Category Archives for Financial Education & News

Why “Safe Harbors” Can Be Risky Business And How You Can Mitigate

Whenever investors are spooked by turbulent times, dollars tend to flow out of the stock market, and into “safe harbors” investments such as bonds, bond funds, CDs, money markets, or even cash. As

Continue reading...

What Happens When You Fail at Market Timing

The impact of missing just a few of the market’s best days can be profound. There’s no proven way to time the market—targeting the best days or moving to the sidelines to avoid the worst. History

Continue reading...

What is the Purpose of Indexes and Index Funds? (Part IV)

Compared to actively managed funds that seek to “beat” the market by engaging in now-outdated speculative strategies, a more solid solution for sensibly capturing available market returns is offered

Continue reading...

Financial Planning for Women: The Best Tips for Success

You might be suprised to learn that when it comes to the big earners — those earning more than $1 million a year — women now take the cake over men. Also, the millionaire club is getting a

Continue reading...

Market Index Mechanics – Interesting Idiosyncrasies (Part III)

Market indexes and market index mechanics, you read about them all the time. In Part III of this series, we take a closer look at market index mechanics to gain a better understanding of why they do,

Continue reading...

Index Points and What they Mean (Part II)

Checking an index point at any given time is like dipping your toe in the water to see how the ocean is doing. You may have good reasons to do that toe-check, but as with any approximation, be careful

Continue reading...

What is the Total Cost of Ownership?

A question worth finding answers to is ‘what is the total cost of ownership?’ The costs you expect to pay are likely to be an important factor in making any investment decision, including major

Continue reading...

Timing Markets Isn’t Everything

The lure of getting in at the right time or avoiding the next downturn may tempt even disciplined, long-term investors. The reality of successfully timing markets, however, isn’t as straightforward as

Continue reading...

Good Advice For Your Personal Financial Planning

In today’s world of one-page financial plans, bargain-basement fund pricing and automated investing tools, you don’t just need advice. You need good advice.

Continue reading...

What Are Liquid Investments?

What are Liquid Investments? When a holding is liquid, it simply means you can sell it anytime the market in which it trades is open for business, without losing your proverbial shirt in the exchange.

Continue reading...

Earning The Equity Risk Premium

A rubric of modern portfolio theory taught at colleges and universities holds that investors get paid extra return for taking risk. The risk premium is the amount you get paid for owning a risky asset.

Continue reading...

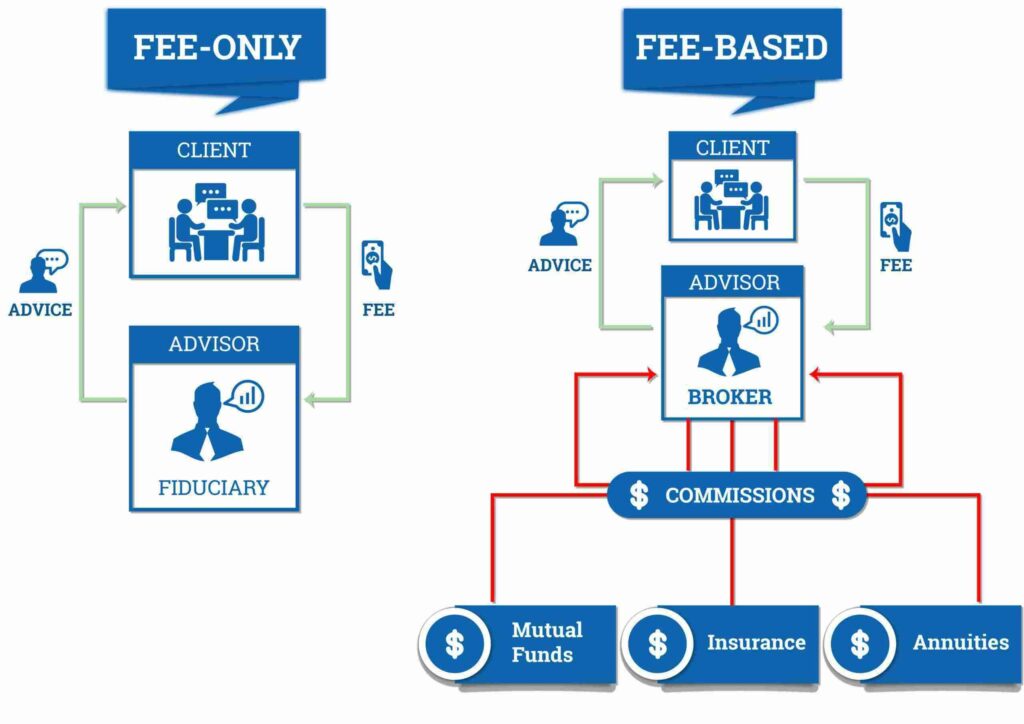

Understanding How Fee Only Advisors Work [Infographic]

The vast majority of employees of banks, brokerage firms, and insurance companies charge a management fee part of the time and are commissioned salespeople at other times. These brokers call themselves

Continue reading...

10 Steps to Easing Financial Anxiety During Major Life Changes

Life happens and, sometimes, it can be incredibly worrisome from a financial standpoint. You’ve struggled through a divorce. Perhaps you’ve faced a life-threatening illness. And, you look at your bank

Continue reading...

Models, Uncertainty, and the Importance of Trust

Models are approximations of the world. They are simplifications of reality. Models can be useful for gaining insights that help us make good decisions. But they can also be dangerous if someone is overconfident

Continue reading...

Cryptocurrency: What’s It All About?

Odds are, you hadn’t even heard the term until recently. Now, it seems as if everybody and their cousin are getting in on it. Psychologists have assigned a term to the angst you might be feeling in the

Continue reading...

Avoiding Financial Scams and Identity Theft Fraud

Young or old, wealthy or poor, online or in person … Nobody is immune from financial scams and identity theft fraud. No matter who you are or how well-informed you may be, the bad guys are out there,

Continue reading...

What is the Purpose of Indexes and Index Funds? (Part IV)

Index Investing – Opportunities and Obstacles Legend has it, a pharmacist named John Pemberton was searching for a headache cure when he tried blending Coca leaves with Cola nuts. Who knew his recipe

Continue reading...

Make the Most of Spousal and Survivor Benefits from Social Security

Even after the crackdown, special rules can pay off handsomely for husbands and wives as survivor benefits come into play. Social Security smiles on married couples, with special rules that can richly

Continue reading...

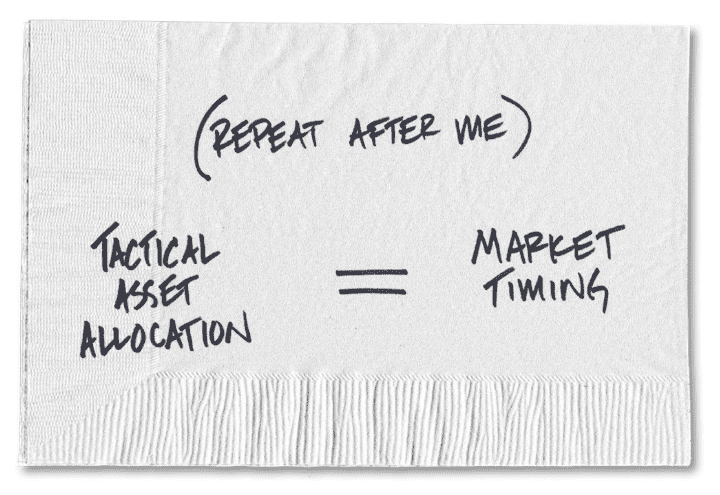

Mean Reversion in Expected Stock Returns a.k.a. Market Timing

This study looks for evidence of mean reversion in the equity, profitability, size, and value premiums. Regressions test for statistical evidence of mean reversion, and trading simulations examine whether

Continue reading...

Did Your Market Timing Broker Disappoint You?

Every year brings its share of surprises. But how many of us could have imagined that 2016 would see the Chicago Cubs win the World Series, Bob Dylan receive the Nobel Prize in Literature, Donald Trump

Continue reading...