Category Archives for Investment Advice

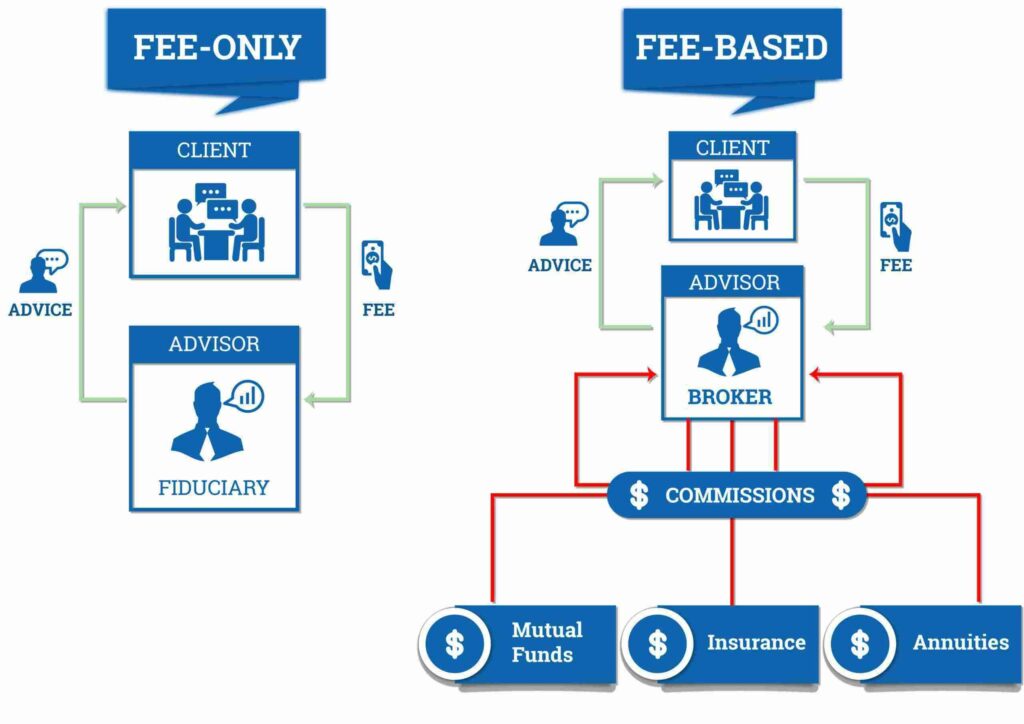

Understanding How Fee Only Advisors Work [Infographic]

The vast majority of employees of banks, brokerage firms, and insurance companies charge a management fee part of the time and are commissioned salespeople at other times. These brokers call themselves

Continue reading...

Alternative Reality

Diversification has been called the only free lunch in investing. This idea is based on research showing that diversification, through a combination of assets like stocks and bonds, could reduce volatility

Continue reading...

10 Steps to Easing Financial Anxiety During Major Life Changes

Life happens and, sometimes, it can be incredibly worrisome from a financial standpoint. You’ve struggled through a divorce. Perhaps you’ve faced a life-threatening illness. And, you look at your bank

Continue reading...

The Tao of Wealth Management

The path to success in many areas of life is paved with continual hard work, intense activity, and a day-to-day focus on results. However, for many investors who adopt this approach to managing their wealth,

Continue reading...

What You Pay, What You Get: Connecting Price and Expected Returns

It has been more than 50 years since the idea of stock prices containing all relevant information was put forth. Information might come in the form of data from a company’s financial statements, news

Continue reading...

The Impact of Inflation

This erosion of the real purchasing power of wealth is called inflation. Inflation is an important element of investing. In many cases, the reason for saving today is to support future spending. Therefore,

Continue reading...

Models, Uncertainty, and the Importance of Trust

Models are approximations of the world. They are simplifications of reality. Models can be useful for gaining insights that help us make good decisions. But they can also be dangerous if someone is overconfident

Continue reading...

What Is Correlation (and Why Would You Care)?

Here at Finley Wealth Management, we try to keep the financial jargon to a minimum. But even where we may succeed, you’re likely to encounter references elsewhere that can turn valuable information into

Continue reading...

Tuning Out the Noise

For investors, it can be easy to feel overwhelmed by the relentless stream of news about markets. Being bombarded with data and headlines presented as impactful to your financial well-being can evoke

Continue reading...

A Focus on Fixed Income

It’s been approximately a decade since the Great Recession began. By year-end 2008, the U.S. Federal Reserve (the Fed) had lowered the target federal funds rate to near-zero and embarked on an aggressive

Continue reading...

Doing Well and Doing Good?

Growing interest in the impact of fossil fuels on the global climate may spark questions about whether individuals can integrate their values around sustainability with their investment goals and, if so,

Continue reading...

Evidence-Based Investing vs. Indexing

Making a Good Thing Even Better As the public grows increasingly familiar with “passive” or “index” investing, it’s becoming easier for individual investors to gain cost-effective exposure to

Continue reading...

Sailing with the Tides

Embarking on a financial plan is like sailing around the world. The voyage won’t always go to plan, and there’ll be rough seas. But the odds of reaching your destination increase greatly if

Continue reading...

10 Things To Do When Markets Get Scary

“This is a test; this is only a test. Had this been an actual emergency …” The truth is, the markets are doing just what markets do from time to time, they correct themselves. In fact, overall market

Continue reading...

Our Jekyll-Hyde Relationship with Investment Risk

“What the imagination can’t conjure, reality delivers with a shrug.” – Trumbo (movie voice-over) Whether it’s the recent destruction wrought by Canada’s Fort McMurray oil sands wildfire, a

Continue reading...

Cost Control: An Investor’s Greatest Investment

In the mid-1800s, is a collection of essays entitled “Conduct of Life,” Ralph Waldo Emerson observed, “Money often costs too much.” More than 150 years later, his words remain well worth heeding,

Continue reading...

The Vital Role of Rebalancing

If there is a universal investment ideal, it is this: Every investor wants to buy low and sell high. What if we told you there is a disciplined process for doing just that and staying on track toward your

Continue reading...

Market Timing: The Built-in Hurdle

Market timing generally refers to approaches that seek to outperform a traditional static asset allocation by switching back and forth between asset classes. However, as shown in this article, these approaches

Continue reading...

Home Bias and Global Diversification

By pursuing a globally diversified approach to investing, one doesn’t have to attempt to pick winners to achieve a rewarding investment experience. Every day we enjoy the benefits of an interconnected

Continue reading...

The ABC’s of Behavioral Biases (F–H)

Let’s continue our alphabetic tour of common behavioral biases that distract otherwise rational investors from making the best choices about their wealth. Today, we’ll tackle: fear, framing, greed,

Continue reading...

Three Key Investment Strategies Hidden in Plain Sight: Part 3

In the first two installments of our three-part “hidden in plain sight” investment strategy series, we’ve covered the importance of staying invested to earn market returns, while managing the risks

Continue reading...

Three Key Investment Strategies Hidden in Plain Sight: Part 2

In our last piece, we described why most investors should ignore the never-ending onslaught of unpredictable financial investment news and tend to three strategies that can be much more readily managed

Continue reading...

Three Key Investment Strategies Hidden in Plain Sight: Part 1

If you’ve ever dabbled in graphic design, you’re familiar with the concept of white space. When viewing an illustration, we typically pay the most attention to the visible ink on the page, such as

Continue reading...

Quit Monkeying Around!

In the world of investment management, there is an oft-discussed idea that blindfolded monkeys throwing darts at pages of stock listings can select portfolios that will do just as well, if not better,

Continue reading...

More Evidence on Evidence-Based Investing: An Historical Overview of Capital Market Theory

Why do we refer to our approach as evidence-based investing? We believe that the evidence – especially the kind that has been peer-reviewed and time-tested – is at the root of everything else we do

Continue reading...

Smart Shopping Pays When It Comes To Your Investments

Costs matter. Whether you’re buying a car or selecting investments, the costs you expect to pay are likely to be an important factor in making any major financial decision. People rely on a lot of different

Continue reading...

When Diversification Isn’t a Free Lunch

Diversification has been called the only free lunch in investing This claim is rooted in Markowitz’s work on modern portfolio theory, which showed that through diversification, combinations of assets

Continue reading...

Misperceptions About Market Correction: Are You Prepared?

If you enjoy fine literature, we recommend all of Warren Buffett’s annual Berkshire Hathaway shareholder letters, dating back to 1965. While financial reports are rarely the stuff from which dreams are

Continue reading...

Diversifying a Portfolio with Real Estate

Real estate as a wealth generator is hardly a new idea. People owned the property long before the advent of stock exchanges and other capital markets. In more recent times, large corporations and institutions

Continue reading...

Avoiding Financial Scams and Identity Theft Fraud

Young or old, wealthy or poor, online or in person … Nobody is immune from financial scams and identity theft fraud. No matter who you are or how well-informed you may be, the bad guys are out there,

Continue reading...