- You are here:

- Home »

- Blog

Tax Planning in Turbulent Times

How do we plan when we cannot know? The particulars may evolve, but it seems there are always an array of tax breaks to encourage us to save toward our major life goals—such as retirement, healthcare,

Continue reading...

Swing in Small Value Stocks Shows Benefits of Staying the Course

Value stocks, or those with low relative prices, have outperformed higher-priced growth stocks in the US over the long term. Similarly, the stocks of smaller companies have fared better than the stocks

Continue reading...

Is Inflation Haunting Your Financial Dreams? (Part 2)

The Federal Reserve has been suggesting rising rates should wane. We hope they’re right. But we also know the future remains uncharted. Nearly any outcome is possible, and none is inevitable. This means

Continue reading...

Is Inflation Haunting Your Financial Dreams? (Part 1)

Recent headlines have been reporting a noticeable uptick in inflation. Superlatives like “best” and “worst” grab the most attention, so outlets have been abuzz with reports of how a 5% May consumer

Continue reading...

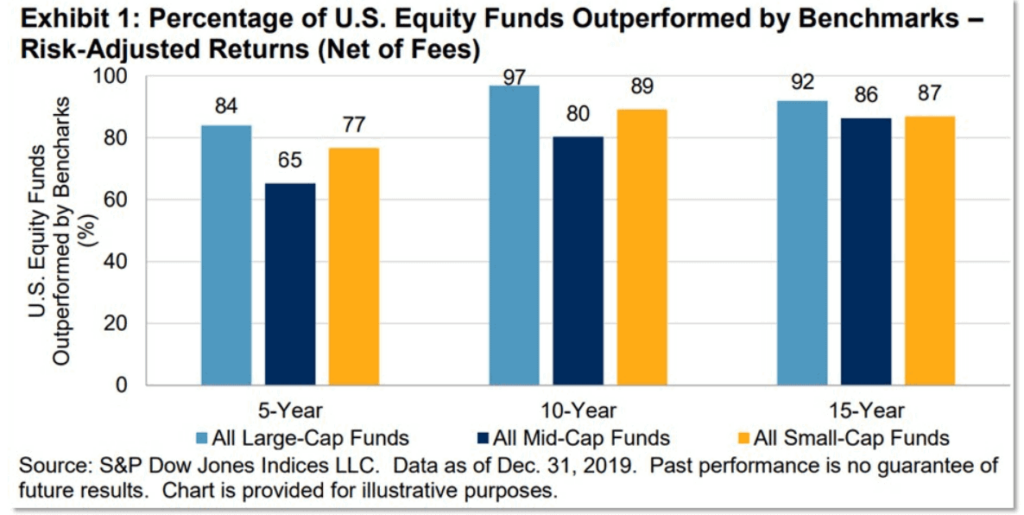

Don’t Let A Market Timer Gamble with Your Life Savings

The prediction game may be a losing one for many investors, and each year there are published reports that highlight the difficulties conventional managers face.

Continue reading...

Why Investors Might Think Twice About Chasing the Biggest Stocks

As companies grow to become some of the largest firms trading on the US stock market, the returns that push them there can be impressive. But not long after joining the Top 10 largest by market cap, these

Continue reading...

Tax Planning In Retirement

There is one major tax-planning principle that changes in retirement that is often overlooked by retirees and their advisors alike, which results in paying more taxes than necessary. Entering retirement,

Continue reading...

What Is Fiduciary Investment Advice, and Why Does It Matter (Now More Than Ever)?

Having a fiduciary duty to our clients puts us on similar footing with other professional consultants, such as physicians or attorneys. You hire us partly because we have dedicated our career to understanding

Continue reading...

The More Things Change

“If there is a unifying theme to all this, it is that investors big and small showed no fear of risk-taking to start 2021. In fact, they embraced it.” – Wall Street Journal

Continue reading...

SPACS, NFTs, and Flourishing in the Economic Jungle

“The American marketplace is an economic jungle. As in all jungles, you easily can be destroyed if you don’t know the rules of survival. … But you also can come through in fine shape and you

Continue reading...

How Has Market Behavior Evolved For Emerging Markets Investing?

Understanding market behavior and evolution are just as important for emerging markets as for developed markets, as emerging markets are an important part of a well-diversified global equity portfolio.

Continue reading...

When It’s Value Stocks vs. Growth Stocks, History Is on Value’s Side

Recently, growth stocks have enjoyed a run of outperformance vs. their value counterparts. But while disappointing periods emerge from time to time, the principle that lower relative prices lead to higher

Continue reading...

Top Heavy Market? Giant Firms on Top Is Nothing New

A top-heavy stock market with the largest 10 stocks accounting for over 20% of market capitalization and a marquee technology firm perched at No. 1? This is not new. A breakdown of the largest US stocks

Continue reading...

Under the Macroscope: When Stocks and the Economy Diverge

What’s going on in the market when stocks and the economy diverge? It can be puzzling when a bleak economic report emerges from the press, only to be accompanied by a positive surge in the stock market.

Continue reading...

Strategic vs. Tactical Asset Allocation: Does It Matter?

Strategic vs. tactical asset allocation … they both sound pretty good as an investment strategy, don’t they? There’s only one problem: I may have left you guessing as to what I’m even talking

Continue reading...

Choosing Between a Fee-Only or Fee-Based Advisor

in your search for a dependable financial advisor, you might assume fee-only advisor vs. fee-based advisor are one and the same. Unfortunately, fee-only and fee-based advisors are not interchangeable.

Continue reading...

Three Upside-Down Investment Insights

A trio of weird, but wonderful “upside-down” investment ideas in this post. Often, all you need to be an excellent investor is a healthy dose of common sense: A penny saved is a penny earned. Buy low,

Continue reading...

Earning Dividends Is Not The Only Way To Grow Income

Earning dividends aren’t the only way a stock investor can generate income. Investors often see earning dividends as a way to grow income. But dividend strategies are not the only way to produce cash,

Continue reading...

Cost of Investment Decisions And Why They Matter

Much of what impacts your investment decisions is beyond your control. That said, you do have a big say on how much you spend on investing. By tending to the costs of your investment decisions, you can

Continue reading...

Why Hire an Independent Advisor To Further Your Financial Interests?

From books to blogs, from media mavens to marketeers, from pundits to pros … there’s never a lack of talking heads telling you how to make the most of your money. Why hire an independent advisor to

Continue reading...

Playing the Prediction Game – Hindsight Is 20/20. Foresight Isn’t.

Downplay the prediction game! Rather than basing investment decisions on predictions of which way debt or equity markets are headed, a wiser strategy may be to hold a range of investments that focus on

Continue reading...

Why “Safe Harbors” Can Be Risky Business And How You Can Mitigate

Whenever investors are spooked by turbulent times, dollars tend to flow out of the stock market, and into “safe harbors” investments such as bonds, bond funds, CDs, money markets, or even cash. As

Continue reading...

What Happens When You Fail at Market Timing

The impact of missing just a few of the market’s best days can be profound. There’s no proven way to time the market—targeting the best days or moving to the sidelines to avoid the worst. History

Continue reading...

Lessons for Long-Term Investors – Tale of Two Decades

The first two decades of the 21st century have reinforced important lessons for long-term investors. Holding a broadly diversified portfolio can help smooth out the swings. Having a sound strategy built

Continue reading...

What is the Purpose of Indexes and Index Funds? (Part IV)

Compared to actively managed funds that seek to “beat” the market by engaging in now-outdated speculative strategies, a more solid solution for sensibly capturing available market returns is offered

Continue reading...

Financial Planning for Women: The Best Tips for Success

You might be suprised to learn that when it comes to the big earners — those earning more than $1 million a year — women now take the cake over men. Also, the millionaire club is getting a

Continue reading...

Market Index Mechanics – Interesting Idiosyncrasies (Part III)

Market indexes and market index mechanics, you read about them all the time. In Part III of this series, we take a closer look at market index mechanics to gain a better understanding of why they do,

Continue reading...

Index Points and What they Mean (Part II)

Checking an index point at any given time is like dipping your toe in the water to see how the ocean is doing. You may have good reasons to do that toe-check, but as with any approximation, be careful

Continue reading...