Category Archives for Financial Education & News

Investing in Uncertain Times

After taking a closer look at interest rates and inflation we come to the heart of the matter: When interest rates, inflation, or both are on the rise, what’s an investor to do?

Continue reading...

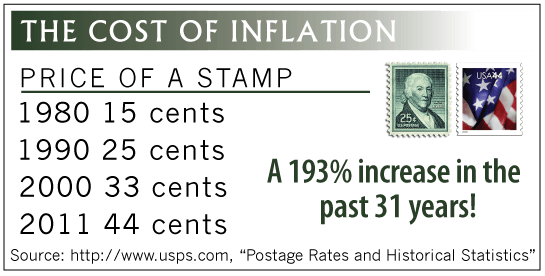

Has rising inflation got you down?

Inflation is the rate at which money loses its purchasing power over time. As you might guess, there are many ways to measure such a squishy figure. There are various economic sectors, such as energy,

Continue reading...

Fed Takes Center Stage

At its March 15–16 Federal Open Market Committee (FOMC) meeting, the U.S. Federal Reserve raised its federal target funds rate by a quarter-point. It was the first increase since December 2018, but it

Continue reading...

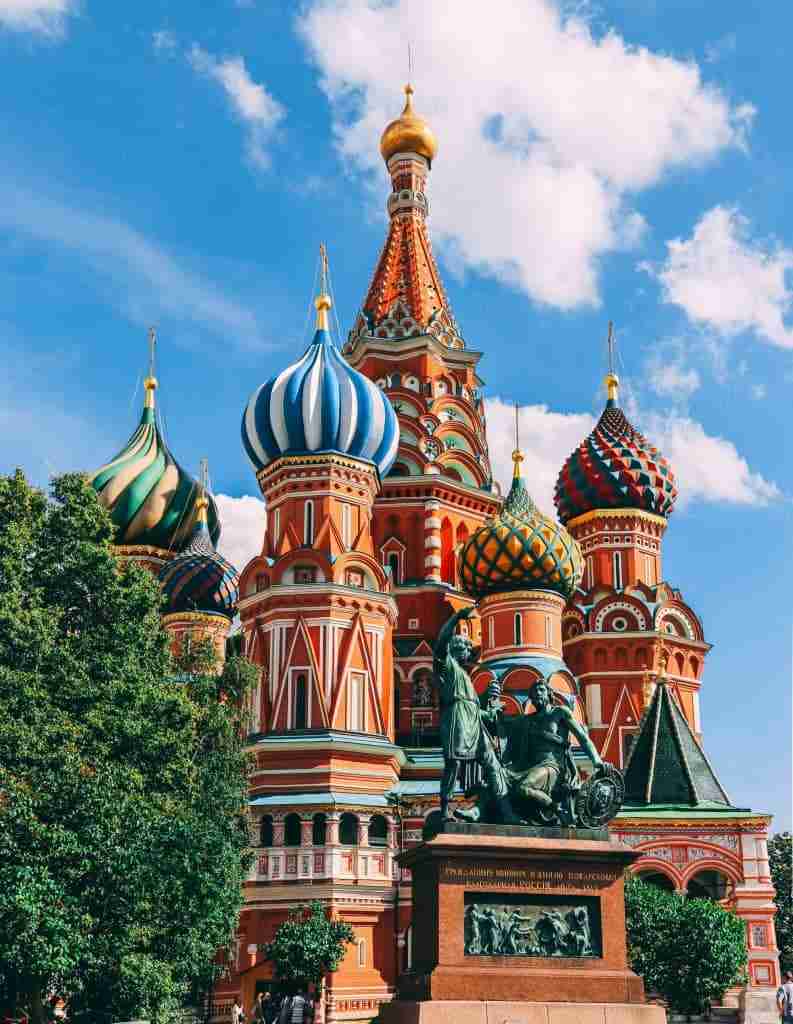

Ukraine

Despite our fervent hopes that Ukraine’s sovereign rights would prevail over tyrannical aggression, it’s now clear that Vladimir Putin has doubled down on the latter.

Continue reading...

Navigating Geopolitical Events

The recent conflict between Russia and Ukraine is an important reminder that geopolitical risk is a part of investing in global markets. Navigating geopolitical events requires expertise and flexibility.

Continue reading...

The Small Caps That May Be Holding Back Your Portfolio’s Returns

The underperformance of small caps in 2021 was driven by poor returns of small growth companies with low profits. These companies have underperformed historically. An approach that excludes small growth

Continue reading...

You Want the Size, Value, and Profitability Premiums … But How?

Capturing the size, value, and profitability premiums in real-world portfolios requires expertise. Investors should be cautious about favoring one premium over another or one region over another based

Continue reading...

Fighter Planes and Market Turmoil

Have you been reading the daily headlines—watching markets stall, recover, and dip once again? If so, you may be wondering whether there’s anything you can do to avoid the motion sickness.

Continue reading...

Market Review 2021: A Recovery Amid Challenges

It was a year of uncertainty and anticipation, of hopes for a return to a degree of normalcy following the onset of the COVID-19 pandemic in 2020. And it was a year that showed, again, the difficulty of

Continue reading...

A New Year Conversation

This is no surprise. The world is enormous. To cope with information overload, we engage in what behavioral psychologists refer to as heuristics. These are rules of thumb or mental shortcuts that take

Continue reading...

Myth-Busting with Momentum: How to Pursue the Premium

While both simulated and real-world data suggest momentum may not be suitable as a driver of long-term asset allocations, we believe momentum considerations can be integrated in a cost-effective way to

Continue reading...

When It Comes to SMAs, How Do You Measure the Impact of Personalization?

Many investors want their portfolios to do more than just pursue reliable premiums. They may also want to seek tax efficiency; reflect their environmental, social, and governance (ESG) values; respect

Continue reading...

Reading Fed Tea Leaves? Watch Market Prices Instead

Yields reflect the aggregate expectations of all market participants, including opinions on how and when the Fed will act. And even if a crystal ball could reveal the timing and direction of the Fed’s

Continue reading...

The Ever Changing World Goes On

“News is, by definition, something that doesn’t last. It exists for only a moment before it changes. … It’s not important to living a good life. It’s not going to help you make better decisions.

Continue reading...

Will Inflation Hurt Stock Returns? Not Necessarily.

Since 1991, one-year returns on US stocks have fluctuated widely. Yet weak returns occurred when inflation was low in some periods, and 23 of the past 30 years saw positive returns even after adjusting

Continue reading...

Tuning Out the Noise

For investors, it can be easy to feel overwhelmed by the relentless stream of news about markets. Being bombarded with data and headlines presented as affecting your financial well-being can evoke strong

Continue reading...

Tax-Wise Investment Techniques

We view effective tax planning as a way to reduce your lifetime tax bill—or beyond, if you’re preparing for a tax-efficient wealth transfer to your heirs.

Continue reading...

When Everything Screams Inflation

After last year’s economic shocks, we shouldn’t be surprised to see prices rebounding. But the potential for inflation is one among many factors investors take into account when agreeing on a price

Continue reading...

Tax Planning in Turbulent Times

How do we plan when we cannot know? The particulars may evolve, but it seems there are always an array of tax breaks to encourage us to save toward our major life goals—such as retirement, healthcare,

Continue reading...

Swing in Small Value Stocks Shows Benefits of Staying the Course

Value stocks, or those with low relative prices, have outperformed higher-priced growth stocks in the US over the long term. Similarly, the stocks of smaller companies have fared better than the stocks

Continue reading...

Is Inflation Haunting Your Financial Dreams? (Part 2)

The Federal Reserve has been suggesting rising rates should wane. We hope they’re right. But we also know the future remains uncharted. Nearly any outcome is possible, and none is inevitable. This means

Continue reading...

Is Inflation Haunting Your Financial Dreams? (Part 1)

Recent headlines have been reporting a noticeable uptick in inflation. Superlatives like “best” and “worst” grab the most attention, so outlets have been abuzz with reports of how a 5% May consumer

Continue reading...

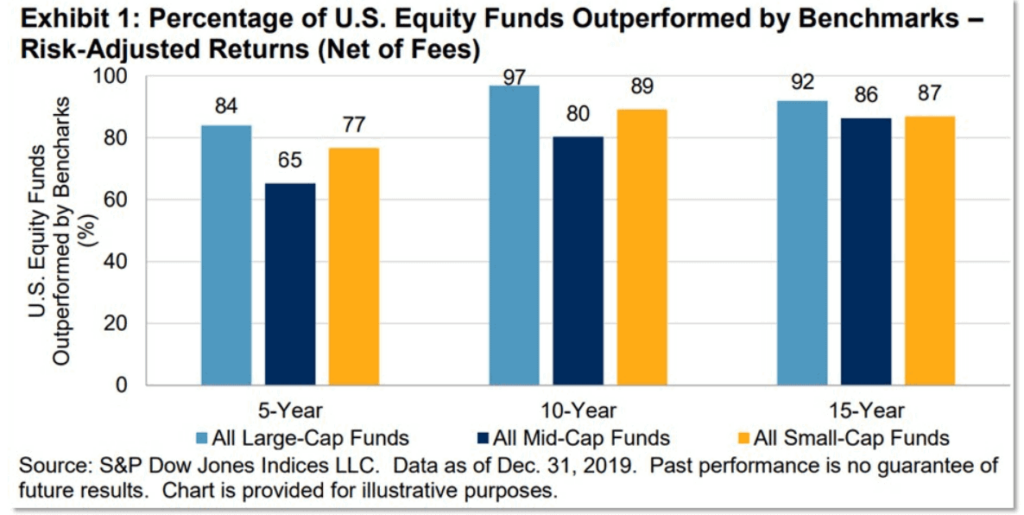

Don’t Let A Market Timer Gamble with Your Life Savings

The prediction game may be a losing one for many investors, and each year there are published reports that highlight the difficulties conventional managers face.

Continue reading...

What Is Fiduciary Investment Advice, and Why Does It Matter (Now More Than Ever)?

Having a fiduciary duty to our clients puts us on similar footing with other professional consultants, such as physicians or attorneys. You hire us partly because we have dedicated our career to understanding

Continue reading...

SPACS, NFTs, and Flourishing in the Economic Jungle

“The American marketplace is an economic jungle. As in all jungles, you easily can be destroyed if you don’t know the rules of survival. … But you also can come through in fine shape and you

Continue reading...

Top Heavy Market? Giant Firms on Top Is Nothing New

A top-heavy stock market with the largest 10 stocks accounting for over 20% of market capitalization and a marquee technology firm perched at No. 1? This is not new. A breakdown of the largest US stocks

Continue reading...

Under the Macroscope: When Stocks and the Economy Diverge

What’s going on in the market when stocks and the economy diverge? It can be puzzling when a bleak economic report emerges from the press, only to be accompanied by a positive surge in the stock market.

Continue reading...

Earning Dividends Is Not The Only Way To Grow Income

Earning dividends aren’t the only way a stock investor can generate income. Investors often see earning dividends as a way to grow income. But dividend strategies are not the only way to produce cash,

Continue reading...

Why Hire an Independent Advisor To Further Your Financial Interests?

From books to blogs, from media mavens to marketeers, from pundits to pros … there’s never a lack of talking heads telling you how to make the most of your money. Why hire an independent advisor to

Continue reading...

Playing the Prediction Game – Hindsight Is 20/20. Foresight Isn’t.

Downplay the prediction game! Rather than basing investment decisions on predictions of which way debt or equity markets are headed, a wiser strategy may be to hold a range of investments that focus on

Continue reading...