’ve also stress-tested in a 2015 working paper looking at the same five factors in international markets.

In short, over time, the academic community has continued to study new and existing factors, and how they appear to interact and contribute to beta-generating returns. The more we understand about factor investment management, the harder it has become to believe that the pursuit of extra, alpha-generated returns can add consistent value – after the costs involved and beyond what already is available through a low-cost, well-structured, evidence-based portfolio.

Factors That Figure in Your Evidence-Based Portfolio

Existing and unfolding inquiry on market return factors continues to hone our strategies for most effectively capturing expected returns according to your personal goals. The same inquiry continues to identify other promising factors that may help us augment our already strong, evidence-based approach to investment management. By considering each new potential factor according to strict guidelines, our aim is to extract the diamonds of promising new evidence-based insights from the considerably larger piles of misleading misinformation.

The Human Factor in Evidence-Based Investment Management

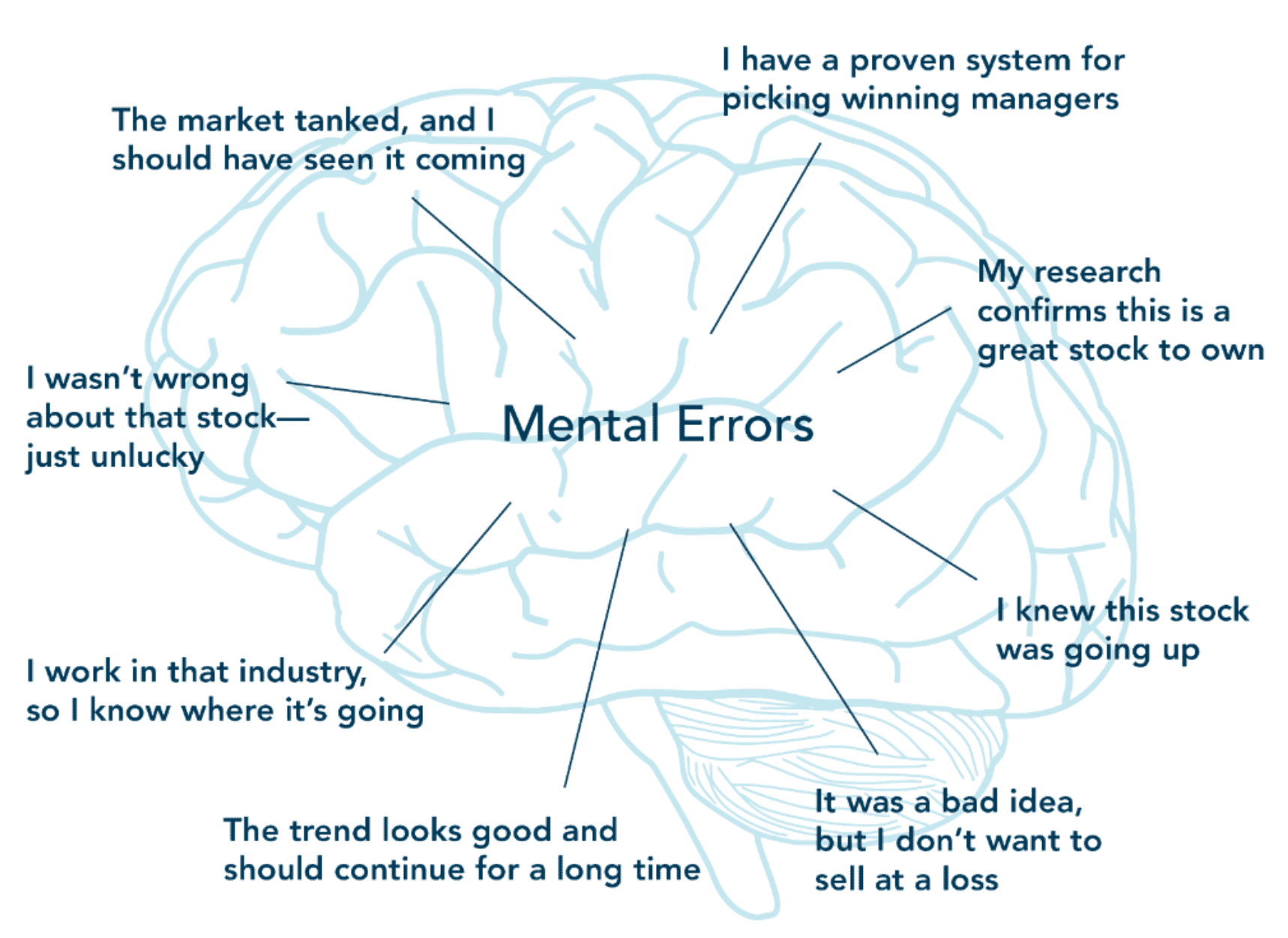

We turn now to the final and arguably most significant factor in your evidence-based investment management strategy: the human factor. In short, your own impulsive reactions to market events can easily trump any other market challenges you face.

Despite everything we know about efficient capital markets and all the solid evidence available to guide our rational decisions … we’re still human. Solid evidence and rational decisions often have nothing to do with what's going on in our heads. It's a brew of chemically generated instincts and emotions that spur us to leap long before we have time to look.

Rapid reflexes often serve us well. Our prehistoric ancestors depended on snap decisions when responding to predator and prey. Today, our child’s cry still brings us running without pause to think; his or her laughter elicits an instant outpouring of love (and oxytocin).

But in finance, where the coolest heads prevail, many of our base instincts cause more harm than good. Your brain signals can trick you into believing you’re making entirely rational decisions. Overpowered by ill-placed, “survival of the fittest” reactions you make mistakes.

Put another way by neurologist and financial advisor William J. Bernstein, MD, PhD, “Human nature turns out to be a virtual Petri dish of financially pathologic behavior.” [Source]

Behavioral Finance, Human Finance

The field of behavioral finance studies the relationships between our heads and our financial health. What happens when we stir up that Petri dish of financial pathogens?

Wall Street Journal columnist Jason Zweig’s “Your Money and Your Brain” provides a good guided tour of the findings, describing both the behaviors themselves as well as what is happening inside our heads to generate them. To name a couple of the most obvious examples:

When markets tumble – Your brain’s amygdala floods your bloodstream with cortisol. Fear clutches at your stomach and every instinct points the needle to “Sell!”

When markets unexpectedly soar – Your brain’s reflexive nucleus accumbens fires up within the nether regions of your frontal lobe. Greed grabs you by the collar, convincing you that you had best act soon if you want to seize the day. “Buy!”

An Advisor’s Greatest Role: Managing the Human Factor

Your brain cooks up plenty of insidious biases to overly influence your investment management activities. To name a few, there’s confirmation bias, hindsight bias, recency, overconfidence, loss aversion, sunken costs and herd mentality.

Think you are aware of your behavioral stumbling blocks? it can still be devilishly difficult to avoid tripping on them. Lightning-fast reactions in your brain fire well before your logic has any say. It is difficult to see and avoid collisions with yourself that your own myopic vision might miss.

How have we done so far in our goal to inform you, without overwhelming you?